In Challenged Ad Climate, Sports Advertising Continues Growth

The viewership and advertising divide between TV sports and non-sports programming continued to grow at a sizable rate in 2022, and projections for 2023 are that it will be more of the same.

Advertisers spent about $17.7 billion on national U.S. linear TV sports programming last year, up from $14.9 billion in 2021, according to iSpot.tv data. The total does not include regional sports network or streaming ad spending.

Meanwhile, both network sellers and media agency buyers project 2023 advertiser spending on linear TV sports could increase by another 15% to 20% in dollars, and not all of that would be from rate hikes.

“Live sports continue to be the only show in town,” says Jeff Gagne, SVP, strategic investments at Havas Media. “And advertiser spending on live sports will continue to be the long-term trend going forward.”

Jeff Gagne

Gagne adds, “Viewers are not tuning into the other types of programming on television. Networks and channels with no sports, both broadcast and cable, are steadily losing viewers.”

Jon Diament, who oversees linear and digital sales for TBS Sports, TNT Sports and NBA TV, along with Warner Bros. Discovery’s other channels, says: “It’s good to be in sports sales right now. Everything else is pretty challenged.”

Another TV network sports sales executive agrees, saying, “Sports ad sales is a bright light in our company. Sports ad sales are up, and every other programming platform is down. Sports ad sales are taking a bigger internal share of the ad pie at every network that carries sports. This trend will continue.”

Adam Schwartz

Adam Schwartz, SVP, director of national broadcast, sports media at Horizon Media, adds: “Sports continues to become more and more important to advertisers, with even non -traditional sports advertisers moving more dollars into sports. More female brands are dipping their toes into the NFL and that’s going to continue because more women are watching the NFL than any entertainment show on television.”

Networks Reap Benefits

Jim Minnich, VP of revenue and yield management for sports at Disney Advertising Sales, says sports audience for the past two years have been “off the charts, very vibrant. Virtually every live sport telecast has been performing well.”

Minnich says ESPN and ABC are about 85% sold out for the remainder of the TV sports 2022-23 seasons, and in some sports like the NBA playoffs, including the finals on ABC, the networks are between 90% and 95% sold.

Jim Minnich

He says advertising in Major League Baseball telecasts for the 2023 season are about 90% sold out, while the Home Run Derby, telecast in July on ESPN, has just “one or two avails left.”

Even the first season of the revived XFL, which will air on ABC, ESPN, ESPN2, FX and ESPN Plus beginning in mid-February, is about 85% sold, Minnich says, although pricing is clearly very advertiser friendly.

In regard to that, one buyer says about the XFL, “as long as the pricing is appropriate, there is a value proposition for everything.”

Some naysayers about the popularity of TV sports might argue that a network like ESPN, which televises only sports, can much more easily lure new advertisers into the fold with broad packages and year-round selling.

Peter Lazarus

But NBC’s Peter Lazarus, EVP of sports ad sales, says NBC, which offers mutliplatform programming, is not only selling sports on a year-round basis now but also has made an effort to become closer to the agencies in working to meet their needs.

“Sports ad sales has moved to a year-round business,” Lazarus says. “It has also evolved from a simple buyer-seller relationship to true partnerships. We really need each other more and we understand our clients’ business better than ever before.”

And NBC is not just doing new and different types of deals in conjunction with the NFL, but also involving some of its other televised sports.

The network recently did a major deal with self-storage company PODS (Portable on Demand Storage) in which it will sponsor 11 “championship” sports events on NBC. They include the Players Championship golf tournament; Kentucky Derby; Preakness Stakes; the Premiere League Championship game; Indianapolis 500; men’s and women’s French Open; U.S. Open tennis tournament, both men’s and women’s; Tour de France cycling; and the US. Open golf championship.

In addition to PODS running commercial sports in all of the events, it will also get some in-event features, promotional spots and live talent reads, among other special elements.

NBC also recently signed a TV rights deal to carry Big 10 college football games and this fall will air a Big 10 game every Saturday night during the college football season. That is in addition to its NFL Sunday Night Football telecasts.

“Comcast and NBC are investing heavily in sports, and we’ll have two nights of sports on in primetime this fall,” Lazarus says.

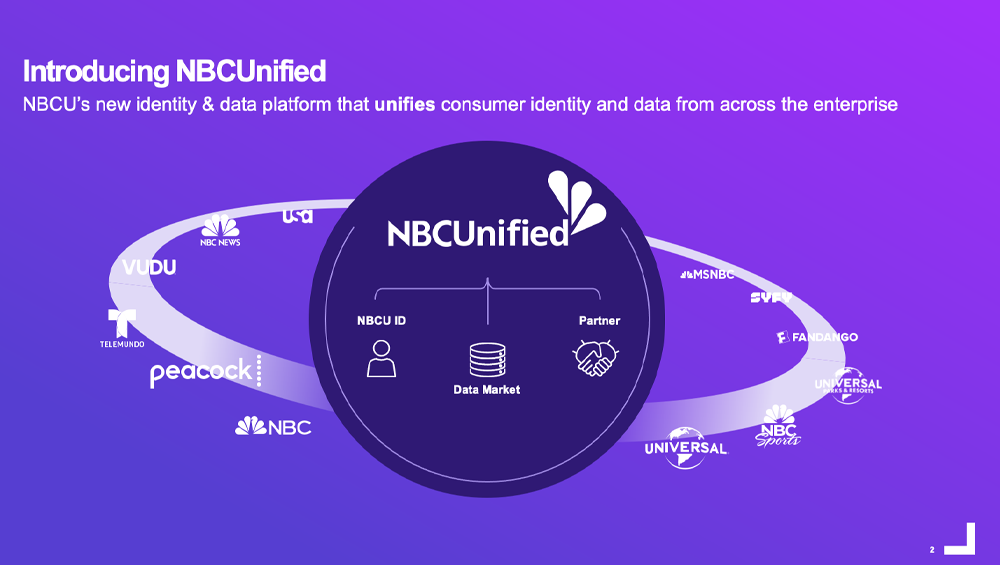

NBC also last month announced the launching of NBCUnified, which among other things helps any size advertiser use an array of data to more specifically reach the exact advertiser profiles they are trying to reach in the NBCU universe, and that includes TV sports viewing.

“Sports is a key part of this,” Lazarus says. “Today we have to be more analytical when selling advertising, including sports, and to prove our performance beyond just overall viewership.”

“Sports is a key part of this,” Lazarus says. “Today we have to be more analytical when selling advertising, including sports, and to prove our performance beyond just overall viewership.”

Earlier Sports Buying Continues

Assorted media agency buyers agree that advertiser spending on entertainment programming in primetime and other dayparts was down by 20% or more in the 2022 upfront, so the networks were amenable to selling TV sports inventory as part of traditional entertainment upfront packages rather than selling separately in the usual sports upfront.

“The networks need to show that they are successful in selling advertising in advance for the coming season, and sports is the way to do that now,” says one sports media buyer.

In addition to that, sports ad buyers face a growing concern of assuring that they get the amount of ad inventory they want, particularly in the NFL, so they are buying earlier.

Lazarus says not only did NBC sell about 10% more sports ad inventory in the 2022 upfront, but between 80%-90% of total NFL ad inventory was sold before the start of the season.

“While it’s still early, we anticipated this momentum to continue and hope it will be on par with last year’s increase in sports ad spending,” Lazarus says, “keeping in mind that we always do need to save some inventory for in-season scatter sales.”

NFL Juggernaut Continues

NFL cumulative viewership for the 2022 regular season across all the networks that televised games was down 3% to an average of 16.7 million per telecast, but that is primarily due to Amazon Prime taking over the Thursday night window from Fox. In order to watch on Amazon, one has to be an Amazon Prime member. If one eliminates Amazon from the mix, the other networks’ cumulative viewership was up about 3%-4%, according to network estimates.

Regular season ratings for NBC, CBS and Fox were all up, and during the season some of the games brought in huge audiences, culminating with the AFC Championship on CBS, which drew 53.1 million viewers.

NBC’s Sunday Night Football telecasts averaged 19.9 million viewers, more than double the most-watched primetime entertainment show on broadcast television.

As for advertisers in the NFL, the 10 biggest spenders bought a cumulative total of $1.1 billion in advertising during the season, according to iSpot.tv data.

For the regular NFL 2022-23 season, Progressive spent $193 million on NFL advertising, while GEICO spent $180.6 million and Verizon $129.6 million. AT&T Wireless invested $105 million. Rounding out the Top 10 was State Farm ($94.5 million); Fan Duel ($94.2 million); Pfizer ($89.8 million); T-Mobile ($81.3 million); Hyundai ($77.7 million); and Walmart ($76.9 million).

With all the early buying of NFL ad inventory, when the economy hit a snag midway into the season, scatter ad sales did slow up for the networks, but the good news was that they were meeting their ratings guarantees so they did not have to issue any makegoods.

Some scatter pricing did come down for the NFL playoffs as the networks tried to move the inventory they had and even a few Super Bowl advertisers were said by sources to be seeking to pull out.

But with the Super Bowl coming up this Sunday, Fox has sold out with prices ranging from $6.2 million to $7 million per 30-second spot. Fox officials were not available to comment.

NBA Ads Selling Out

The NFL and NBA can’t really be compared evenly on a game-by-game viewership basis, since each NFL team plays only once a week for 17 weeks while the NBA teams are each playing 82 games with many televised each night.

Jon Diament

Still, the NBA is heavily sold during the current regular season as well as for the playoffs through the finals on ABC. And the NBA All-Star game on TNT on Feb. 19 has been sold out for some time Diament says.

Just how well the NBA is performing viewership -wise can be seen looking at what happened on Christmas Day.

The ESPN and ABC always televise five games on Christmas Day and get solid viewership, but this year, Christmas fell on a Sunday and the NFL had three games being played that day in direct competition with those NBA games.

The three NFL games drew a cumulative viewership of 65.5 million viewers, but the NBA drew a total of 21.5 million viewers, more than the five-game total from Christmas Day 2021.

Havas Media’s Gagne says: “When you have more sports televised at the same time, more viewers come to the well and more viewers drink. Those Christmas viewers in some instances may have been switching back and forth, watching both the NFL and NBA.”

What About Streaming Sports?

Viewership of streamed sports, while growing (particularly among younger potential viewers), has still not had a major negative impact on linear TV sports viewing. Most of the viewers watching streaming sports are younger and are not big linear TV watchers, networks say.

In most instances, the TV networks televising live linear sports also have streaming alternatives that they sell as part of packages with big linear TV sports deals. So, they are not losing linear sports viewers, just picking up another ad revenue stream.

As long as streaming sports viewership remains so fragmented, linear television is still the place sports marketers are going to want to place the bulk of their ad dollars.

Comments (2)

elizabethgorgon1 says:

February 13, 2023 at 8:49 am

Outdoor advertising on transport is one of the most effective ways to promote goods and services on the market. But when ordering it, it must be taken into account that the durability and appearance of advertising depends on the correct choice and the quality of the materials used, which are best purchased only from a reliable supplier. You can always find out more about outdoor advertising here.

Joe Bottoms!! says:

March 3, 2023 at 9:16 am

Please don’t tell me yu are surprised by this..The rest of network programming is drab.. you can figure out the story in the first 5 minutes