BIA Lowers U.S. Local Ad Revenue Estimate

Examining the continuing economic fallout from the coronavirus in recent months, BIA Advisory Services today adjusted its estimate for the total local advertising market for 2020 to $140.4 billion, down from $144.3 billion in April. BIA’s updated forecast estimate represents a 6.1% decline from 2019, even with strong political advertising anticipated this year and a few business verticals showing advertising strength.

“To update our post-COVID forecast from April, we analyzed the continuing impact on local advertising by the weakened economy, continuing job loss reports, and the downturn in some key business verticals,” said Mark Fratrik, BIA’s SVP-chief economist. “Right now, we believe a realistic view of the economy overall and the advertising marketplace is that after a dramatic decrease in the second-quarter and a bumpy start to the third, the remainder of the year will turn positive but end up with an overall decline in local advertising for the year.”

Local political ad spend continues to be one positive area. As campaigns continue to migrate to online rallies and events, both presidential and down ballot candidates are spending significant dollars in local broadcast and digital advertising.

Since its April forecast, BIA increased the expected political ad spend from $7.1 billion to $7.3 billion. Of the $209 million increase, the distributed share to different media include $138 million to TV OTA, $40 million to cable, $26 million to online-digital, and $5 million to radio OTA.

Within health care, health and personal care stores are estimated to spend $97.6 million in 2020 and pharmaceutical and medicine manufacturers are forecast to spend $658.3 million to promote wellness products and services. In terms of finance-insurance, as people want help rebuilding their savings, college funds and retirement accounts, companies in consumer-lending stores are forecast to spend $1.6 billion while investment-retirement stores are projected to spend $3.0 billion in local advertising this year.

Within health care, health and personal care stores are estimated to spend $97.6 million in 2020 and pharmaceutical and medicine manufacturers are forecast to spend $658.3 million to promote wellness products and services. In terms of finance-insurance, as people want help rebuilding their savings, college funds and retirement accounts, companies in consumer-lending stores are forecast to spend $1.6 billion while investment-retirement stores are projected to spend $3.0 billion in local advertising this year.

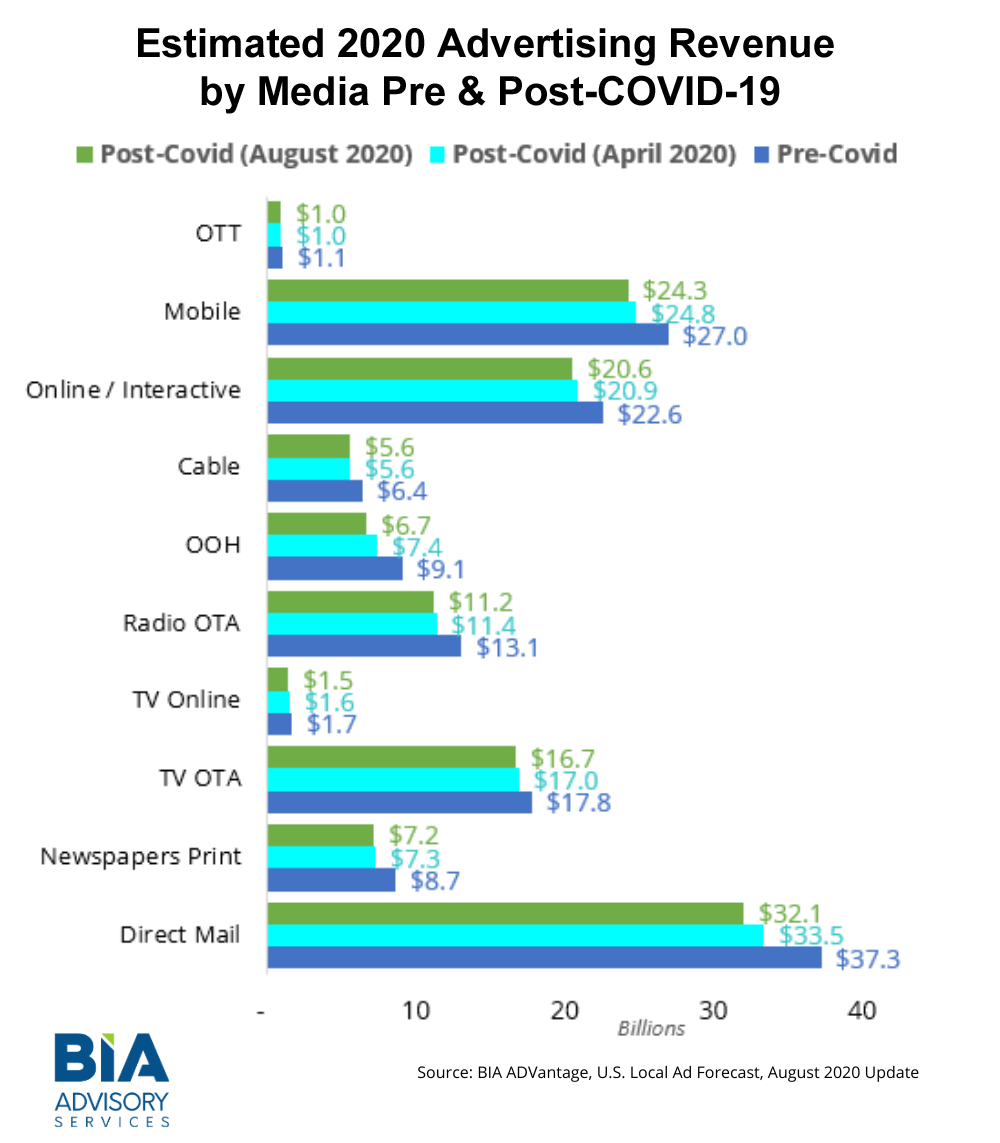

As for overall media ad spend, when comparing ad revenue estimates of both pre- and post-COVID, all media, except over-the-top, are experiencing a decline in ad revenue, as shown in the chart above.

“The economic situation caused by the pandemic continues to create a difficult local advertising market,” said Tom Buono, BIA CEO-founder. “It’s critical to examine where the advertising dollars are flowing and what your particular business can go after. As ad budgets shift, an understanding of what is happening in your local market represents a real opportunity to expand your share of wallet.”

BIA will join SalesFuel to present local advertising data and analysis during a webinar, Accelerating 4th Quarter Revenue: Planning for 2021, on Tuesday, Aug. 18, at 11 a.m. ET. The webinar is designed to help executives organize their sales plans and prepare revenue assessments.

Comments (0)