The Federal Trade Commission will be the agency to review Amazon’s proposed acquisition of Hollywood studio MGM, according to people familiar with the matter, just as the commission gets a new chairwoman, Lina Khan, who has been critical of the online giant’s expansion.

Content is king in the direct-to-consumer streaming wars with The Walt Disney Co. in the lead and Steve Cahall, analyst at Wells Fargo, sees more deals like the proposed WarnerMedia-Discovery merger on the horizon as media companies seek enough ammunition to compete.

Amazon said Wednesday that it has struck a deal to acquire movie studio MGM for $8.5 billion, bolstering its efforts to become a top player in Hollywood. The deal will give the e-commerce and cloud computing giant a famed studio and catalogue of film and TV titles to beef up its Amazon Prime streaming service, from the James Bond and Rocky franchises to television series like The Handmaid’s Tale and Fargo.

An abrupt landing to a turbulent trip comes with a familiar message: Buying into the content business is hard

ViacomCBS is the latest media company to be spotlighted as a possible takeover target amid the heightened M&A speculation following the WarnerMedia-Discovery tie-up. ViacomCBS shares, which have lost 35% over the past three months, rose 3% in midday trading on Thursday after Bank of America Merrill Lynch analyst Jessica Reif Ehrlich upgraded ViacomCBS to buy from underperform, citing the potential for an acquisition.

A deal would add Metro-Goldwyn-Mayer’s 4,000 films to Amazon’s streaming library, including the James Bond, Rocky and Legally Blonde franchises.

Streaming Wars Are Now Takeover Wars

Discovery’s merger pursuit suggests companies as big as ViacomCBS still aren’t big enough to compete when tech and media giants are on the prowl

Jason Kilar was named chief executive of WarnerMedia just last year, but now he is negotiating his departure after being sidelined by David Zaslav, the longtime leader of Discovery.

“We are the best media company in the world” says the CEO poised to lead the content powerhouse. The enlarged Discovery-WarnerMedia will have massive reach across news, sports, unscripted, lifestyle content and some of entertainment’s biggest franchises and tentpole events from the HBO and Warner Bros. imprimaturs.

This week’s announcement of a mega-merger between AT&T’s WarnerMedia and Discovery must still pass muster with consumers who may not be willing to pay a premium fee for much of what they watch.

Makan Delrahim, who as the Justice Department’s antitrust chief during Donald Trump’s administration challenged AT&T’s combination with Time Warner, has a different view of the planned spinoff of WarnerMedia. “I wish both companies and Mr. Zaslav and Mr. Stankey the best,” Delrahim said, referring to David Zaslav, the CEO of Discovery, and John Stankey, the CEO of AT&T.

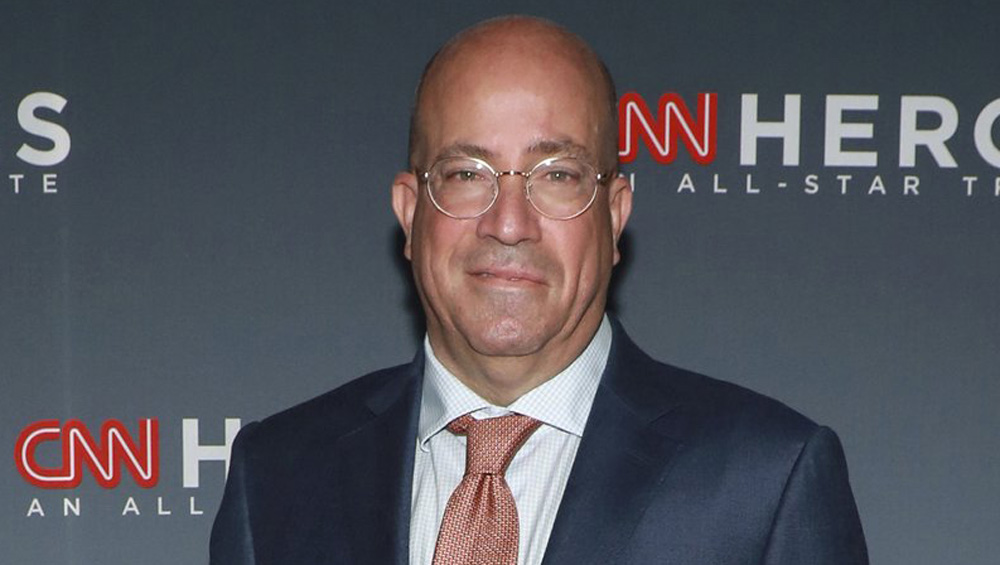

Sources say Jeff Zucker may drop his plan to leave CNN at year’s end and instead remain head of the network, as a result of the massive merger of AT&T-Discovery media assets announced Monday morning. Driving the news: Nothing has been decided. But absent this tectonic media shift, Zucker — who’s chairman, WarnerMedia News and Sports, and president of CNN Worldwide — was gone. Now, the door is open for him to stay.

AT&T and Discovery Monday announced a definitive agreement to combine WarnerMedia’s premium entertainment, sports and news assets with Discovery’s leading nonfiction and international entertainment and sports businesses to create a premier, standalone global entertainment company led by Discovery CEO David Zaslav. Under the terms of the agreement, which is structured as an all-stock transaction, AT&T would receive $43 billion in a combination of cash, debt securities, and WarnerMedia’s retention of certain debt, and AT&T’s shareholders would receive stock representing 71% of the new company; Discovery shareholders would own 29% of the new company.

TVN Executive Session | NPG Still In The Hunt For More Stations

Mike Meara, president of News Press & Gazette Broadcasting, says the family-owned company has no plans to get swallowed up in the industry’s consolidation trend and is very interested in picking up more stations itself. Note: This story is available to TVNewsCheck Premium members only. If you would like to upgrade your free TVNewsCheck membership to Premium now, you can visit your Member Home Page, available when you log in at the very top right corner of the site or in the Stay Connected Box that appears in the right column of virtually every page on the site. If you don’t see Member Home, you will need to click Log In or Subscribe.

Univision and Televisa have come to terms on a merger agreement, a long-awaited deal that will create a Spanish-language TV giant with broad reach in Mexico and the U.S. The deal calls for Televisa to contribute its media, content and production assets and a handful of networks to a new entity to be known as Televisa-Univision. Televisa’s assets are valued at $4.8 billion. The new company will be led by Univision CEO Wade Davis, who headed the investor group that acquired Univision in early 2020.

With its nearly $4 billion bid to acquire Atlantic Broadband all but a memory, Altice USA CEO Dexter Goei told analysts Wednesday that the company still wants to grow via acquisitions, and has its eye on a handful of potential “bite-sized” deals.

TVNewsCheck‘s Michael Depp and Harry Jessell look at TV’s M&A prospects this year following Gray’s acquisition of Quincy and discuss the major moves at Nexstar’s NewsNation.

Digital media companies that survived the pandemic are now rushing to join forces as they scramble to battle the tech giants for ad dollars.

A blank-check company backed by former Citigroup Inc. rainmaker Michael Klein is among the parties interested in buying a stake in AT&T Inc.’s DirecTV satellite-television business, according to people with knowledge of the matter. Churchill Capital Corp. IV, which raised $2.07 billion in July, is working with advisers on a potential bid for the asset, the people said, asking not to be identified because the discussions are private.

As showbiz scales up to battle Big Tech, Makan Delrahim, the nation’s top antitrust regulator (and a former movie producer), is becoming as influential as any mogul over Netflix, megamergers, the Writers Guild and maybe the entire future of the entertainment business.

Sinclair Broadcast Group has settled the lawsuit stemming from its failed $3.9 billion takeover of Tribune Media. The merger was scuttled after the FCC referred it to an administrative law judge, making it untenable. Tribune responded by terminating the deal and filing suit against Sinclair in August 2018, alleging breach of contract.

Hasbro has completed its $3.8 billion all-cash acquisition of Entertainment One. The merger gives Hasbro access to a pool of valuable international brands, including the wildly popular children’s character Peppa Pig, along with PJ Masks, Clifford the Big Red Dog and the upcoming Ricky Zoom. Those join Hasbro’s already lucrative existing catalog of properties — which includes Transformers, G.I. Joe, Ouija and what it gained last year after buying the remaining stake in the Mark Gordon Co., the independent TV and film studio behind Grey’s Anatomy.

TiVo has scrapped plans to split itself into two separate companies, and instead announced a $3 billion merger with Xperi, a company that sells audio, imaging and computing technology products.

The FCC held a meeting with private equity firm Apollo Global Management this week to ask questions about its agreement to finance New Media Investment’s planned purchase of Gannett Co., the publisher of USA Today, sources say. The FCC is concerned that the $1.8 billion loan Apollo is providing to finance the merger could violate its duopoly laws, sources say.

FCC Chairman Ajit Pai on Wednesday circulated a draft order that would grant approval to the $26 billion tie-up of T-Mobile Us Inc. and Sprint Corp.

FTC Chairman Joe Simons, who is overseeing a tech task force, for the first time said he is prepared to break up major tech companies. He said this could be done by “unwinding” past mergers if the agency finds the companies are harming competition. Antitrust experts have argued for years that major tech companies buy startups to shut down their competition.

Vitec Group Drives Record Results Through M&A

Analysts, investors and expert attorneys will examine the consolidation landscape at TVNewsCheck’s daylong conference in October.

Twenty-First Century Fox has triggered a 46-day deadline to raise its bid for Sky in a battle with Comcast for control of the British pay-TV group. Under British takeover rules, Rupert Murdoch’s Fox now has until Sept. 22 to trump Comcast’s £14.75 per share offer for Sky, which values the broadcaster £25.9 billion ($33 billion), after it formalized its own £14 per share bid.

The withdrawal by Comcast leaves the path open for The Walt Disney Co. to buy the 21st Century Fox assets with its latest offer of $71 billion. The Department of Justice has OK’d Disney’s bid as long as it sells 22 regional sports networks. Fox shareholders are set to vote on Disney’s offer July 27.

The U.S. Justice Department has only a remote chance of overturning AT&T’s takeover of Time Warner, Chief Executive Randall Stephenson said on Friday, while warning the case could affect bidding for 21st Century Fox.