YouTube TV is not only the fastest-growing virtual pay TV provider with an estimated 6.9 million subscribers, but has surpassed Dish Network (6.7 million), and now has become the fourth-largest of any pay TV provider of any kind, says MoffettNathanson Research. YouTube TV has grown 35% year-over-year (at just over 5.1 million subscribers in the third quarter of 2022).

Ahead of next Wednesday’s fast-approaching deadline, broadcasting and pay TV industry representatives are using the limited time left to pitch the FCC on their preferred substance of potentially new media ownership rules. Broadcasters are urging the FCC to loosen some current rules and allow for more TV station ownership consolidation at the local level. Meanwhile, cable and satellite TV companies think current rules have loopholes that need to be closed to reduce the number of signal blackouts and moderate their payments to stations for carriage.

A lot has been said about how cord-cutting decimates traditional linear television’s viewership.

But according to Inscape, the data division of Vizio, many of the people who haven’t cut the cord have also reduced their viewing of satellite and cable TV. In its Q2 2023 TV Market Trends report about 5% of U.S. pay TV households have stopped viewing content via cable and satellite. That’s up from 4% in Q4 2022. Others have cut back significantly.

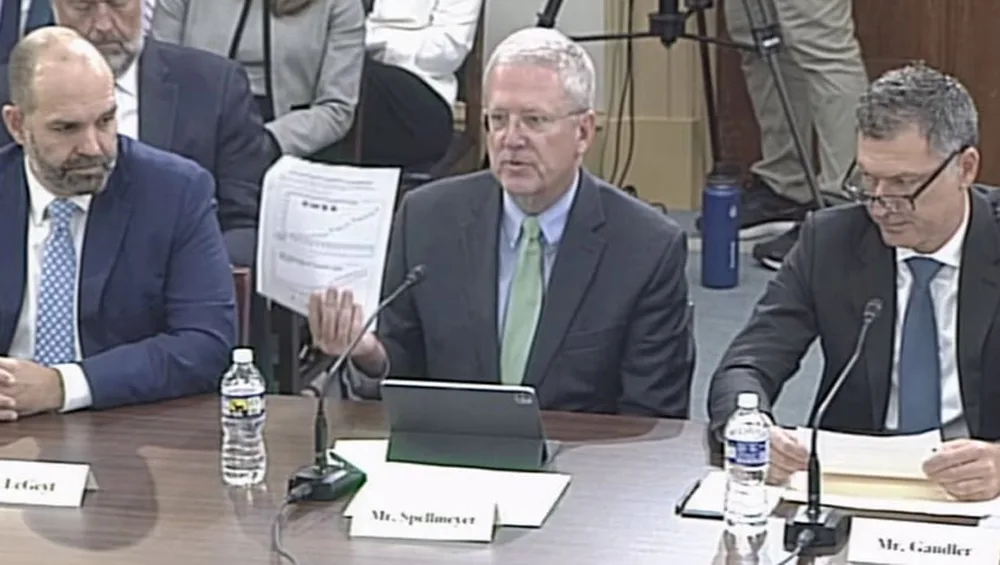

Federal lawmakers this week expressed their frustration over rising cable and satellite television prices and numerous programming blackouts that have resulted in many of their constituents losing access to local news, network shows and live sports on pay TV systems several times over the last few years. Pictured: Three industry witnesses participating in the hearing, l-r: Curtis LeGeyt, CEO, NAB; Grant Spellmeyer, CEO, ACA Connects; David Gandler, CEO, Fubo. (House Committee on Energy & Commerce)

Wall Street analysts say that the rift can result in a migration of subscribers and could even tip Hollywood’s power structure.

Pay-TV and cable providers continued to bleed subscribers during the second quarter of 2023 as cord-cutting among consumers continued to accelerate. The largest pay-TV providers in the U.S. – who represent about 96% of the market – lost about 1.73 million net subscribers in the second quarter of 2023, compared to a pro forma net loss of about 1.725 million during the same period a year ago, according to Leichtman Research Group.

By 2027, the U.S. television industry will see $30 billion less annually from traditional subscription and advertising revenue than it did a decade earlier amid ongoing cord cutting, according to a new forecast by PwC. The rate of subscriber decline in the traditional TV bundle hit a milestone in the third quarter of 2022, when the number of pay TV households fell below half the total number of U.S homes for the first time.

The number of traditional pay TV households in the U.S. will continue to decline and could equal the amount of non-pay TV homes in the next few years. That’s according to new estimates from media analyst firm MoffettNathanson, which is forecasting that the number of households sticking with traditional pay TV will shrink to below 60 million by 2024. At that point, the firm estimates there will be approximately 73 million U.S. pay TV subscribers (including virtual MVPDs), down from 93 million in the third quarter of 2019 and 84 million in the third quarter of 2021.

Global pay TV subs will hit 1.1 billion in 2021, a slight 0.5% gain but revenue from video services will slump by 3.5% this year, Kagan predicts, accelerating an ongoing shift to streaming.

U.S. viewers will spend more on streaming video than pay TV for the first time in 2024, according to new research from Strategy Analytics. The company is releasing its latest U.S. Subscription TV Forecast, which projects that consumer spending on traditional pay TV services fell by 8% to $90.7 billion in 2020. It expects that number to decline further to $74.5 billion in 2023. At the same time, spending on subscription streaming services (including VOD and virtual MVPDs) rose by 34% to $39.5 billion in 2020 and will reach $76.3 billion in 2024, surpassing traditional pay TV.

With media companies pivoting to streaming, analyst Michael Nathanson of MoffettNathanson is asking if streaming is really a better business than traditional pay TV. His conclusion: With Netflix the only mature streaming company to use as a model, domestic streaming isn’t all that much different in terms of profit margins from low-end basic cable and premium pay networks, said Nathanson in a report.

Pay TV’s Bleak Post-Pandemic Outlook

The pandemic has taken a huge toll on the pay TV industry, and with the near-term future of live sports in question, there are no signs of it getting better in 2021. The fraught pay TV landscape is forcing some smaller, niche cable channels out of business altogether.

ESPN and Fox Sports had to come together if the heavyweight showdown between Deontay Wilder and Tyson Fury at the MGM Grand hotel this Saturday was to happen. And it’s also true that both networks are blanketing the airwaves this week like never before in an effort to get people to dig into their pockets for the $79.99 it will cost to watch the fight at home.

The U.S. satellite and cable TV business declined at an unprecedented rate last year — with traditional pay TV providers dropping a staggering 6 million customers, a 7% year-over-year decline. In the fourth quarter of 2019 alone, traditional TV distributors lost around 1.5 million subs, dropping to about 83 million total at year-end, according to estimates from Wall Street analyst firm MoffettNathanson.

Univision Communications and Televisa today announced a distribution arrangement that would make a Univision-branded linear television channel available across the region in early 2020. The 24-hour pay TV channel will […]

The growing interest in legal sports gambling could mean more potential TV viewers, according to a recent analysis of sports programming by Altman Vilandrie & Co. Some 92% of frequent gamblers (those who participate regularly in sports betting and/or fantasy sports) are pay TV subscribers.

Cord cutting accelerated to record speed in the second quarter, with the major U.S. pay TV operators reporting an all-time-worst loss of 1.53 million subscribers during the period.

Gains by OTT-TV providers in the fourth quarter of 2018 again were not enough to offset the huge losses being absorbed by traditional pay-TV providers. According to MoffettNathanson’s latest “Cord-Cutting Monitor” report, the US pay-TV industry lost 248,000 subscribers in 4Q — 985,000 losses among the traditional providers (cable, telco and satellite) against 737,000 sub gains by the virtual MVPD market.

Traditional pay TV providers have widened their net loss of subscribers by 30% in the third quarter of this year. MoffettNathanson Research says this year’s drop amounted to 1.12 million. “It is the largest quarterly loss ever (the first time the industry lost over 1 million subscribers in a quarter),” writes Craig Moffett, senior research analyst, MoffettNathanson.

In a survey from SpotX, a video advertising serving platform, commissioned by Kagan, 54% of respondents expected to see an 11% to 20% increase on advertising spend by moving to audience based buying/selling — 32% expected a a 6% to 10% gain.

Big traditional pay TV providers lost 3.7% or 3 million subscribers in 2017 — one of the worst years ever, according to one report. But other research says that new, rising virtual pay TV services have softened the blow.

U.S. cable, satellite and IPTV operators lost a combined 845,000 video subscribers in the fourth quarter of 2017, analyst Vijay Jayant estimated in a note to investors.

Over the past decade, prices for TV service have risen almost twice as fast as inflation, according to an analysis of government data. Data provider S&P Global Market Intelligence says customers’ cable and satellite TV bills have soared 53% since 2007, to $100.98 in 2017.

Over the past decade, prices for TV service have risen almost twice as fast as inflation, according to an analysis of government data. Data provider S&P Global Market Intelligence says customers’ cable and satellite TV bills have soared 53% since 2007, to $100.98 in 2017.

New data from MoffettNathanson shows traditional pay TV subscriber erosion worsened in the just-completed second quarter, rising from 2.5% in 1Q to 2.7%, “the fastest rate of decline on record.” […]

Cord-cutting and competition from new platforms are expected to lead to more than 1 million sub losses in a first for the industry.

Since internet-TV packages have begun to heat up in earnest, a question has hung in the air: Are they cannibals? Will these packages hurt their traditional counterparts, sometimes offered by the same company, by cannibalizing their customers. In short: Will people who have a $100-a-month DirecTV package right now trade it down for something smaller and digital? In a new report from UBS analysts led by John Hodulik, the answer seems to be “yes.”

Over-the-top “skinny bundles” are continuing to grow, and their subscribers are streaming plenty of content, but for now, they’re still a relatively small piece of the puzzle compared to traditional cable or satellite subscriptions as well as all over-the-top viewing (including people who subscribe to OTT services like Netflix while still having traditional cable).

Now that the first-quarter earnings season is in the rear view, it’s time to assess the damage. Here’s a complete look at the results, ranking the top seven cable, satellite and telco pay-TV operators and offering a look at their performance in a number of key metrics, including subscriber growth and average revenue per user.

The slow-motion crumbling of pay TV has suddenly started to look like a looming avalanche. The unprecedented surge in cord-cutting during the first three months of 2017 has heightened Wall Street fears that the industry’s enormously profitable big bundle of channels is coming apart at the seams — for real this time.

The rumbling under the ground of traditional television is growing louder according to the results of Deloitte’s latest annual Digital Democracy Survey, which polled 2,131 U.S. consumers in early November. The audit, consulting, tax and advisory firm found that 74% of U.S. households subscribe to pay TV and about two-thirds of these people say they keep it because it’s bundled with internet service.

Traditional pay TV distributors witnessed some of the steepest declines in fourth-quarter 2016 — but adding in new “virtual” pay TV providers trimmed those drops. For many, this means cord-cutting has arrived. MoffettNathanson Research says there was a 1.7% decline in traditional cable, satellite, and telco TV distributors — losing 319,000 to total 96.499 million U.S. subscribers.

Pay TV networks start the new year with discouraging news from Nielsen: The universe of homes that subscribe to cable or satellite for January is down 1.7% vs. the same time last year, even though the number of TV households grew 1.7% to 118.4 million, Nielsen estimates — and Pivotal Research Group’s Brian Wieser reports.

MoffettNathanson analyst Craig Moffett estimates cable, satellite and telco TV operators lost around 757,000 subs in the second quarter, or 708,000 if the gains by Dish Network IP-based platform Sling TV are factored in.

Pay TV providers could lose money on deals made with every single TV network group should growth rates from subscribers’ fees continue. Bernstein Research analysis, along with SNL Kagan research, says gross profit margins — which now average 25% for pay TV providers — are projected to fall to 17% in 2018. They will be zero in 2023 if trends continue.

Consumers are continuing to increase their use of TV Everywhere,” even if they aren’t identifying the practice of streaming video content as such.