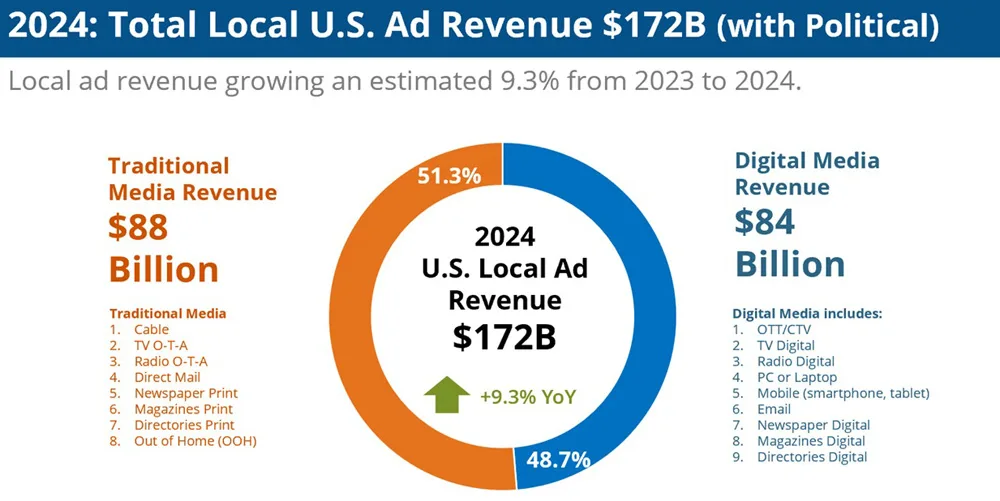

Political spending in 2024 is forecast to be $11.1 billion; increasing $2.2 billion (+24%) over 2022, and $1.5 billion (+15.5%) over 2020 political ad spending. Political will be the top spending vertical category in 2024 for many of the media channels in BIA’s forecast, including TV OTA, TV digital, Cable TV, Radio OTA and CTV/OTT. While local ad spending on digital is growing, traditional advertising is forecast to account for 70.2% of political ad spend in 2024, down from 77.9% in 2020. As with past presidential elections, in 2024 over-the-air TV will get the largest share of political ad dollars in local with an estimated $4.6 billion in forecast spending

It says “Our slight adjustment down for this year is mainly due to mixed economic signals, a slowdown in certain consumer purchases, and lower than expected spending in Digital and Direct Mail advertising at the end of 2023 that may flow into this year.” It expects political ad spend to hit $11.1 billion, up 15.5% from 2020.

That total will be bolstered by political and increased auto and legal ad spending. BIA CEO Tom Buono addresses television’s share of the local advertising marketplace for key ad spending verticals.

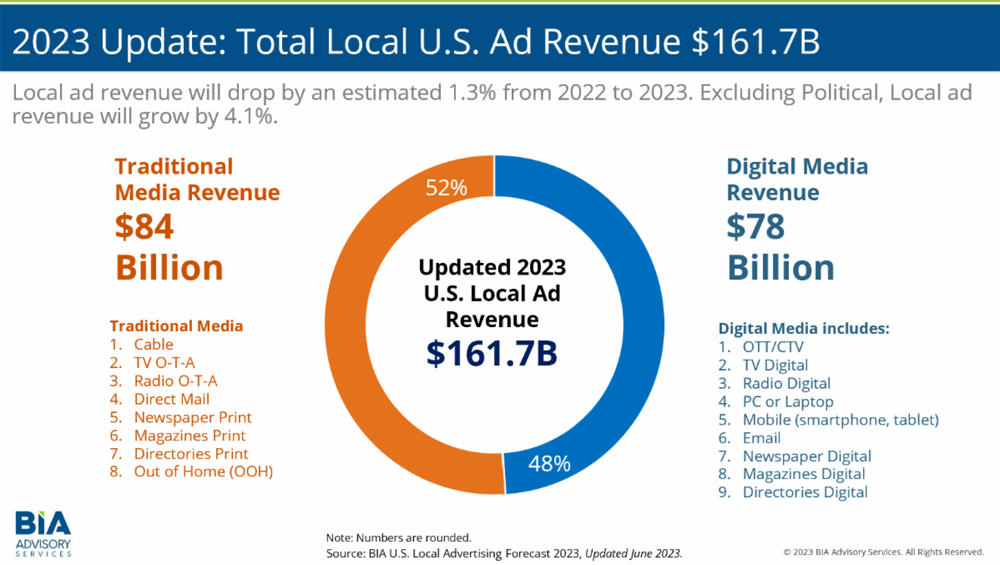

The adjustment in local advertising revenue is mainly due to a decrease in digital advertising plus a slow economic start to the year.

Over-the-top is set to be the fastest-growing form of local advertising, reaching $3.4 billion in revenue by 2026, according to a new forecast from BIA Advisory Services. Local OTT revenue is expected to be up 57% this year to $2 billion, BIA said. While growing quickly, OTT revenue remains a fraction over over-the-air TV revenue, which are forecast to total $20.4 billion in 2022 and hit $21.9 billion in 2026.

Live virtual events for broadcasters this week focus on revenue as well as technology. They include an Akamai webinar on securing Javascripts, a Cisco presentation about Precision Timed Protocol in SMPTE 2110 Fabrics and the Sports Video Group’s annual College Sports Summit. TVNewsCheck will present Optimizing Spot TV in a Challenging Economy and BIA will focus on Selling Digital Marketing Services to Local Businesses. Media Financial Management Association continues its series of webinars for CFOs and other financial managers. For the full list of events and links to their registration pages, visit TVNewsCheck’s Virtual Events Directory.

Its projection drops 5% to $18.5 billion, saying political, OTT and digital advertising will slightly balance the negative effect of the pandemic on local advertising.

BIA today revised its local advertising forecast. “In the U.S., the economic impact could evolve in a few different ways. We could see a relatively quick rebound beginning once the health impact is more quantified, a slower rebound over a longer period or a decline into a recession. Given the significant steps taken by government officials and agencies to minimize the spread of the virus and what has happened in other countries, we believe we are looking at a two to three-month period to stabilize the epidemic.”

In addition to advanced TV, the forecast examines growth across TV OTA, TV online, OTT, retrans and non-broadcasting.

BIA Advisory Services has expanded its forecasts to include local over-the-top (OTT) advertising. The firm presented at TVB Forward 2019 in New York City and estimates that 2019 will generate $857 million in […]