Trolling Nielsen, Comscore Says Its Local Data Has Been Consistent

Comscore data shows higher viewing versus under-counting by Nielsen

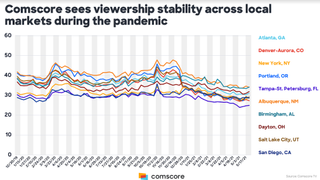

Comscore, taking another swipe at ratings rival Nielsen, said its local-market data shows that during the pandemic, TV usage climbed starting last March, then decreased, but still finished the year higher than in 2019.

Nielsen has been under fire for under-counting viewing with its panel-based data showing that TV usage was lower during the pandemic.

Earlier this week, the Media Rating Council announced that an analysis of Nielsen data showed under reporting of as much as 9% in some local markets. In May the MRC, which audits and accredits TV measurement services, said Nielsen’s national rating service also under-counted TV viewing.

The TV networks and distributors represented by the VAB said the undercount was the result of Nielsen’s inability to properly manage its sample households because of COVID protocols.

While Nielsen’s ratings are based primarily on a panel of sample homes, Comscore focuses on the big data from cable boxes and smart TVs. (Nielsen supplements its panel data with return path data).

Also Read: Nielsen Says COVID-19 Has Disrupted Local Rating Panels

“After the pandemic became widely recognized in early March, markets consistently saw an upswing in television usage, which climbed higher as the country went into partial lockdown. A slow decrease leveled out at somewhat higher levels than the previous year," Comscore said. “National-level, consistent ebbs and flows can be seen across all markets, as well as market-specific variations caused by things like news events, extreme weather conditions, and local sports.”

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Nielsen said it has been working with the MRC to implement procedural changes that prioritized the safety of our panelists and people, as well as the integrity of currency metrics used by the industry.

“Since early March 2021, Nielsen has been actively applying key learnings in the field as we return to pre-COVID maintenance procedures. Our first step was to identify the homes that were in most need of a maintenance visit. As of June 4, we have addressed 100% of the homes with maintenance needs. As we continue to execute our panel recovery strategy, we are excited to help the industry return to normal following this unprecedented pandemic,” the company said in a statement.

Comscore CEO Bill Livek, speaking at the TV Measurement & Data Summit produced by B+C parent company Future plc., said that because Comscore collects viewing data passively from consenting viewers, it didn’t need to take any special actions to maintain its systems during the pandemic.

“We were unaffected by it and that's where I think we saw the frailty of traditional systems. I like to believe that Comscore is the future,” he said.

“A long time ago we set out a vision of having the best local measurement service in a highly fractionalized world and we've accomplished that,” said Livek, who was with Rentrak before it was acquired by Comscore said.

He said there are more than 1,000 stations now working with Comscore. (You can watch Livek’s keynote session here.)

Earlier this week, Capitol Broadcasting said it was signing up again for Comscore’s ratings service after taking a year off, citing the differences between the way Comscore and Nielsen measure viewing.

"Comscore has been a reliable partner for us over the past years, but we tried to make a go just using a singular service recently,” said Joeel Davice, VP and general manager of Capitol Broadcasting.

“However, given the rapid shifts in consumer behavior during the pandemic, and the other service declining 47% in its A25-54 set meter homes year over year in our market, we felt Comscore's huge footprint was critical to our business," Davis said. "With Comscore, we know 50% of homes in the market are being directly measured, making us confident the information is accurate and that we can move forward and harness the intelligence to gain an advantage in the market."

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.