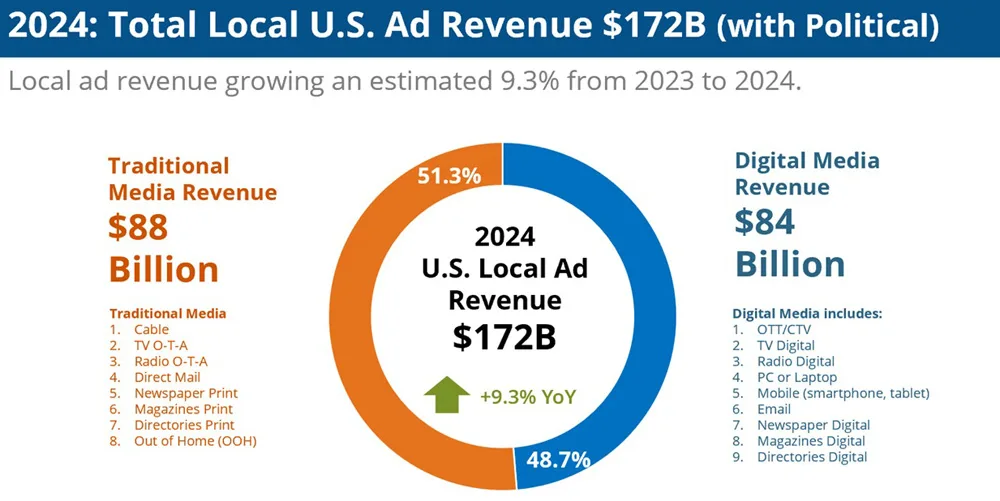

It says “Our slight adjustment down for this year is mainly due to mixed economic signals, a slowdown in certain consumer purchases, and lower than expected spending in Digital and Direct Mail advertising at the end of 2023 that may flow into this year.” It expects political ad spend to hit $11.1 billion, up 15.5% from 2020.

With ratings ebbing and business models crumbling, last year’s edition registered the largest audience of any TV event in history, with 115.1 million viewers (albeit with the caveat of revised Nielsen methodology). This year’s matchup between the San Francisco 49ers and the Taylor Swift-enhanced Kansas City Chiefs could bring somehow make the big game even bigger.

Advertisers spent $1 billion buying advertising on connected TV in June, a significant milestone, according to Vivvix, Kantar’s ad tracking unit, in its first-half report. “This milestone validates the projections on CTV’s ascendency from experimental to a ‘table stakes’ medium,” said Andrew Feigenson, CEO of Vivvix.

The youngsters do watch and recall ads, the report also finds.

Ad commitments for primetime broadcast TV fell 3%, to $9.595 billion, compared with $9.91 billion in last year’s market, according to Media Dynamics Inc., an advertising consultancy that tracks the upfront, when U.S. TV networks try to sell the bulk of their commercial inventory for their next programming cycle. Cable TV saw even worse erosion, with advertisers committing $9.52 billion for primetime TV, down 7% compared to the $10.23 billion in commitments secured last year.

Elon Musk–owned social network X, formerly Twitter, said late Thursday that it is lowering requirements for its creator payout program. The company said that the creators who have garnered 5 million impressions in the last three months will be eligible for ad revenue sharing — a third of the previous 15 million impression requirement. Creators will be able to withdraw as low as $10 instead of $50, the company said. Users still need to be verified and must have at least 500 followers to qualify for payouts.

After a record-breaking 35% gain in 2021, internet advertising revenue’s growth slowed to 10.8% in 2022, to reach $209.7 billion, according to the latest annual report on internet revenue from the Internet Advertising Bureau (IAB), conducted by PwC. The first two quarters saw 21.1% and 11.8% growth, respectively, but growth slowed to 8.4% and 4.4% in Q3 and Q4.

Several TV ad sales execs — who have already weathered billions in lost ad revenue since March as live sports and Hollywood productions remain on lockdown — say they are concerned that the biggest ad sales revenue hits are actually yet to come. That’s because no one knows when regular business operations will be able to resume, and more importantly, whether consumers will return to their pre-pandemic spending habits — particularly the 30 million people who have filed for unemployment since the coronavirus began to shut down the country.

October’s national ad market was up 7% over the same period a year ago, according to Standard Media Index. Breaking down the national TV category, broadcast networks dropped 7% in media spend, with cable networks 5% higher. Digital was up 17%.

The second-quarter earnings season of 2017 has wound down for media companies and broadcasters. Here’s a roundup of the developments that highlighted the reports: OTT, retrans, subscriber losses and ad revenues under pressure.

Interpublic research arm Magna has upgraded its U.S. ad revenue forecast and now predicts that media owners’ net advertising revenues will grow 6.3% to $179 billion in 2016, the strongest growth rate since 2010.

A year that started off with promise ended with a clunk, with advertising revenue growing at the slowest rate in six years. Total 2014 spending was up 3% percent, but when you take out political spending and the Winter Olympics, that number shrinks to just 1.6%, or $161 billion, according to Magna Global.

Belo Expects Rev Growth Of 18% In 2010

CEO Dunia Shive says the TV station group’s core revenue should be up 9% for the year in addition to the more than $55 million in political ad money. She sees growth ahead next year, but not quite as strong as in ’10.

CBS Predicts 3.4% Gain In Broadcast Ad Rev

Speaking at UBS’s 38th annual global media and communications conference in New York, CBS Chief Research Officer David Poltrack said that network television advertising revenues are up 6.2% in 2010, up from his previous forecast of 5%.

Magna Raises 2011 Ad Forecast To +5.4%

It projects that media suppliers around the world will grow their advertising revenues by 5.4% next year to a total $412 billion. Video retains its dominance around the world, with more than 40% of advertising — a total of $169 billion — relying on TV in 2011.