AdTheorent uses machine learning to deliver value for programmatic advertisers. Combined, the companies said they will become one of the largest independent omnichannel audience activation platforms for buyers and sellers of advertising.

For the first time, Walt Disney is allowing direct access of its programmatic platform — Disney Real-Time Ad Exchange (DRAX) — with two of the largest demand-side platforms (DSP): Google’s Display & Video 360 and The Trade Desk. Google and The Trade Desk will be Disney’s launch partners in this effort, called DRAX Direct — providing those platforms’ advertisers with a new way to directly purchase Disney’s connected TV inventory.

After a difficult year for traditional advertising, top ad-tech executives see some changes coming in 2024. Growing in importance are connected TV as a channel for advertisers, the need for accountable data and a continuing shift to automation. Here are some predictions as 2024 gets underway.

OpenX Technologies Inc., an omnichannel supply-side platforms, has launched TV+, “an ongoing initiative to unlock the full potential of CTV by combining the most powerful aspects of linear and programmatic […]

Spectrum Reach, Charter Communications’s ad-sales unit, said it will use Beachfront Media as its sell-side ad server. Working with Beachfront will enable Spectrum Reach to sell ads to programmatic buyers across traditional set-top box TV, connected TV and online video platforms.

PubMatic said it launched Activate, a new technology that enables buyers to access premium video and CTV inventory on Pubmatic’s programmatic platform via direct deals. Launch partners include Dentsu, GroupM, Havas, LG, Mars and Omnicom Media Group Germany.

Video platform Zype and ad tech company TripleLift said they are working together to offer in-show advertising placements that can be inserted in connected TV streams and executed programmatically. TripleLift’s said its ad formats are non-disruptive and enable content owners to reduce ad breaks without sacrificing revenue, while giving advertisers contextual relevance.

In a move to make linear TV more like digital media, Dish Media is partnering with SeaChange, an ad-insertion company, and Beachfront, a sell-side ad server, to give advertisers the ability to buy TV commercial time seconds before the ads air. Dish says this “first of its kind” effort, called National Linear Programmatic, will be available to advertisers across its more than seven million TV homes.

The supply of marketing technology vendors powering the programmatic advertising marketplace grew more than 520% over a nine-year period, analyzed by the Association of National Advertisers in its just-released “The CMO’s Guide To Programmatic Transparency” report. The analysis estimates there were more than 8,000 suppliers as of 2020, and they had been expanding at around 1,000 per year in recent years, suggesting the pool could now be well over 10,000.

DoubleVerify says that several of its programmatic targeting services have been accredited by the Media Rating Council. The products include fraud avoidance for connected TV, desktop, mobile web and mobile app ads, including invalid traffic avoidances and ID display and video viewability targeting for desktop, mobile web and mobile apps.

Asserting that the programmatic advertising marketplace is “riddled with material issues including thin transparency, fractured accountability, and mind-numbing complexity,” the Association of National Advertisers this morning announced a request-for-proposal for a consultant to study and come up with recommendations for improving it.

Brands looking to buy Roku’s original content channel programmatically will no longer be able to do so through third-party platforms. Moving forward, Roku Channel will be available to be purchased programmatically only through the streamer’s own demand-side platform.

Verizon Media and Vizio today announced a strategic partnership to deliver new cross-platform and connected TV (CTV) advertising solutions, anchored in unique TV viewership data and premium programmatic inventory access. Effective immediately, […]

Today, Fox Corp. and FreeWheel, a Comcast company, announced a partnership to enable programmatic trading of addressable set-top box (STB) video on demand (VOD), marking what they call an industry […]

MadHive, an enterprise software platform that powers modern media, is launching an Audience Forecaster tool to address industry-wide problems like frequency control and transparency for OTT, CTV. The feature set […]

Programmatic media buys now account for 85% of all digital ad spending, according to estimates released in a new report from the Interactive Advertising Bureau. The estimates, part of the IAB’s “Brand Disruption 2020” report released Monday, put U.S. programmatic ad spending at nearly $79 billion — an increase of 87% from 2017, the first year benchmarked in the report.

More leading local broadcasters join the advertising consortium, which now includes groups representing more than 740 stations.

Tremor Video, a programmatic video platform, today announced it has expanded its demand-side platform’s (DSP) advanced artificial intelligence (AI) and machine-learning technology. Tremor Video says the move positions it “at […]

Accenture Interactive is acquiring Adaptly to bolster the agency’s programmatic services offerings. Financial terms were not disclosed. Founded in 2010, the 150-person Adaptly partners with digital platforms, including Amazon, Facebook, Google, Instagram and Snapchat, to run campaigns for clients such as Chico’s, Mazda, Prudential and Sprint.

Martin Sorrell’s S4 Capital has agreed to buy San Francisco-based programmatic ad firm MightyHive for an enterprise value of $150 million, funded by the issue of new shares worth $94 million. Sorrell said the deal marked an important second strategic step for his new company. “The peanut has now morphed into a coconut, and is growing and ripening,” he said on Tuesday.

Known for the native advertisements that drive most of the pureplay’s revenue, BuzzFeed’s new standalone news site is moving in a different direction, monetizing only through display units from open exchanges at its launch.

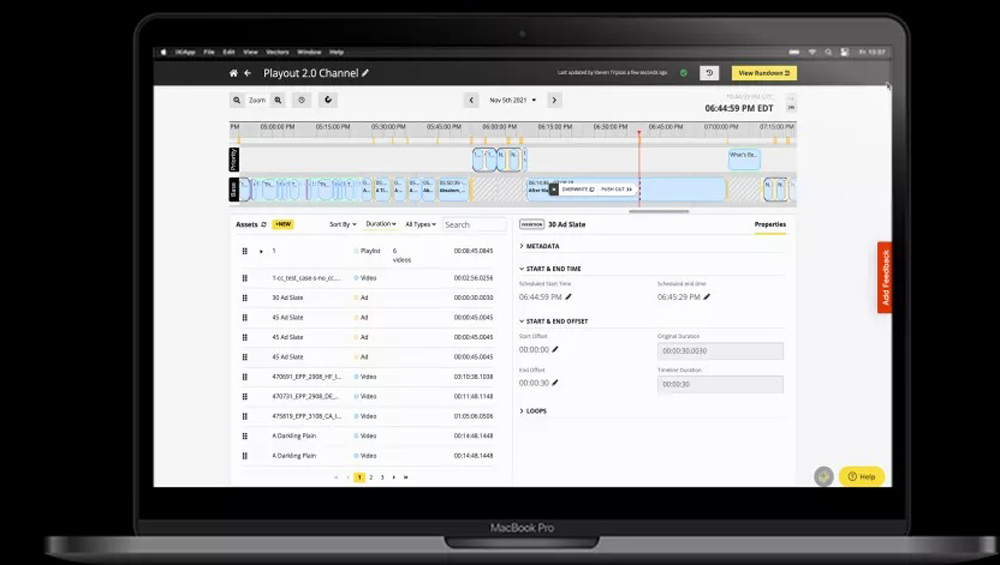

The station group will use ITN Holdings’ ProVantageX end-to-end television and video-everywhere platform so it can receive and respond more quickly to requests, simplify transactions, coordinate schedule maintenance and streamline the workflows for agencies across all FTS stations and their sales representatives.

Political Broadcasting, Programatic Issues

While most of the principles governing the FCC rules on political broadcasting are relatively established, new advertising practices and opportunities always raise questions as to how those established rules are to be applied. Programmatic buying of ad time is one of those areas where these questions have arisen in recent years. In the last few years, programmatic buying has become the buzzword in broadcast ad circles. Here are some answers.

Snap has told Snapchat shows partners that it plans to bring in more programmatic ads after struggling to fill space inside the programming. According to three sources, including two media executives who have aired shows on Snapchat Discover and one ad buyer who has knowledge of Snap’s plans, Snap plans to inject more programmatic ads within Snapchat shows.

The platform, integrated into DoubleClick for Publishers, eliminates the need for ad slots to be sold as fixed lengths in the advertising break. The technology automatically optimizes the ad buy by determining the best combination of personalized and relevant ads for each viewer.

Accenture’s R&D division has spent the last year developing breakthrough product placement technology that can seamlessly insert a brand into online video, including the ability to replace existing labeling.

Havas Group has released the Client Trading Solution, a programmatic solution offering clients visibility and control over their advertising campaigns. Havas calls the client-facing platform, developed by data science firm MFG Labs, a “control tower” for programmatic trading.

Driving the addressable TV market’s growth, which some estimates put at 50% this year, is advertisers’ satisfaction with their campaigns there. Michael Bologna, president of One2one Media, estimates about 54 million U.S. TV households currently have the necessary technology for such ad insertion. Another 30 million-40 million televisions are expected by year’s end.

As more brands integrate television and video media buys, Google is making traditional TV inventory available to buy programmatically in DoubleClick Bid Manager in the U.S.

Many of the new WO Programmatic ad capabilities introduced today were developed following test buys performed earlier this year in partnership with Amplifi US, the media investment platform of Dentsu Aegis Network.

Despite the fact that programmatic media and ad tech, in general, have received a thrashing in recent months, spending on programmatic display advertising is projected to reach nearly $33 billion in 2017, according to eMarketer’s latest forecast.

Forecast: Native will account more than half of all display spending, with growth of more than 36% in 2017. Behind the growth: Mobile-friendliness and programmatic buys.

In a deal to bolster its video offerings for advertisers, Adobe has acquired demand-side platform TubeMogul for $540 million. Programmatic-geared TubeMogul works with brands like Dannon and Quiznos to run digital, mobile and video campaigns by powering the ad-tech pipes in platforms like Facebook and Snapchat.

In a deal to bolster its video offerings for advertisers, Adobe has acquired demand-side platform TubeMogul for $540 million. Programmatic-geared TubeMogul works with brands like Dannon and Quiznos to run digital, mobile and video campaigns by powering the ad-tech pipes in platforms like Facebook and Snapchat.

Ad Buyers Want More Automated Selling

“We’ve been talking about this too long. I can’t go into a market programmatically half way,” says Frank Friedman of Zenith Media, speaking of the need to have all stations in a given DMA participate. “We need to separate the fear of automation lowering rates. If we don’t automate we’re going to fail.”

Videa Debuts Automated TV Ad Platform

The new marketplace provides stations, agencies and brands a simplified way to sell and buy local television station inventory at scale.

Inventory from stations participating in WideOrbit’s programmatic TV marketplace will now be available through CoreDirect.

Programmatic Ad Buying And Political Rules

With the national presidential conventions complete, and most of the state primaries for Congressional, state and local offices either behind us or to occur in the next few weeks, the most concentrated period for the purchase of political advertising on broadcast stations is now upon us. One of the new wrinkles this year that has not captured the attention that it deserves is the political broadcasting issues raised by programmatic buying of advertising time.