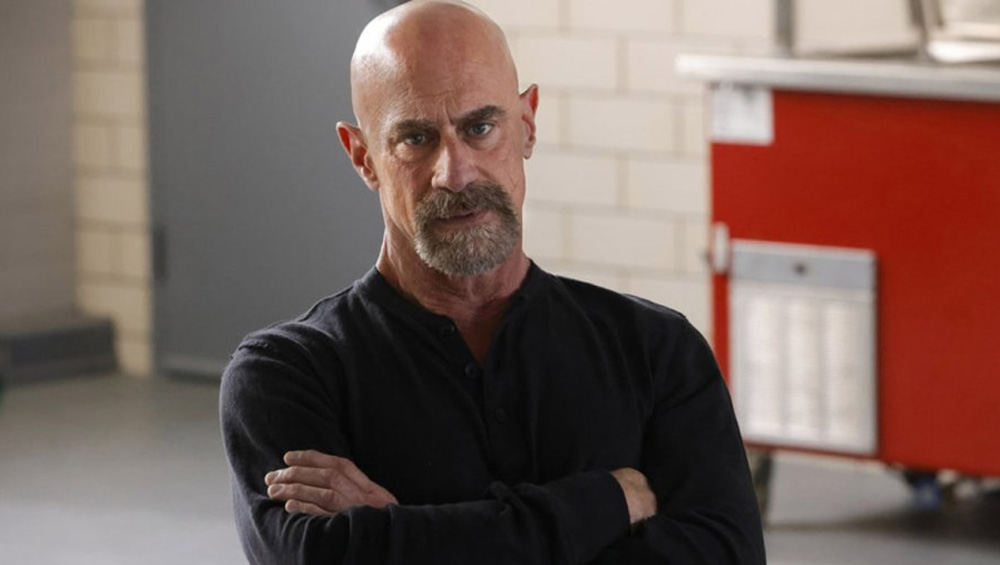

The Peabody Awards on Thursday revealed its full list of nominations for its 84th edition, with high-profile TV series like The Bear, Bluey, The Last of Us, Reservation Dogs, Fellow Travelers, Blue Eye Samurai, Last Week Tonight, Jury Duty and Marvel’s Moon Girl and Devil Dinosaur among those making the cut.