Studio Execs: Streaming Won’t Kill Syndication

TV syndication executives say don’t believe everything you hear about streaming programming killing off broadcast syndication.

Broadcast television is going to be around for a long time to come and studios will continue supplying syndicated programming for TV stations of all sizes, they say.

And while they acknowledge that television viewership is fragmenting due to the rise in streaming program offerings and there are major opportunities right now to make profits on streaming projects, they say both streaming and broadcast will co-exist and survive long-term and that studios producing streaming programming are not abandoning broadcast syndication.

Changing Metrics

“Everyone is trying to figure out how to invest money into streaming platforms while keeping linear television afloat,” says Steve LoCascio, president of CBS Media Ventures. “Everyone is trying to figure out what the new model will look like.”

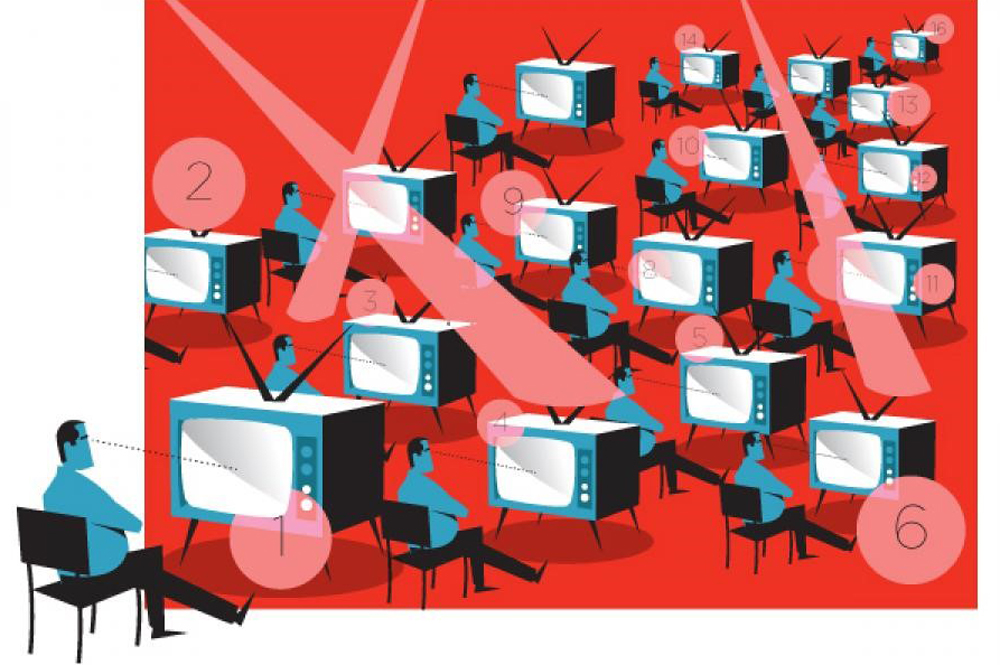

LoCascio acknowledges that there is a “fight for eyeballs” everywhere in television, but says while viewership is fragmenting, “overall our syndicated shows are still reaching 50 million viewers a week.”

LoCascio acknowledges that there is a “fight for eyeballs” everywhere in television, but says while viewership is fragmenting, “overall our syndicated shows are still reaching 50 million viewers a week.”

Sean O’Boyle, EVP and national syndication sales manager, NBCUniversal Syndication Studios, says both broadcast syndicated shows and streaming programming can be produced by the studios, however, the formula must be right.

“I believe broadcast syndication will continue to be relevant, but it needs to be ‘right sized,’” O’Boyle says. “The amount of money spent on syndicated show production needs to match the audience levels” so that the shows can be profitable for the studios as well as for the stations.

“The larger studios are putting money into streaming programming, but they are still introducing new broadcast syndication shows,” O’Boyle says. “They can still do both, and they are.”

Ira Bernstein, co-president of Debmar-Mercury, adds that as production costs continue to go up, while viewership declines, “you can’t just do a $40 million talk show and have the smaller stations buy it.”

But he says opportunities are still there and adds, “Broadcast television is not going away, and neither is broadcast syndication. They’ll both be around for a long time.”

Another syndication studio exec, who did not want to speak for attribution, was more adamant about defending the studios against charges that they are moving more production dollars into streaming at the expense of syndicated programming.

“The argument that studios are putting more money into streaming and ignoring new syndication programming is bullshit,” the exec said bluntly. “Studios follow the money. They will make programming wherever they can make money on it. And that is not just in streaming. It’s in syndication too.”

This exec adds that while TV syndication includes shows across a wide spectrum of programming genres, most new programming for streaming right now been and miniseries and movies, and that’s not what TV stations are looking to buy in syndication.

“Streaming programming right now is mostly big events like movies or short series runs,” this studio exec adds. “A traditional sitcom or drama series is not going to work that well on streaming sites.”

Allen Pushes Back

One studio exec who takes exception with those who say the studios are not abandoning TV syndication is Byron Allen, chairman and CEO of Entertainment Studios and Allen Media Group and a producer of syndicated programming, as well as a cable network and TV station owner.

Byron Allen

Allen says his company is “100% committed to making content for broadcast syndication, but our studio competitors have pulled way back and are producing more programming for streaming,” Allen says. “I see less investment being made producing first-run syndicated shows for TV stations.”

Allen contends that the studios are now spending more than $50 billion a year to produce streaming programming at the expense of new TV syndicated fare. And in addition to spending all of this cash on streaming production, it is going to “lead to a talent drought for network and syndicated programming.”

But LoCascio says spending on streaming programming at Paramount+, which like CBS Media Ventures is part of Paramount Global, doesn’t affect the money CBS or CMV is spending on broadcast syndication programming.

“Just because Paramount+ is spending money to produce streaming programming doesn’t mean anyone is limiting (CMV) spending on syndication,” LoCascio says.

The Station Viewpoint

Greg Conklin, VP, corporate programming, for Gray Television, is another strong proponent of the future of TV syndication and says bluntly, “I don’t agree that syndication is dead.”

Gray owns or operates TV stations in 113 U.S. markets reaching about 36% of all TV households in the country, and Conklin oversees programming including syndication.

He believes that stations are always going to need new programming, whether it be from the major studios or from the smaller syndicates. And because Gray in some markets owns multiple stations, there will always be a need for different programming.

He believes that stations are always going to need new programming, whether it be from the major studios or from the smaller syndicates. And because Gray in some markets owns multiple stations, there will always be a need for different programming.

“Every year we try to freshen up syndication offerings for our stations and we’re always looking for something different,” Conklin says.

For the current syndication season, Conklin added Positively America with Ernie Anastos, a weekly multi-segment discussion show featuring an assortment of topics and hosted by the veteran news anchor.

The series premiered nationally in about 35 of Gray’s 113 markets in the fall.

Can Streaming Help TV Syndication?

“I think we are in a little bit of a transition,” Flory Bramnick, EVP, distribution, Sony Pictures Television, says about the TV syndication business and the need to come up with a new business formula.

She says economically for the studios, it is helpful to be able to offer programming for both TV stations and other platforms, including streaming, and that includes even offering the same shows on both platforms.

Bramnick believes the audiences are different and that “they don’t compete with each other.”

Streaming, she says, has a different audience, a different type of viewer than TV station syndication or even broadcast.

Bramnick points out that Sony did a deal to make Jeopardy available on Netflix and Hulu “and it did not hurt the syndication ratings.” This season to date in syndication, Jeopardy is still the most-watched show in syndicated television, averaging 8.8 million viewers nightly.

Bramnick points out that Sony did a deal to make Jeopardy available on Netflix and Hulu “and it did not hurt the syndication ratings.” This season to date in syndication, Jeopardy is still the most-watched show in syndicated television, averaging 8.8 million viewers nightly.

She says Sony also did deals for Seinfeld with both Netflix and on cable and the audiences are distinctly different from the TV syndication audiences.

“Netflix actually helped propel Seinfeld audiences to broadcast stations,” she says. “There is no chance that streaming programming will put an end to syndication.”

Viewers Love Top Syndie Shows

While audience fragmentation continues and more viewers are watching streaming programing, the three entertainment shows drawing the most television viewers nightly continue to be syndicated game shows Jeopardy, Wheel of Fortune and Family Feud.

And TV station groups are busily working to renew them for their local stations.

Jeopardy, while down about 400,000 viewers compared to last season, is still averaging 8.8 million viewers per night, while Wheel of Fortune is averaging about the same 8.1 million viewers per night it averaged last season, according to Nielsen data.

Jeopardy, while down about 400,000 viewers compared to last season, is still averaging 8.8 million viewers per night, while Wheel of Fortune is averaging about the same 8.1 million viewers per night it averaged last season, according to Nielsen data.

The third syndicated game show, Family Feud, is drawing a weekday average of 7.5 million viewers.

The most-watched broadcast television regular entertainment series this season is FBI on CBS, which is averaging 7.1 million viewers, just 200,000 more than Judge Judy is averaging, and the syndicated court show has been in repeats for more than a year.

The only other broadcast network regular season primetime show other than NBC’s Sunday Night Football and news magazine 60 Minutes to be averaging more viewers than Judge Judy is CBS comedy Young Sheldon with 7 million viewers. And Young Sheldon is also airing in syndication on TV stations across the country and is averaging 1.1 million viewers a night.

Advertisers Still On Board

According to iSpot.tv data, from mid-September through mid-December this new syndication season, advertisers had placed almost $300 million on 10 syndicated shows, including $51.8 million on Family Feud.

Family Feud also recorded 8.81 billion TV ad impressions, or ad viewers, while Jeopardy recorded 1.65 billion TV ad impressions and Wheel of Fortune drew 1.09 billion TV ad impressions for the first three months of the new season, according to iSpot.tv data.

Sitcom Longevity Also Important

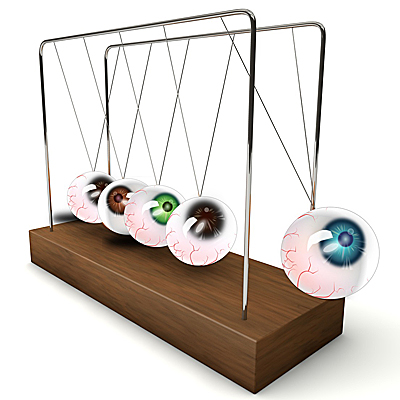

While it’s true that streaming programming is siphoning away traditional broadcast TV viewers, the long-term off network sitcoms now in syndication continue to draw advertisers and get significant TV ad impressions.

Over the first three months of the new season, Friends took in $82.4 million in ad dollars and averaged 21.3 billion TV ad impressions, while King of Queens took in $40.8 million in ad dollars and averaged 9.39 billion ad impressions, according to iSpot.tv data. The Office took in $30.1 million in ad dollars, and recorded 6.39 billion ad impressions, and Seinfeld drew $16.4 million in ad dollars, recording 4.82 billion in ad impressions.

Over the first three months of the new season, Friends took in $82.4 million in ad dollars and averaged 21.3 billion TV ad impressions, while King of Queens took in $40.8 million in ad dollars and averaged 9.39 billion ad impressions, according to iSpot.tv data. The Office took in $30.1 million in ad dollars, and recorded 6.39 billion ad impressions, and Seinfeld drew $16.4 million in ad dollars, recording 4.82 billion in ad impressions.

Nice Start For Talk Shows

While the viewer numbers aren’t as sizable as the big three game shows, a bunch of the veteran syndicated talk shows are also drawing respectable-sized audiences this season to date.

Live with Kelly & Ryan (2.2 million), Dr. Phil (1.9 million), The Kelly Clarkson Show (1.35 million), The Drew Barrymore Show (1.19 million) and Rachel Ray (1.03 million) are all averaging over 1 million viewers a day this season, according to Nielsen data.

Live with Kelly & Ryan (2.2 million), Dr. Phil (1.9 million), The Kelly Clarkson Show (1.35 million), The Drew Barrymore Show (1.19 million) and Rachel Ray (1.03 million) are all averaging over 1 million viewers a day this season, according to Nielsen data.

Newcomer talk shows this season, Sherri and The Jennifer Hudson Show are both close to the million-viewer mark in their first season with 951,275 and 907,245, respectively, while Tamron Hall is averaging 918,399 viewers each day. The other new talk show, Karamo, starring Karamo Brown, is averaging 464,181.

Touting Kelly Clarkson, NBC Universal says the show is the first syndicated talk show to deliver total viewers growth for a second consecutive season since the fall of 2014.

CBS Media Ventures’ decision to reformat The Drew Barrymore Show this season into two half hours that can be run back-to-back rather than an hour-long show is paying off. It has resulted in not only a rating increase but also a significant increase in ad revenue for the show.

According to iSpot.tv data, advertisers invested $11.9 million in the show during the first three months of the season.

Dateline Gets An Upgrade

True crime magazine Dateline, which in syndication features episodes from the long-running NBC primetime series, expanded its Monday through Friday carriage on several large-market NBC owned stations in syndication this season and boosted its daily viewership by 24% to 1.58 million viewers a day.

Dateline was already one of the most watched weekend syndicated shows, averaging 4.8 million viewers per telecast this season, and it now reaches more than 90% of the country in syndication.

Not Much New For 2022

The three new talk shows this season filled the void left by the departure of some veteran syndie talk shows that got canceled, but beyond that, there was not much new to hit the syndication air waves this season.

Byron Allen’s Entertainment Studios launched another court series, We the People with Judge Lauren Lake. It has been drawing about 415,000 viewers daily.

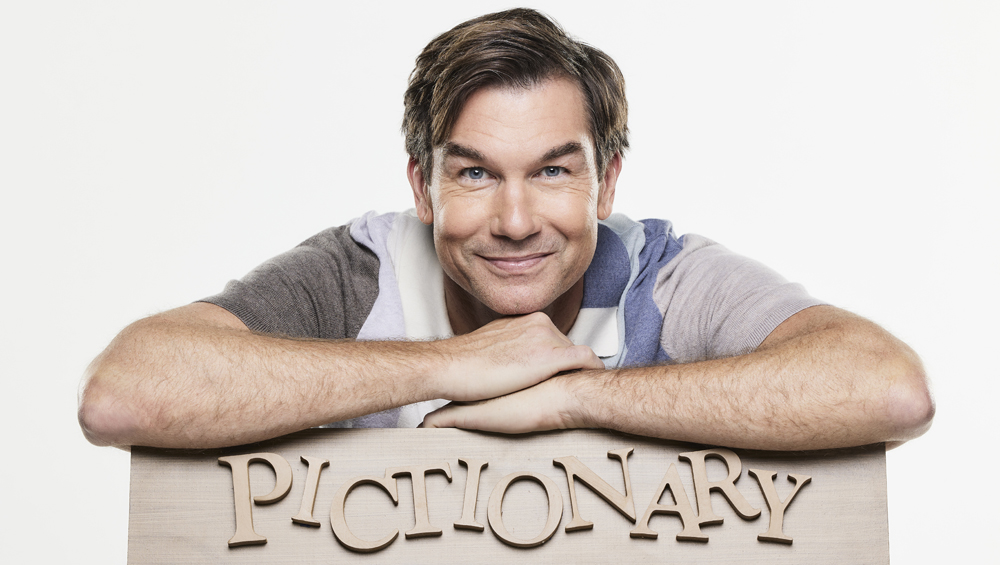

Fox Television Stations added game show revival Pictionary, hosted by Jerry O’Connell, to its fall syndication lineup after a summer preview test run, and it is averaging 659,691 viewers.

Fox Television Stations added game show revival Pictionary, hosted by Jerry O’Connell, to its fall syndication lineup after a summer preview test run, and it is averaging 659,691 viewers.

Disney Media Entertainment & Distribution launched off-network drama American Housewife to stations in about 85% of the country, Monday through Friday, and also brought two other off-network dramas, 9-1-1 and The Rookie to weekend syndication.

American Housewife is averaging 492,809 daily viewers, while The Rookie is averaging 1.15 million viewers and 9-1-1 is averaging 929,448.

What’s In Store For 2023

Right now, the 2023 season, which premieres in September, seems like a status quo year for TV syndication, although that could change. So far there is no talk of any show cancellations after the large bunch of shows that were taken off the air prior to this season.

Execs among the station groups and the studios and distributors say a good amount of time is going to be spent on renewals of current syndicated series as multiyear deals are expiring.

“We’re spending more time for 2023 on dealing with renewals rather than looking for replacement shows,” says Gray’s Conklin. “We’re going to spend a lot of our time making sure the right pieces are in place and tweaking schedules, but don’t see major changes right now.”

One change for Gray in the ’23 season, however, is to move its internally produced news team series Investigate TV, which now runs on its own stations as a weekend half-hour show, to Monday through Friday.

“We’ve been nurturing it for the past two years and now we’re ready to roll it out to all of our stations on a daily basis,” Conklin says.

Debmar-Mercury’s Bernstein says first-year talk show Sherri will be renewed, and game show People Puzzler, hosted by Leah Remini, currently airing on Game Show Network, will premiere in syndication for the 2023 season.

Sony, which owns Game Show Network, has also been working on development of game shows and other programming for syndication.

Last spring, Sony launched a game show division to develop programming for syndication and also bought Industrial Media and renamed it Sony Pictures Non-Fiction.

Sony’s Bramnick says to expect some announcements about syndicated games shows for both the 2023 and 2024 season.

“We really believe in the [game show] format and you’ll see a lot of production from Sony in that area both for primetime broadcast and for syndication,” she says.

Sony is also moving broadcast network primetime drama series The Good Doctor into syndication for fall 2023.

Byron Allen says his Entertainment Studios will be offering another court show and a home makeover show for syndication this fall, along with programming from a few other genres.

“We are 1,000 percent committed to the broadcast stations and are investing heavily in content to ensure the success of local stations,” Allen says.

What About NATPE?

The National Association of Television Program Executives’ (NATPE) annual conference is expected to be revived in the U.S. in 2024, but many TV executives at both the stations and studios believe it will no longer have much impact on the future of the syndication business, which has changed quite a bit since the annual conference was first held in 1964.

A U.S. bankruptcy court recently approved Canadian publishing company Brunico Communications’ purchase of NATPE’s assets, with more specific details for the revived conference to be announced down the road.

NATPE’s annual conferences in the U.S. were not held in 2021 or 2022, before the organization filed for bankruptcy, and will not be held in 2023.

While many who’ve attended over the years have a sense of melancholy when discussing the NATPE annual conference, for most programming studios and TV stations, the January meeting had basically become just a place where everyone could meet face to face and socialize a bit.

“It’s sad,” says Ira Bernstein, co-president of Debmar-Mercury, commenting on NATPE not holding its annual conference for the past three years. “I attended every year since 1984 and it is a big deal that it was no longer being held. But it is very much a sign of the times. Consolidation of the stations into a few but larger groups has made the NATPE conference less important.”

NBCU’s O’Boyle says, “while we are always eager and supportive of any venue to meet with our clients, the NATPE conference has become less relevant than it once was.”

He adds that while the concept of meeting with all clients in one location is “always a good idea,” he says syndication programming development and sales are now a year-round business.

Sony’s Bramnick says, “From a seller’s standpoint, NATPE gave us more opportunity and made it easier to see our customers in one place. It filled a nice role.”

But she adds that the pandemic began the practice of virtual meetings with clients, and the syndication business was able to function effectively without the annual NATPE conference.

Still, she says, “We can always see our customers one on one, but there is something about doing it with all the fanfare and having everyone together in one location,” she says. “It seems to elevate the conversation.”

CBS’s LoCascio will also be glad to see the NATPE conference return, even though he acknowledges that “business hasn’t been done there in a while.”

“NATPE has been more about going to see all of our clients in one place and spending a few days with them,” he says. “This is still a business that’s based on relationships, and face to face is important.”

While the NATPE conference has had less impact on the larger studios and bigger local stations in recent years, the smaller syndication programming developers and distributors and the smaller stations say it has had a more profound impact on their businesses.

Cassie Yde, president of Television Syndication Co. (TVS), which distributes nine regular weekly syndication series to smaller stations around the country, says, “No NATPE conference has been problem for smaller syndicators who sell and distribute weekly programming.”

Yde says it’s too expensive to travel and make in-person calls to each individual station or even to all the larger station groups. “So, NATPE was and will be again an important place to meet with all the stations in one location,” she says.

From the TV station group perspective, Gray’s Conklin agrees with Yde that there needs to be a venue where stations can go to meet with the smaller syndicators.

“Getting to see the smaller syndicators in person is better than having face to face Zoom calls,” Conklin says.

Another benefit of some type of national meeting, Conklin adds, is that it gives everyone a better perspective of what is going out throughout the industry. “Less secrecy,” he says.

Comments (2)

AIMTV says:

January 11, 2023 at 12:13 pm

I agree with most of the comments and conclusions. Syndication is NOT dead. Studios can walk (broadcast) and chew gum (stream) simultaneously. And yes, NATPE is needed, especially for the smaller syndicators. But the part where Byron Allen saves syndication? With cluttered unwatchable content “curated” from EPKs, old shows/content presented as if it’s fresh, and commercial inventory far exceeding the industry standard, his efforts seem to represent part of the problem rather than THE solution. Creativity and storytelling talent, not pure profiteering, must eventually play a role, if broadcasters are to compete with the plethora of viewing options.

[email protected] says:

January 12, 2023 at 12:14 am

Byron Allen’s court shows aren’t real since he uses actors & actresses, seems to be a lot of court shows that are just repeats that were canceled years ago still on in Syndication. I would like to see a return to dating shows don’t get why dating shows went out and syndication got rid of the dating shows.