When you lend your likeness to a nationwide ad campaign, things don’t always go perfectly. Just ask Milana Vayntrub, AT&T’s Lily.

AT&T Inc. has begun to explore options for its 70% stake in DirecTV as it approaches the end of an agreement under which it can legally sell its interest in America’s third-largest pay TV provider. Among AT&T’s options are: a dividend recapitalization, adding a new investor, or selling the stake and exiting the venture as early as August 2024, according to people familiar with the discussions, who asked not to be identified because the discussions aren’t public. A deal isn’t imminent and discussions are still in the early stages, they say. The current ownership structure may still continue as is.

Broadcasters Go Private With 5G

Broadcasters are now making active use of 5G in everyday production operations, usually alongside LTE in contribution feeds sent with bonded cellular systems. But the most exciting production applications to date for 5G have actually used private 5G networks that broadcasters have set up themselves for big-event coverage.

AT&T will remain a top-tier sponsor of NCAA athletic events through the 2024-2025 academic year, having signed a deal to extend its pact with the massive college-sports league. AT&T has been an NCAA “corporate champion” since 2001, and unveils the extension just as the NCAA’s 2023 “March Madness” basketball tournament is set to kick off.

Cellphone carriers facing roughly $200 million in fines for sharing their customers’ locations are for now shielded from paying by the FCC’s partisan deadlock, according to people familiar with the matter. A partisan divide leaves the regulator short of the votes required to require T-Mobile, AT&T and Verizon to pay fines.

In the midst of a retransmission fee dispute with DirecTV, Mission Broadcasting has prepared letters for its station general managers to send to government officials blaming an intractable satellite company for the blackout impacting their constituents.

Microsoft’s acquisition of Xandr from AT&T has officially closed, the company announced Monday, allowing the company to build up its ad business — particularly in connected television and linking it to search advertising. Financial terms of the deal were not disclosed, but reports estimate the price at about $1 billion.

HBO Max/HBO Gain 3 Million Subscribers In 1Q

AT&T, in its Wall Street swan song as an entertainment entity, reported solid subscriber pickup for HBO Max and HBO for the first quarter of 2022 on Thursday. The now-divested WarnerMedia unit was again a drag on profitability because of continued investments in HBO Max and the launch of CNN+ — reflecting a key reason AT&T spun it off.

AT&T has firmed up more details of its spinoff of WarnerMedia, which is poised to combine with Discovery in a $43 billion merger. In an SEC filing, the telecom giant said it will issue its shareholders a special dividend on April 5. For each share of AT&T common stock, holders will get 0.24 share in Warner Bros Discovery. AT&T’s stock will begin two-way trading on April 4, with shareholders getting the option to buy or sell shares of AT&T with or without the WBD shares. Shareholders will also get a quarterly dividend worth a shade less than 28 cents for each AT&T share, on top of the company’s annual dividend of $1.11 a share after the spinoff closes. Above, AT&T CEO John Stankey and Discovery CEO David Zaslav.

AT&T chief executive John Stankey’s compensation totaled $24.8 million last year, up from $21 million the year earlier. According to a proxy statement filed with the SEC, retired CEO Randall Stephenson made $16.3 million in 2021 (down from $29 million).

One America News might have to shut down because of DirecTV’s decision to drop the right-wing network from its channel lineup, OAN said in a lawsuit against DirecTV and its owner AT&T. DirecTV recently said it will drop OAN after their carriage contract expires in early April. DirecTV will also drop AWE (A Wealth of Entertainment), as OAN and AWE are both owned by Herring Networks. Herring alleges breach of contract and other violations were committed by AT&T, DirecTV and AT&T Board Chairman William Kennard.

Discovery investors voted in approval of the company’s $43 billion acquisition of WarnerMedia from AT&T to create Warner Bros. Discovery during a special meeting of stockholders on Friday, marking one of the final formal steps before the transaction can close. The deal, a spinoff of WarnerMedia from AT&T, is expected to be completed early in the second quarter, with insiders estimating between April 11 and 28. The merger has already received approval from the U.S. Department of Justice and the boards of directors of both AT&T and Discovery.

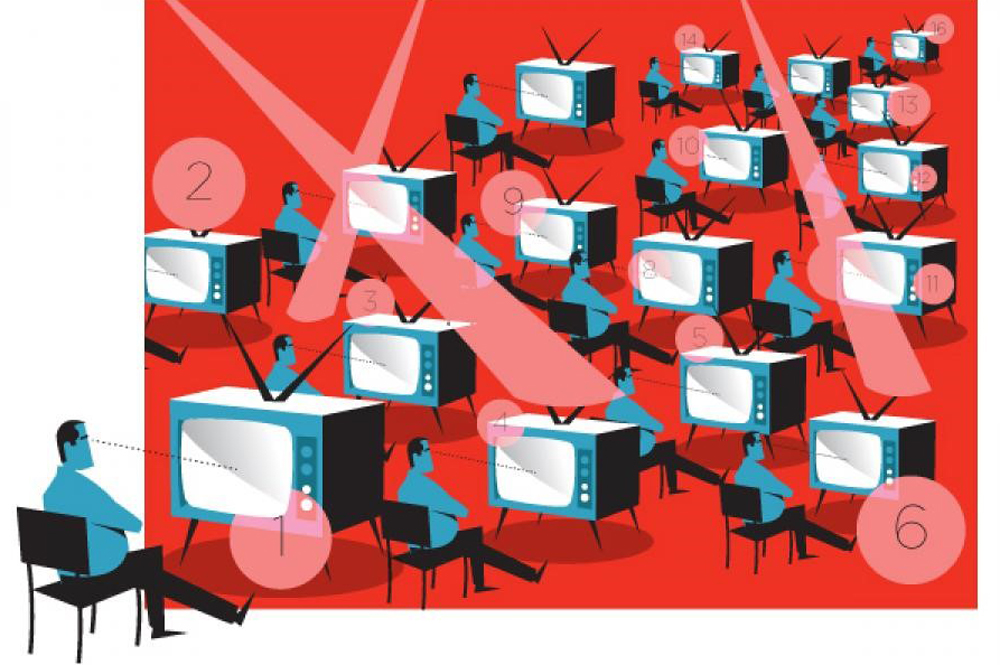

AT&T and State Farm are the latest big advertisers to experiment with new ways of figuring out just who is watching TV – and the commercials that support it. The two marketers are among those who are taking part in an alliance between Discovery and Omnicom Media Group. Under the pact, a handful of Omnicom clients, including the telecom and insurance giants, will test new ways of tabulating linear TV audiences using Comscore and VideoAmp, and examine recent viewership data.

Teed up by riveting playoffs, NBC will rely on the same core technical setup it employs for its regular-season NFL games when it broadcasts Super Bowl 56 on Sunday. “The more you can stick with what got you to where you are, the better off you are,” says Drew Esocoff, the big game’s director. Above, the Infinity Screen by Samsung in SoFi Stadium (Photo: Will Navarro).

The company is picking a simpler method to complete its deal with Discovery that will make the transaction easier for individual investors to digest, but will still leave the telecom company with about 7.2 billion shares outstanding.

AT&T may be leaning toward a straightforward spinoff of the 71% stake in the new Warner Bros. Discovery in the coming months rather than a complex “split-off,” or exchange offer. A transaction in one of those forms will take place when AT&T merges its WarnerMedia business with Discovery.

Former president Donald Trump, who has been using his ongoing national circuit of campaign-style rallies to urge the boycott of DirecTV and parent company AT&T for removing conservative channel One America News (OAN), has expanded his wrath to Comcast. Speaking Saturday at the fairgrounds in the East Texas flatland town of Conroe, Trump described both publicly traded telecommunications giants as “left-wing lunatics who are destroying our nation.”

AT&T is looking to make sure local viewers have access to emergency weather information, and at the same time remove an issue raised by a U.S. senator from weather-plagued Louisiana related to an ongoing carriage impasse with Nexstar.

It looks like AT&T’s DirecTV and Uverse customers will have to wait at least another day for the possible resolution of the week-long retransmission consent battle between the pay TV giant and Nexstar Media Group.

The Justice Department’s antitrust case against AT&T reached a crescendo Wednesday as government lawyers asked an economist to explain how the telecom giant’s proposed $85 billion merger with Time Warner would lead to higher cable bills for consumers.

Justice Department Antitrust Chief Makan Delrahim appeared in the courtroom Thursday to watch the proceedings in the government’s lawsuit to stop AT&T’s bid to purchase Time Warner as attorneys honed in on another merger: Comcast and NBCUniversal.

A little less than two weeks and eight witnesses into the trial over AT&T’s proposed $85 billion purchase of Time Warner, and we already have a good sense of some of the issues the case — which some are calling the antitrust trial of a generation — will likely pivot around.

The Justice Department, seeking to stop AT&T Inc’s deal to purchase Time Warner Inc, sought on Monday to show how often Time Warner subsidiary Turner would threaten to cut off cable companies to win concessions during contract negotiations.

The government and AT&T clashed on Thursday as each launched their opening salvos in a far-reaching trial on the telecom giant’s proposed $85 billion merger with Time Warner.

ATT-TW Case Holds Future Of TV In Balance

Fans will be glued to the “March Madness” college basketball tournament as the joint owner of rights for the games, Time Warner Inc, goes before a judge today to defend a proposed takeover by AT&T Inc. With some 12 million viewers per game last year, the NCAA tournament exemplifies the marquee programming the U.S. government argues will become more expensive if Time Warner is bought by AT&T, the biggest pay-TV provider via subsidiary DirecTV.

AT&T says it needs to buy Time Warner to compete with the likes of Amazon, Netflix and Google in the rapidly evolving world of video entertainment. The Justice Department’s antitrust lawyers worry that consumers will end up paying more to watch their favorite shows, whether on a TV screen, smartphone or tablet.

D.C. Federal District Judge Richard Leon oversees the first day of “trial” concerning AT&T’s proposed $85 billion acquisition of Time Warner.

The talk in media circles is focused on what happens if the AT&T deal is stopped by the government and Time Warner is forced to go it alone.

In a standoff with far-reaching implications, the government claims that the megamerger would give AT&T, which already owns the nation’s largest pay-TV provider, DirecTV, added clout to bully others, freeze out new entrants in the TV industry and increase rates for consumers. The dispute — a rare standoff in an antitrust case — will be decided by a federal judge after a trial that begins Monday in Washington, barring a last-minute settlement.

Two titans — the U.S. Justice Department and telecommunications giant AT&T Inc. — are locked in a high-stakes showdown to decide who controls some of the nation’s most popular television channels.

AT&T has filed for a trademark for “AT&T TV” with the U.S Patent & Trademark Office, a possible signal that the telco will eventually move away from its current TV brand names, DirecTV and U-verse.

“AT&T is merging with Time Warner not to thwart online viewing, but to advance it, by enabling AT&T to introduce new video products better suited to mobile viewing,” the company writes in papers submitted to a federal judge in New York.

The Wall Streer Journal reports a group of 11 former Department of Justice officials has asked a judge to revisit questions about whether the White House interfered in the government’s lawsuit challenging AT&T Inc.’s proposed acquisition of Time Warner Inc. Journal subscribers can read the full story here.