Sinclair Reorganizes Under Sinclair Inc. Umbrella

Sinclair Broadcast Group announced today that it intends to implement a reorganization in which a new holding company, Sinclair Inc. (New Sinclair), would become the publicly-traded parent of Sinclair Broadcast and its subsidiaries.

Beyond its familiar television broadcast business, Sinclair Broadcast and its affiliates own, manage and/or operate technical and software services companies, intellectual property for the advancement of broadcast technology, and other media and non-media related businesses and assets including real estate, venture capital, private equity, and direct investments.

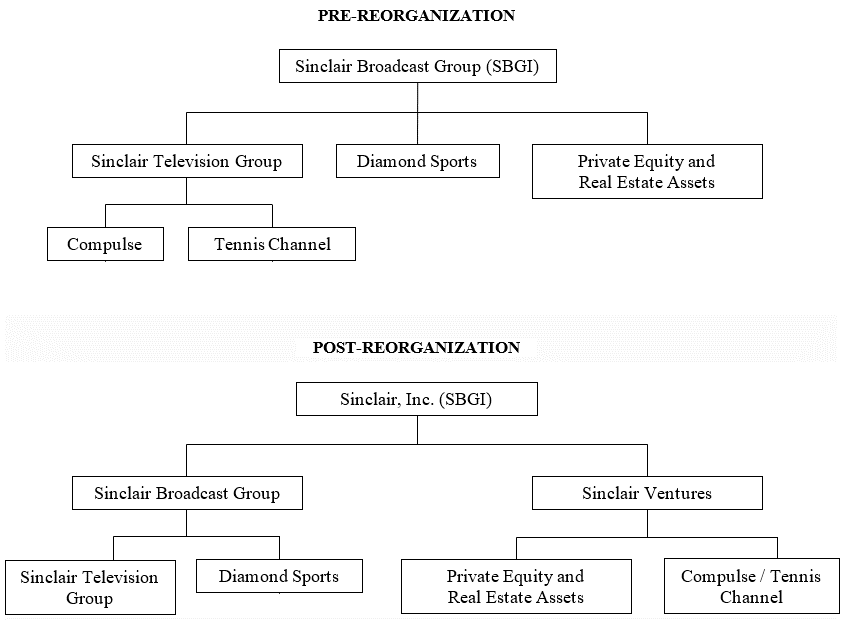

These other businesses and assets include, among other things, Compulse, a marketing technology and managed services company, and Tennis Channel. As part of the reorganization, these other businesses and assets will be held by New Sinclair through a new subsidiary to be known as Sinclair Ventures, rather than by Sinclair Broadcast or its direct subsidiary, Sinclair Television Group Inc.

“We believe the new structure will provide greater flexibility for creating value within the company. The new structure simplifies the corporate structure and improves the transparency of financial disclosures on the value drivers of the company,” commented Christopher S. Ripley, president and CEO of the company. “We believe these other assets, some of which are currently buried in the broadcast division, can receive greater visibility outside the ‘broadcast’ umbrella, while Sinclair Broadcast will become a broadcast-focused subsidiary for which stockholders can better value its true performance. In short, we believe a holding company structure can unlock unrecognized value and provide structural flexibility for the growth and monetization of our current and potential future media and non-media businesses.”

In the reorganization, each outstanding share of Sinclair Broadcast’s Class A common stock and Class B common stock would be exchanged automatically on a one-for-one basis for a share of Class A common stock and Class B common stock, respectively, of New Sinclair. New Sinclair’s Class A common stock is expected to continue to trade on the Nasdaq Global Select stock market under the ticker symbol “SBGI” just as Sinclair Broadcast’s Class A common stock does today.

The rights and benefits of the holders of shares of New Sinclair’s common stock, including voting rights, would be the same as the rights and benefits of the holders of shares of Sinclair Broadcast’s common stock in all material respects. Under applicable law, the Reorganization will be accomplished through a share exchange and is subject to the affirmative vote of two-thirds of all the votes entitled to be cast on the matter at a special meeting of Sinclair Broadcast’s stockholders expected to be held in the second quarter of 2023.

The company said the reorganization is not expected to result in a change in the directors, executive officers, management or business of the public company, or to impact the timing of the declaration and payment of regular quarterly dividends. The reorganization is not expected to result in gain or loss to Sinclair Broadcast’s stockholders for U.S. federal income tax purposes.

Below are simplified illustrations of the business structure before and after the reorganization:

Comments (0)