Massive levels of linear TV programming on CTV platforms (connected TV) have resulted by making up around 85% of total CTV ad inventory for long-form content, according to Bernstein Research. The stock research firm expects CTV ad inventory to end up growing 3% in the first quarter of this year, with linear inventory sinking 6% year-over-year.

Brands want to measure ads everywhere, but media companies keep making it harder.

Krishan Bhatia, formerly a senior ad sales executive at NBCUniversal, has been hired as vice president of global video advertising at Amazon. Bhatia will oversee Amazon’s TV advertising business including live sports, Amazon Freevee, Twitch, Prime Video Ads and third-party publishers. He will report to Alan Moss, Amazon’s global ad sales VP.

Spanish-language media company TelevisaUnivision and Transmit, a technology platform that maximizes the audience and revenue of the world’s most valuable streamed content, have formed a new partnership to introduce an […]

AI video advertising company Waymark has secured partnerships with top broadcast, cable, radio, and streaming platforms that now cover over 90%+ of U.S. Designated Market Areas (DMAs) and it’s now introducing […]

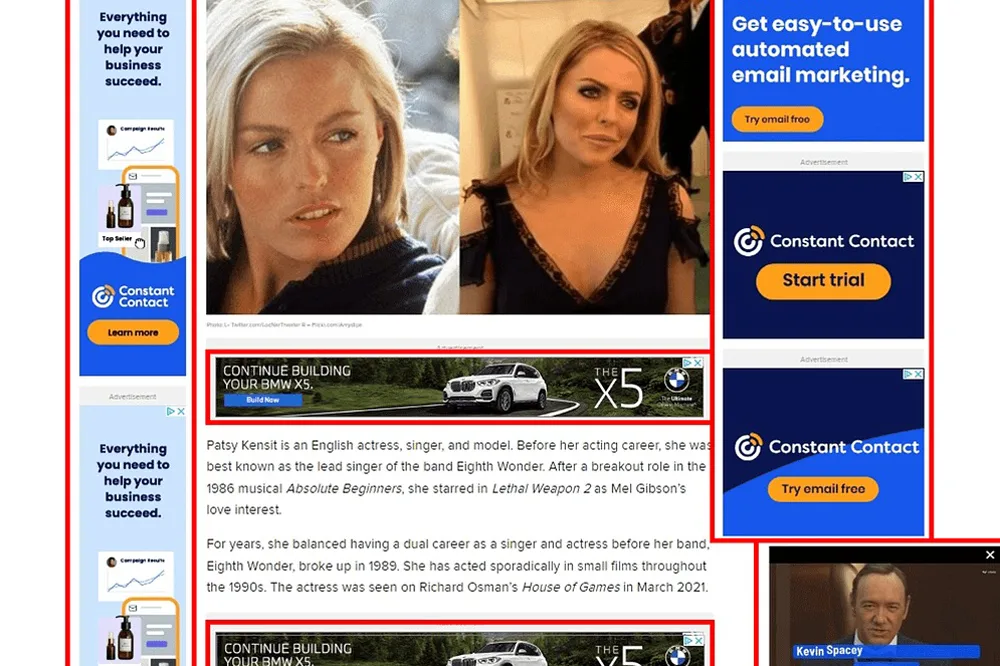

The ad industry is railing against online publishers that get visitors largely by advertising clickbait headlines around the web, then turn a profit by serving a barrage of ads to anyone who bites. These “made for advertising” sites stand accused of giving visitors a poor experience, delivering dubious results for advertisers and elevating carbon emissions because they run many more energy-consuming instant auctions for their ad inventory than websites with typical ad loads. Pictured: Example of a typical MFA site with an excessive volume of ad units.

LinkedIn and two advertisers have agreed to settle a long-running battle over the social media platform’s allegedly inflated ad metrics, according to papers filed Monday with a federal appellate court. Settlement terms have not been disclosed. The move likely brings an end to a dispute dating to 2020, when the tech company TopDevz and recruiting platform Noirefy alleged in a class-action complaint that LinkedIn’s erroneous metrics allowed it to charge inflated prices for ads.

Madhive, a software platform engineered for modern TV advertising, has added Evan Simeone as chief product officer. In this position, he will drive the next phase of Madhive’s product development […]

NBCUniversal said it has sold $1.2 billion worth of advertising in the Paris Olympics and Paralympics, putting it on track to be the gold medal winner for most ad revenue ever generated by an Olympics Games. The revenue total includes about $350 million from new advertisers. Digital ad revenue has already set a record, the company said.

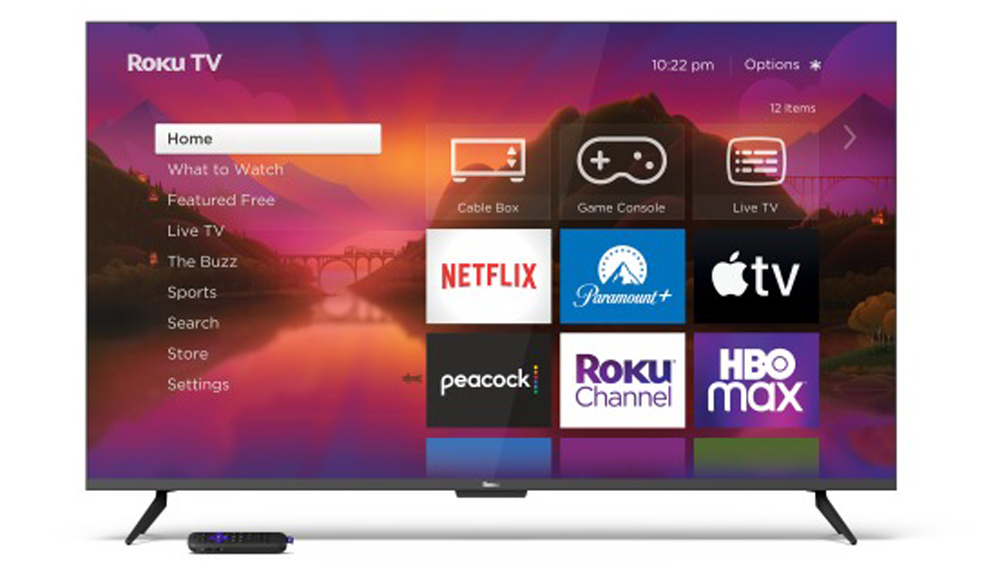

Roku has filed for a new patent that will allow it to show ads while TVs powered by its operating system are paused, event if the television is under the control of a different device ecosystem connected to it via HDMI. The scheme would allow Roku to expand its advertising business, even to those engaging with other TVOS platforms, say Apple TV, on Roku-powered TVs.

The video app is spending millions on ads as Congress considers a bill that could lead to a U.S. ban.

LinkedIn, Microsoft’s business-networking site, has entered the connected TV ad business. NBCUniversal joins as an initial partner to give business-to-business brands a way into CTV. The expansion into CTV from in-stream video ads running on its site will help advertisers get business message in front of the 1 billion LinkedIn members. Through LinkedIn’s Connected TV offering, the ads are delivered only on immersive large-screen TV devices.

The outsized audience for this week’s highly-watched women’s NCAA basketball match between Iowa and LSU may also have noticed that many of the commercials seen during the game belonged to AT&T, State Farm, Home Depot and Gatorade. There was good reason: Optimum Sports.

Fox Corp. today launched its expanded audience network and ad tech platform, AdRise. Acquired as part of the Tubi deal in 2020, AdRise is an advanced, integrated technology platform for […]

With tech companies like Google tightening their grip on third-party data sharing with advertisers, advertisers are eager to glean insights from retailers like Target, according to representatives from four advertising agencies specializing in consumer goods. Shoppers make more than 250 million visits a year to Target stores and its website.

A new TV ad spot shows TikTok taking new steps to oppose a bill that if passed would force ByteDance, the app’s China-based owner, to sell to a company in the U.S. due to potential concerns over data privacy and national security. TikTok’s ad campaign, which cost $2.1 million, uses testimonials by a diverse range of supposed TikTok influencers and sellers to highlight the damage that could be done to Americans who rely on TikTok to make a living were banned in the U.S.

Operative is announcing a number of product and partnership advances at the NAB Show in Las Vegas (April 14-17). The company continues to heavily invest in its global suite of […]

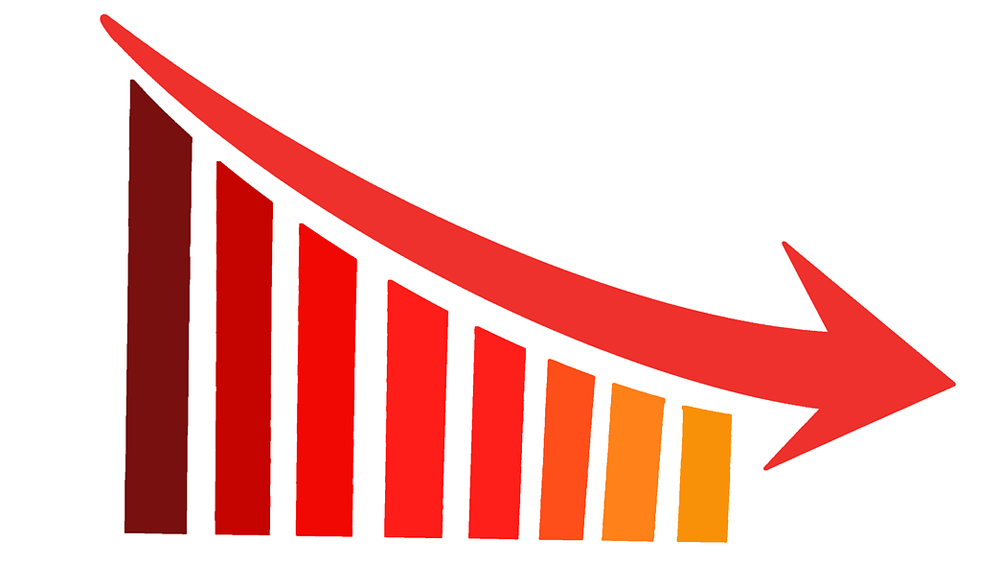

Despite an improving economic outlook, media buyer Magna forecasts that weakness of linear networks will result in national TV ad revenues falling 4.7% to $44.2 billion in 2024. Magna sees spending on linear networks dropping 8.8% to $34.2 billion, while streaming, including ad supported video on demand, connected TV and free ad-supported streaming television is expected to jump 12.9% to hit the $10 billion mark, accounting for 22% of national TV ad market.

WPP’s GroupM unit this morning announced plans to double its annual media investment in women’s sports-related media, and has created a new, dedicated marketplace to focus on it. As part of the initiative, GroupM said it is looking for “first-to-market” opportunities for its roster of clients including Adidas, Ally, Coinbase, Discover, Google, Mars, Nationwide, Unilever, Universal Pictures and others in its 2024-25 upfront media-buying negotiations.

In addition, the insurance company has invested in the National Women’s Soccer League Saturday Night Soccer on Ion with primary brand positioning and in-game sponsorship.

A search advertiser can’t proceed in court with claims that Google conspired with Apple to avoid competing in the search business, a federal judge has ruled. In a dismissal order, U.S. District Court Judge Pitts in the Northern District of California completely threw out the advertiser’s claims against Apple, and sent the claims against Google to arbitration because its contract with advertisers requires arbitration of disputes.

Ease Live, an Evertz company, is introducing contextual on-stream advertising capability for live sports through its interactive graphics platform. This enables leagues, teams, media companies, and other sports content providers […]

Nearly every commercial that runs on TV is backed by a guarantee of how big an audience will watch it. Late last year, Fox and Netflix decided to throw out that rule, one of the oldest in media economics.

Marketers agree that CTV advertising is the most effective digital channel in their media mix and 23.6% plan to increase their spending on connected TV (CTV) campaigns, according to a […]

Focusing its measurement efforts on the upcoming TV and video upfront market, NBCUniversal will be integrating its first-party identity data with that of VideoAmp for NBCU’s One Platform Total Audience. The expanded deal with VideoAmp for One Platform will offer audience-based cross-platform planning and measurement — looking for the overlap of viewing usage of linear and streaming audiences.

For the first time, Walt Disney is allowing direct access of its programmatic platform — Disney Real-Time Ad Exchange (DRAX) — with two of the largest demand-side platforms (DSP): Google’s Display & Video 360 and The Trade Desk. Google and The Trade Desk will be Disney’s launch partners in this effort, called DRAX Direct — providing those platforms’ advertisers with a new way to directly purchase Disney’s connected TV inventory.

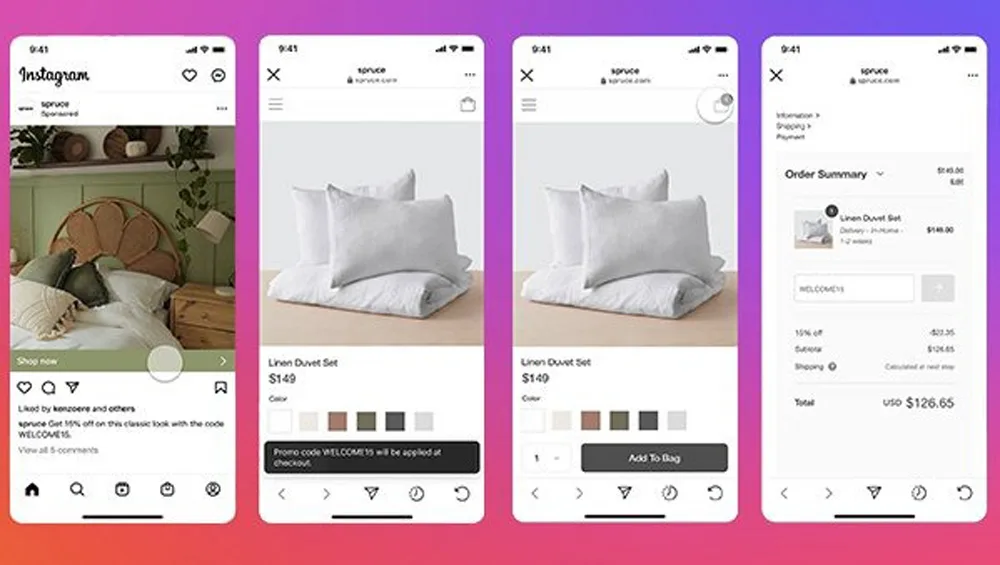

Instagram has officially launched a new “Ads with Promo Codes” option for all brands using Meta’s photo-sharing platform across the globe. The new ad product aims to provide marketers with a more visible way to highlight promotions and automatically apply them for interested consumers.

Michael Nathanson slashes forecasts, sees national ad revenue down 2.6% in 2024 and plummeting 12.3% in 2025.

NBCUniversal said it is working with Google and LiveRamp to deliver more effective personalized commercials on connected TV. NBCU is implementing Google’s Display & Video 360 Publisher Advertiser Identity Reconciliation (PAIR) system, which lets it make its own first-party data more compatible with data from clients. NBCU would be the first major CTV provider using PAIR live later this quarter.

NCAA’s “March Madness,” the three-week men’s college basketball tournament on CBS and Turner cable networks and platforms, has seen TV advertising price increases of mid- to high-single digit percentage gains with overall ad-revenue volume of similar percentage hikes.

Buyers can access inventory directly from sellers including A+E Networks, AMC Networks, DirecTV Advertising, Dish Media, Disney Advertising, Fix Digital, LG Ad Solutions, Vizio and Warner Bros. Discovery.

Qonsent, a technology firm and pioneer in user consent and data privacy management, and Driver Studios, a provider of kids and family entertainment, have partnered to “develop innovative approaches to building […]

Using AI In Media Planning And Buying

The benefits of AI and generative AI are becoming glaringly evident in the world of media buying and planning, where smarter trendspotting and better targeting and optimization rise quickly to the surface.

The wrestling promoter’s first “official hydration drink partner” will also be the first to appear at the center of the WWE mat.

Out-of-home ad spending continued its post-pandemic surge in the fourth quarter of 2023, rising 27% over the same quarter in 2022, according to new estimates from Guideline. National ad spending expanding at more than twice the rate of local — 50% vs. 24% — while live events experienced the greatest overall growth of any out-of-home media format — +181%.

Faced With Unprofitability In ’25, Station Groups Must Pivot Now

Some local station groups must lean into creativity, experimentation and the prospect of divorcing their networks if they’re to survive an ominous 2025.

A group wants the federal government to mirror its blanket restrictions on tobacco ads, citing addiction and its effect on sports.

The Academy Awards have long been a showcase for marketers, with the broadcast one of the few non-sports events to routinely rate among the most popular TV programs each year (the Macy’s Thanksgiving Day Parade is the other big one). Disney says that TikTok will sponsor a “first-of-its-kind red carpet live stream,” with tequila brand Don Julio sponsoring an “in-show moment.” Rolex and Bank of America will also be integrated into the broadcast, which will be hosted by ABC latenight host Jimmy Kimmel.