BIA: Political Advertising Kept 2020 Local TV Revenues Solid

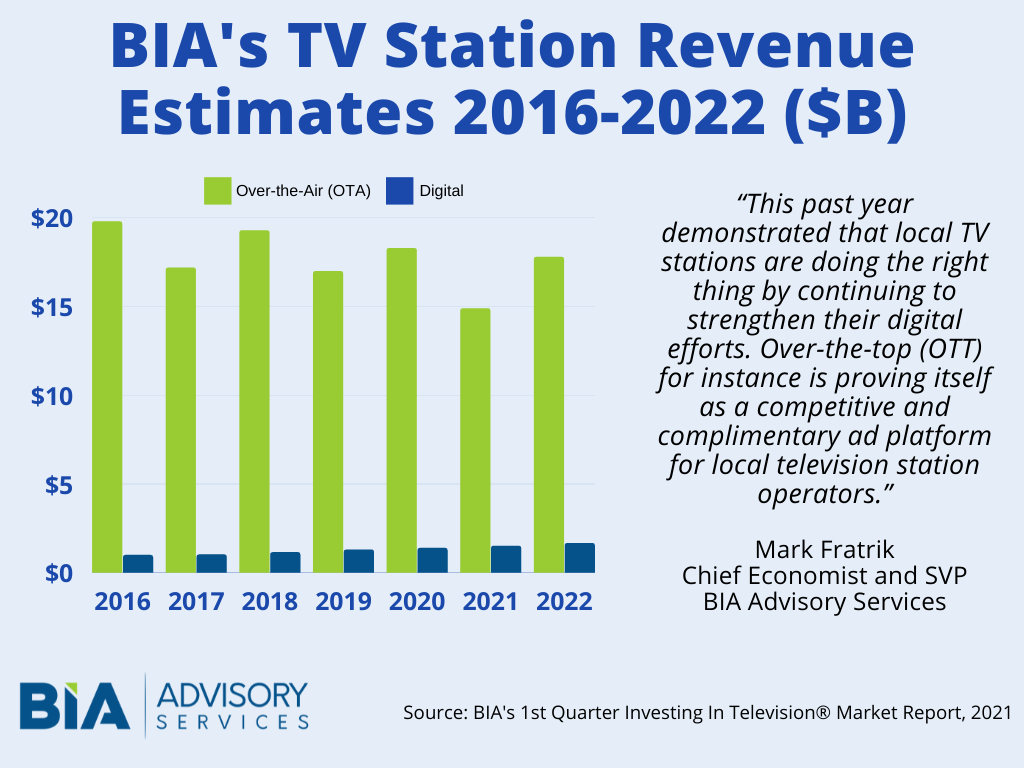

While the COVID-19 pandemic had a big impact on local television revenues in 2020, the November elections ultimately kept the industry in a good position by year-end, according to the first quarter edition of BIA Advisory Services’ 2021 Investing In Television Market Report. Over-the-air (OTA) revenues reached $18.3 billion last year, with another $1.4 billion coming from digital revenues to make $19.7 billion total, versus a combined $18.3 billion in 2019. Political advertising alone accounted for $4.4 billion in 2020 to deliver a softer landing to an otherwise negatively impacted industry.

A deeper dive into the numbers in 2020 shows that core advertising — defined as OTA revenue minus political advertising — drove industry revenues down 23.1%, like the impact the pandemic had on broadcast radio. But the rebound will slightly begin this year, with BIA estimating that core OTA advertising will rise 5.4% and revenues projected to be $14.9 billion for the year. It forcasts 2022 total local over-the-air station revenues at $17.8 billion.

“This past year demonstrated that local television stations are doing the right thing by continuing to strengthen their digital and multi-media sales efforts,” said Mark Fratrik, SVP and chief economist at BIA Advisory Services. “They also need to continue to develop strategies that incorporate over-the-top (OTT) sales to reach specific audiences, while simultaneously reaching the broader local viewers. OTT increasingly is becoming a competitive and complementary advertising platform for local television station operators.”

In addition to the standard big television advertisers like automotive and general services verticals, growth in core advertising this year will come from business verticals that are hyper-focused on market needs and new entrants like Online Gambling, according to Fratrik. These verticals and their estimated ad spend include:

In addition to the standard big television advertisers like automotive and general services verticals, growth in core advertising this year will come from business verticals that are hyper-focused on market needs and new entrants like Online Gambling, according to Fratrik. These verticals and their estimated ad spend include:

- Spending by consumer lending and mortgages will be up 45 percent in 2021, as increased competition from digital and technology companies and banks shift to products that deliver immediate client value. TV OTA and TV Online advertising is expected to be over $2 billion in 2021.

- As people go on vacation and back to work and school, clothing store advertising will rise almost 45 percent. TV OTA and TV Online advertising is expected to be nearly $4.3 billion in 2021.

- Auto & Direct Property Insurance will grow 33 percent this year as the home buying boom continues along with home insurance needs. TV OTA and TV Online advertising is expected to be $4.2 billion in 2021.

- Direct Health and Medical Insurance Carriers will increase their advertising by 29 percent, as consumers look to switch providers for seamless services and flexible coverage. TV OTA and TV Online advertising is expected to be $2.3 billion in 2021.

- Online Gambling, a newer and growing vertical, will be just over $1 billion in 2021. TV OTA and TV Online advertising is expected to be nearly $464 million.

One other aspect that BIA will continue to track is the Summer Olympics in Japan. As concerns linger about the likelihood of the games taking place, Fratrik said if they do, estimates for television will increase and BIA will report on them.

Comments (0)