The Growing Case For Going FAST

Mary Collins

The old, independent television business model is cool again, but with a 21st century twist. Now, anyone with a device connected to the internet has free access to what seems like unlimited commercial video content. All potential viewers need to do is download an app and start watching. No registration or credit card are required. Media businesses, particularly those pursuing a direct-to-consumer (DTC) model, should consider how this fits into their product mix.

Known as FAST (free ad-supported television) channels, these services have their roots in the device-supported streaming of the early 2000s. Roku launched its first player in 2008. Following player updates and a dongle device, the company released an internet-connected smart TV in 2014. Attracted by the potential for post-sale revenues, device manufacturers such as Samsung, Apple and even Amazon launched their own branded content applications. At about the same time, services such as Pluto and Tubi debuted device-agnostic services. Each offered free ad-supported content, primarily older movies and reruns of television series.

FAST channels are not the same as AVOD (ad-supported video on demand) although the distinction is beginning to blur as services begin to offer both options. In the world of FAST channels, it’s the channel’s curator who decides what content appears when the consumer chooses to watch. A viewer tuning into the Baywatch channel could see episode one from the first season or any one of the nearly 250 episodes that followed it. When the episode concludes, it’s again the app and not the viewer that selects what comes next. In other words, the programming is ad-supported and linear, just like that on traditional broadcast and cable channels.

Programs are typically shown with 15- and/or 30-second ads; the linear format means that commercials cannot be skipped. Conversely, in the AVOD scenario, the consumer selects the content to be served, which includes preset advertising breaks. Some AVOD programs allow the consumer to fast forward through commercials, while others do not. When the program is over, the viewer selects something else to watch.

Alan Wolk, the person credited with coining the term “FAST,” explains that there are, generally speaking, three models for services that aggregate and distribute FAST content:

- FAST owned by media companies — examples include Pluto TV (Paramount acquired in 2019 for $340 million in cash), Tubi (purchased by Fox for $440 million in 2020) and Peacock (launched by Comcast-owned NBCU in 2020). Their unique advantages are content from their individual parent companies and that they are device-agnostic.

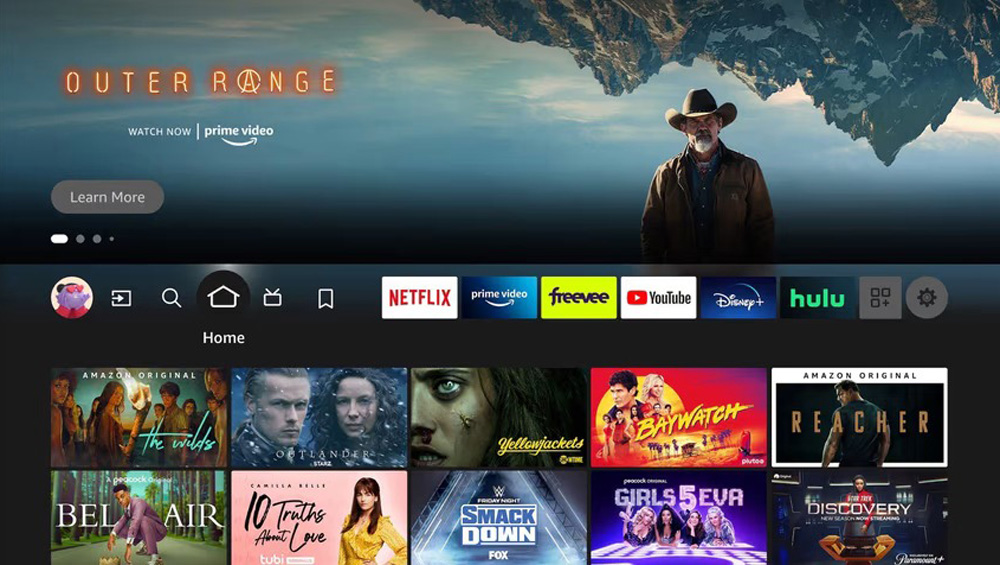

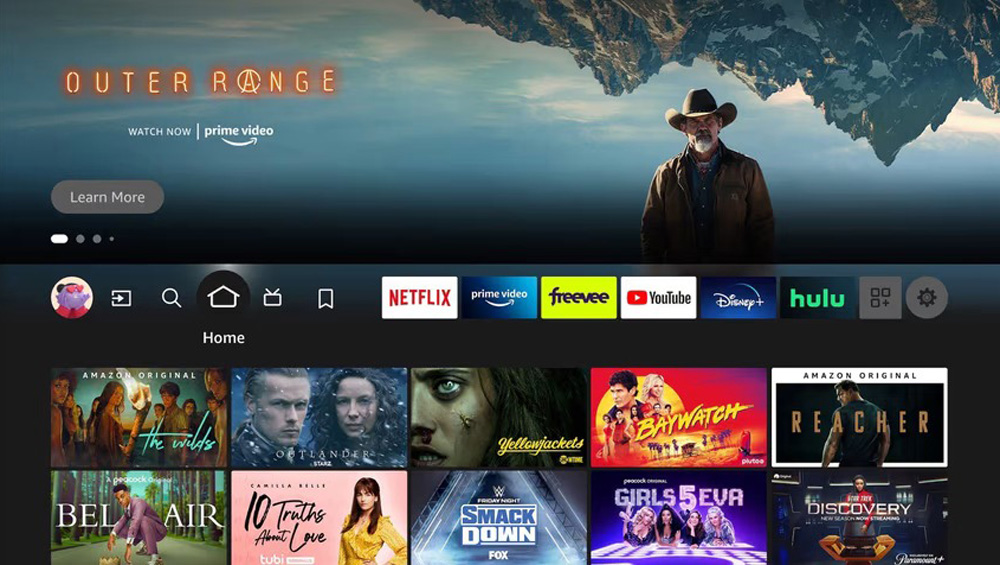

- Channels owned by equipment manufacturers; Wolk mentions “Amazon Freevee, LG Channels, The Roku Channel, Samsung TV Plus and Vizio WatchFree+.” These services benefit from being prominently featured on the devices’ user interface and from being able to access users’ content viewing data.

- Independent applications such as Crackle and Plex which, without corporate ownership, may have more flexibility in format and content.

Separate from what Wolk calls “aggregator apps” are what he refers to as “single source apps.” These rely upon content from one owner. To make this more confusing, these apps tend to have deals with aggregator apps, which distribute the single source content as part of a total service offering. The thing to keep in mind here is that one point of differentiation among aggregator apps is how they curate their linear feeds. For example, despite sci-fi channels being available from multiple FAST sources, consumers won’t see the same sci-fi feed if they skip from one FAST option to another.

S&P Global began tracking FAST service usage among U.S. internet households in early 2018. They found that about 3% of households accessed Pluto TV in the first quarter of that year, while Tubi was used by 4%. The following year, in the first quarter of 2019, Pluto TV garnered 8% usage, Tubi had 6%, and newly launched The Roku Channel was viewed by 13% of U.S. households with internet service.

By the first quarter of 2022, both Pluto TV and the free version of Peacock were used by 20% of U.S. internet households, The Roku Channel and Tubi came in at 19%, and Amazon’s Freevee (formerly IMDb TV) had attracted 14% of that same audience.

Cord cutting, cord shaving and subscription service churn are all exacerbated by consumers’ desire to reduce spending in the face of ongoing inflation and competing budget priorities. With smart television home screens making it easy to add a variety of FAST channel apps, it’s no wonder that consumers are looking to these services to fulfill their desire for video entertainment.

Advertising Appeal

FAST channels make sense for advertisers. While good viewership measurement is lacking, there are compelling reasons to allocate dollars to these channels. We know that people are watching them; S&P Global Market Intelligence studies shows continuous growth in service usage.

Additionally, research from Morning Consult in partnership with Variety Intelligence Platform not only finds that, in July 2022, FAST services represented four of the top 10 streaming services viewed, they also tend to reach more of the audiences advertisers desire – Gen Z adults, millennials, and Gen X. The researchers further assert that advertising on FAST channels can reach unduplicated audiences, consumers who don’t subscribe to any video streaming services.

The environment itself is compelling. Since the apps tend to be downloaded to connected televisions, advertisers can assume their ads will appear in large formats instead of on smaller screens. They can schedule messages in friendly thematic environments. Home improvement channels may be good places for messages about home furnishings or tools.

Ads for package goods, cookware and meal prep kits seem to make sense on channels devoted to food and cooking. There is also some evidence that the linear format encourages viewers to spend more time with a selected channel thus giving advertisers more opportunities to reach their targets.

Finally, FAST channels currently offer a less cluttered advertising environment than that of traditional programming services. S&P Global counts loads of four to eight minutes per hour on ad-supported internet services. Contrast that with the 12 to 17 minutes of advertising Statista says are offered on traditional television channels.

Why Launch A FAST Channel Service?

There are several reasons appropriately positioned media companies may want to add FAST channels. First is the potential revenue. While many media businesses are facing shrinking bottom lines, S&P Global estimates $4 billion in 2022 U.S. FAST service revenues, growing to approximately $9 billion by 2026.

Before they began reserving their product for their own DTC premium services, content companies earned additional income by to leasing library content to other outlets. Launching an ad-supported free linear channel may be a way to recapture some of those lost dollars.

Well-programmed FAST channel offerings can also be used to promote premium offerings. As Variety’s Gavin Bridge points out, it’s unlikely that someone will subscribe to HBO Max to get one of the first seasons of Game of Thrones, but seeing earlier episodes on a free service might push a viewer to subscribe to the premium service to get the rest of the story.

Forbes suggests that premium SVOD (Subscription Video on Demand) services are spending $50 to $75 to acquire a subscriber who generally disconnects in six to nine months. The math doesn’t work for a subscription priced at less than $10 a month. But, if the company is using library content to both earn ad dollars and drive subscription revenues, that could be compelling.

Additionally, companies selling DTC premium services already have at least some of the technology needed to support the launch of FAST channel packages. If they need to add software or equipment to build out the new offering, there are plenty of companies that are willing to provide that support.

There’s no question that the business model for delivering compelling content to viewers continues to change. Free ad-supported services delivering library content to consumers watching on their big-screen televisions is only part of the opportunity, as evidenced by Michel Depp’s interesting interview with the CEO of a channel targeted at out-of-home viewers. With so many diverse players entering the business of selling advertising to and deriving subscription revenue from viewers, video content businesses need to continually evaluate all of their options.

Former president and CEO of the Media Financial Management Association and its BCCA subsidiary, Mary M. Collins is a change agent, entrepreneur and senior management executive. She can be reached at [email protected].

Comments (0)