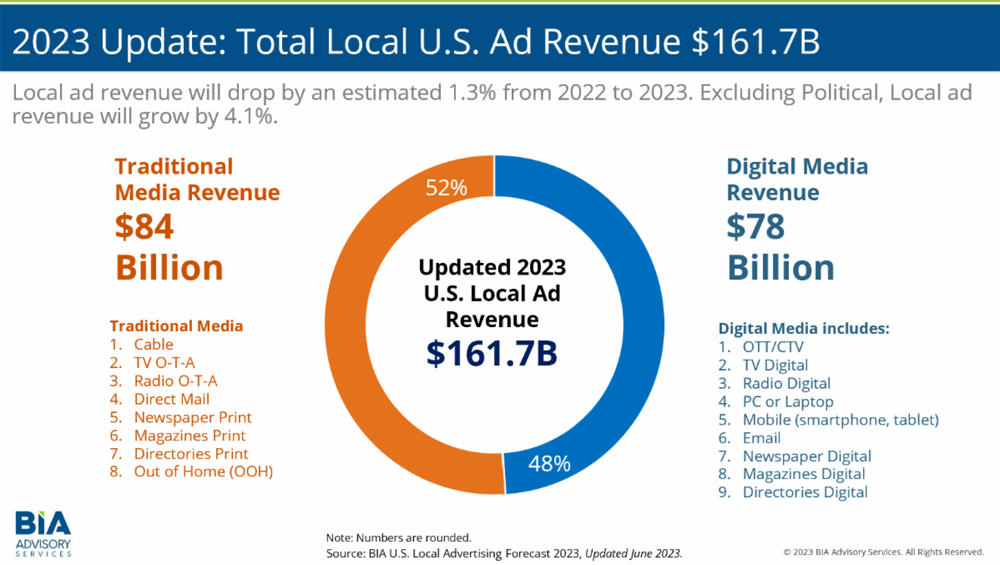

The adjustment in local advertising revenue is mainly due to a decrease in digital advertising plus a slow economic start to the year.

With traditional pay TV experiencing industry declines some service providers are forgoing video and related advertising businesses to focus on high-speed internet customers, however it’s a move that Viamedia CEO and President David Solomon categorizes as a “massive mistake.”

Automated Local TV Ad Sales Finally On Near Horizon

New platforms from Matrix, Operative and WideOrbit aim to make local broadcast competitive with digital. Note: This story, originally published for TVNewsCheck Premium members only, is now available to everyone thanks to a sponsorship by Revenue Analytics.

Why Local TV News Is Always An Essential Media Buy

Michael Felicetti: “Like politics, all news is local. Even when there’s a big national or international news story (whether it’s Russia invading Ukraine, the World Cup or one of the biggest news moments of all time), it’s the local angles that ultimately interest us most. In fact, well over half (62%) of Americans watch local news on television daily. Even when national news seems to drown out local angles, there are still stories close to home that viewers care about: weather, sports and traffic. And for advertisers, local TV news is still a powerful way to reach a very targeted and engaged audience. On both strategic focus and practical planning levels, it provides a way to persist amid the tumult of national news cycles playing out in the background. It provides a means for sustainability.”

Centered on local marketers, the goal of this interactive forum is to connect local business owners in Philadelphia to the resources, technology capabilities and partnerships across Comcast NBCUniversal while building the future of local advertising through NBCU’s One Platform.

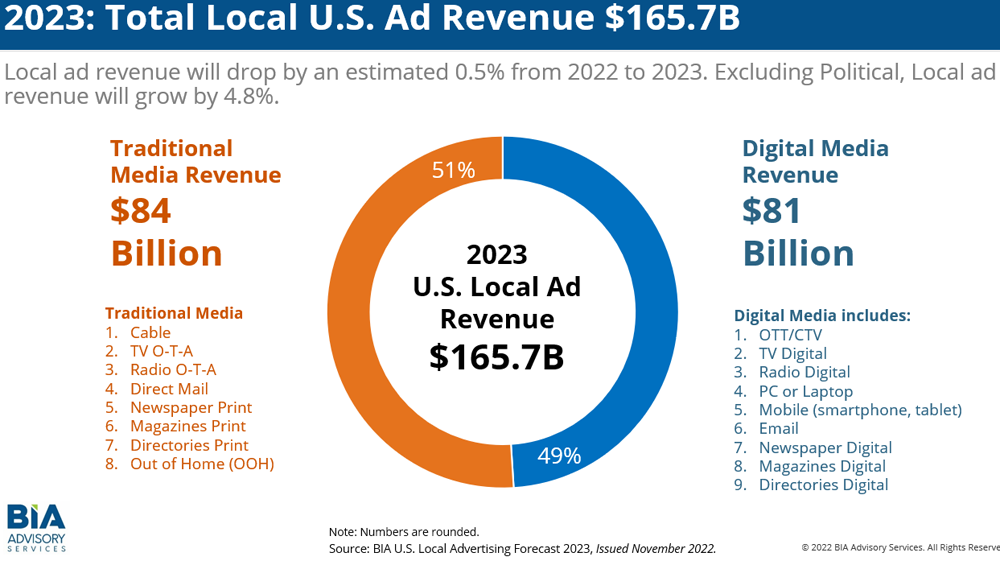

Without political, the U.S. Local Ad Forecast shows a 4.8% increase. The almost flat revenue projections for the year indicate continued economic and supply chain concerns, yet the forecast is more bullish starting mid-2023.

Progress is being made implementing automation technology for multiplatform buying, but challenges with measurement remain. L-r: Rob Weisbord, Sinclair Broadcast Group; Tracy Chavez, Publicis; moderator Paige Albiniak; and Media Monitors’ Philippe Generali. (Alyssa Wesley photo)

The Advanced Advertising Summit panel “The Local View” looked at TV stations and cable operators reaping revenue on their digital and over-the-top platforms. Local advertising on linear TV is in a good spot, the panelists said, and OTT adds to the take. “What we like to focus on is the tremendous broad reach of broadcast,” said Christopher Martinez, Hearst Television OTT director of sales. “Linear and OTT working together has revitalized the need for local.”

Amazon has reportedly begun to focus more on local ads in an effort to compete with Google and its “near me” approach. The move to focus more on local suggests Amazon wants to expand its small and medium-size ad business to local merchants that serve specific geographic areas.

The survey represents nationwide ad spending targeting local audiences in 210 markets across 16 media and 95 business verticals. Local television advertising this year will dip to $16.2 billion, but bounce up to $19.3 billion in 2022, with $1.5 billion and $1.7 billion, respectively, coming from digital platforms.

TV data company Alphonso today announced that CBS Television Stations has selected Alphonso Local to provide TV attribution for local advertisers in all 17 of its owned stations across the […]

Fox said it is seeing improvements in advertising sales at its station group as more businesses re-open after closing to slow the spread of the coronavirus. Speaking Tuesday at the Credit Suisse 22nd Annual Virtual Communications Conference, Fox COO John Nallen said he expected lost revenue to be on the low-end of the $200 million to $240 million range the company forecast when it reported earnings in May.

Don’t Bet Against Local TV Advertising

Local TV is facing a brutal quarter ahead, but the industry has shown creativity and endurance when dealing with past downturns. There’s every reason to believe it will do so again, and its first efforts are already visible.

Why Local TV Advertising Matters Right Now

Fred Fourcher: “We encourage advertisers to find ways to continue their media buys to provide critical support to local news outlets at this important time in our history. The ad impressions that local outlets receive through on-air and online are essential to their continued success.”

Stations Get Creative To Help Local Advertisers

Some TV stations are helping their local advertisers with deeply discounted or free — yes, free — advertising to keep their clients top of mind in their market.

Sarah Jacobs has been named director of revenue strategy and Maggie Drake has been appointed senior director of OTT revenue.

At the Justice Department last Friday, broadcasters were joined by Facebook and Comcast Cable in arguing that they all compete with each other for local advertising dollars. Winning that argument is the first step in convincing the DOJ to stop blocking duopolies of network affiliates. “There’s a really high overlap between these media types,” said Marcien Jenckes of Comcast. “Advertisers have shifted focus from this type of media or that type media. They think instead about their overall return on their media spend.”

The social media giant and search engine now account for 70% of the $60 billion spent on digital advertising in 2018, says a new Borrell report, with Facebook leading the way. “Those expecting the social media juggernaut to collapse due to data breaches, fake news, and reports of click fraud may have more hope than reality in their expectations.”

For businesses with 500 or more employees, this spending averages $4.48 million for advertising and $2.18 million on promotions, according to a new survey from BIA Advisory Services.

How To Offer What Local Advertisers Want

The majority (74%) of local businesses are using digital and traditional media together. Of the remaining advertisers, 22% are purchasing only traditional media, while just 3% percent purchase only digital, and the outstanding 1% reports using some other method. Stations need to get into the marketing services business.

The majority (74%) of local businesses are using digital and traditional media together. Of the remaining advertisers, 22% are purchasing only traditional media, while just 3% percent purchase only digital, and the outstanding 1% reports using some other method. Stations need to get into the marketing services business.

‘Feel Good’ Car Ad Corners The Buy For WKYT

Pivotal Research Group estimates that traditional, linear local TV broadcast advertising — excluding political ad revenues — will sink 2.2% in 2017, to $15 billion. This will be followed by another 4% decline in 2018 to $14.4 billion; a 4.2% decline in 2019 to $13.8 billion; a 4.5% drop to $13.2 billion in 2020; and a 4.7% pullback to $12.6 billion in 2021.

Gordon Borrell, CEO of Borrell Associates, will discuss macro trends that will be affecting local advertisers’ 2017 media buying decisions during a distance learning seminar offered by MFM, the Media Financial […]

What Do Local Advertisers Really Want?

In a nutshell, small and medium-size businesses want to see well-educated sales reps that understand both the customer they are pitching and the variety of solutions they have to offer. SMBs are not looking for someone to sell against digital, or to try to convince them that one medium is better than another; they are looking for sound advice — a marketing expert they can trust.

In a nutshell, small and medium-size businesses want to see well-educated sales reps that understand both the customer they are pitching and the variety of solutions they have to offer. SMBs are not looking for someone to sell against digital, or to try to convince them that one medium is better than another; they are looking for sound advice — a marketing expert they can trust.

Most traditional media will be dramatically transformed, much of it interactive. Think phones that communicate with beacons and allow advertisers to see our search history. Think in-car ads.

Ten years ago the iPhone didn’t exist, local advertisers didn’t know what a Facebook page was, and yellow pages were an essential part of any small business’s ad budget. So what changes will the next 10 years bring to local advertising? Here are five predictions based on conversations with analysts, buyers and others.

3.0 Viewership Data Could Remake Ad Biz

Panelists agreed that the proposed transmission standard holds the potential for producing new kinds of audience data that advertisers are looking for today, allowing stations to join the ad industry evolution toward “geo-targeted” data.

Local advertising will jump 16.4% to $132 billion in 2016 according to a new Local Advertising Insights report from Borrell Associates. Local and state elections, along with local businesses spending more on digital, will drive the uptick, and online will be the year’s winning medium with a 49.8% share and a 36.4% growth rate, while television accounts for 9.1% ($12 billion), growing 19.7%.

Much of that’s driven by digital, especially mobile, which small businesses are embracing. TV and especially radio are being squeezed by mobile’s ability to geo-target.

A Borrell Associates survey of small business owners released this morning finds that “advertising as we’ve come to know it is in decline.” The report, based on a survey of 7,228 small businesses, shows an acceleration in upward and downward trends for media buying, with more respondents planning to increase digital budgets than there were in 2011 and 2013 surveys, as well as more planning to abandon traditional media.

A Tuesday NAB panel explores the changing nature of how — and why — advertisers partner with local media, and the role traditional outlets play in driving consumers to the Web and, ultimately, business. One consensus: local media still has unmatched reach and clout.

In the incredibly competitive local advertising marketplaces throughout the U.S., national advertisers are playing a bigger role. National advertisers are increasing their spending in these local markets to target consumers in specific geographic areas. While they still spend on nationwide networks (e.g., NBC, ESPN), they are increasing their spending with local media companies such as local radio and television stations, and local online properties.

Variety Of Options Drive Sales At Star Trib

The Minneapolis Star Tribune, on the strength of its product portfolio, has found success with digital sales, which now generates about 20% of the paper’s revenue. Its efforts offer lessons for newspapers and broadcasters alike. This is Part IV of a four-part series. Part I on what TV stations are doing to integrate digital ad selling into their sales processes appeared Tuesday; Part II on the automated buying of spot appeared on Wednesday; and Part III on improving digital sales operations appeared on Thursday.

The Minneapolis Star Tribune, on the strength of its product portfolio, has found success with digital sales, which now generates about 20% of the paper’s revenue. Its efforts offer lessons for newspapers and broadcasters alike. This is Part IV of a four-part series. Part I on what TV stations are doing to integrate digital ad selling into their sales processes appeared Tuesday; Part II on the automated buying of spot appeared on Wednesday; and Part III on improving digital sales operations appeared on Thursday.

Automated Spot Buying Looming On Horizon

Automated, or programmatic, systems allow agencies to purchase advertising directly online, either eliminating sales people or limiting their role. In some instances, the systems involve an auction with buyers bidding for time. Such systems are commonplace in digital media, but they had far less success in the broadcast spot market. Now, however, some station groups are seeing the possibilities. This is Part II of a four-part series. Part I on what TV stations are doing to integrate digital ad selling into their sales processes appeared Tuesday; Part III, on Thursday, will focus on improving digital sales operations; and Part IV, on Friday, will offer a case study of a successful digital sales effort and the lessons it offers for broadcasters and newspapers alike.

Automated, or programmatic, systems allow agencies to purchase advertising directly online, either eliminating sales people or limiting their role. In some instances, the systems involve an auction with buyers bidding for time. Such systems are commonplace in digital media, but they had far less success in the broadcast spot market. Now, however, some station groups are seeing the possibilities. This is Part II of a four-part series. Part I on what TV stations are doing to integrate digital ad selling into their sales processes appeared Tuesday; Part III, on Thursday, will focus on improving digital sales operations; and Part IV, on Friday, will offer a case study of a successful digital sales effort and the lessons it offers for broadcasters and newspapers alike.

Digital A Vital Part Of Station Sales Arsenals

The rise of mobile viewing platforms means TV stations have new tools to offer advertisers who want to reach viewers no matter where they are. And it means stations can offer a greater variety of options — and price points — to potential advertisers, many of whom don’t buy time on traditional TV. This is Part I of a four-part series. Part II on the automated buying of spot will appear tomorrow; Part III on Thursday will focus on improving digital sales operations; and Part IV on Friday will offer a case study of a successful digital sales effort and the lessons it offers for broadcasters and newspapers alike.

The rise of mobile viewing platforms means TV stations have new tools to offer advertisers who want to reach viewers no matter where they are. And it means stations can offer a greater variety of options — and price points — to potential advertisers, many of whom don’t buy time on traditional TV. This is Part I of a four-part series. Part II on the automated buying of spot will appear tomorrow; Part III on Thursday will focus on improving digital sales operations; and Part IV on Friday will offer a case study of a successful digital sales effort and the lessons it offers for broadcasters and newspapers alike.

Borrell: Promotions Skyrocket, Ads Drop

U.S. businesses are spending less on advertising than they were 10 years ago, while spending on promotions has nearly doubled in the same period, according to a new report from Borrell Associates.

Execs Scale Back Local Ad Rev Projections

Only 82.6% of sales managers and 81.8% of account executives expect 2012 revenue gains over 2011, according to the 2012 Mid-Year Local Ad Sales Forecast by AdMall.

Shattering Network Scatter With Local TV

Local delivers a customizable, targeted national footprint at lower cost. And it delivers the content — and corresponding GRPs — that aren’t available nationally. How much more credible of an alternative could there be?

Behind The Slowdown In Local Advertising

Local advertising is traditionally slower to rebound than national, and indeed the recovery has hit a hiccup at the local level. Spending actually fell 2.4 percent last year, according to a new report from BIA/Kelsey. The research company’s chief economist, Mark Fratrik, talks about why local advertising fell last year, why he revised his forecast downward, and what to expect from local digital advertising over the next few years.

Local advertising is traditionally slower to rebound than national, and indeed the recovery has hit a hiccup at the local level. Spending actually fell 2.4 percent last year, according to a new report from BIA/Kelsey. The research company’s chief economist, Mark Fratrik, talks about why local advertising fell last year, why he revised his forecast downward, and what to expect from local digital advertising over the next few years.