TVN Focus On Business | Diginets Weather COVID-19, Holding Their Viewers

The COVID-19 pandemic so far has had very little impact on multicasting networks, with the larger Nielsen-measured diginets holding their own in viewer reach.

Meanwhile, the two newest entrants have significantly increased both ratings and station clearances since they launched last fall.

While the traditional classic TV programming multicast networks like ME TV and Cozi TV, and more recently Antenna TV and Decades, continue to reach older audiences, newer entrants are looking to more specialized areas like lifestyle and news to reach younger audiences that are not watching traditional broadcast television or are not interested in historical hit scripted fare.

Positive Pandemic Performance

The current good news is that data from Nielsen, which measures nine diginets, shows that during the month of April, when stay-at-home mandates were in force in several states due to the initial coronavirus outbreak, viewership cumulatively averaged 1.72 million daily viewers across those networks: Weigel Broadcasting’s ME TV, Heroes & Icons and its partnership with CBS, Start TV; along with Scripps/Katz diginets Laff, Escape, Grit and Bounce; NBC’s Cozi TV; and Sinclair/MGM’s Comet.

As quarantine rules were eased and June arrived, that number fell to an average of 1.59 million viewers daily for the month, but that was only 6% less than the cumulative average for those networks in February prior to the start of the pandemic.

Conversely, traditional broadcast viewership was down 21% during that February through June period. In fact, the percentage share of all broadcast viewership for those larger multicast networks grew to 13.5% by the end of June from 11.4% in February. A caveat, however, is that the traditional broadcast networks did lose all their live sports programming beginning in mid-March.

Newcomers Make Inroads

Still, it is an impressive showing for the multicast networks. And the fact that two major broadcast media companies, CBS and NBC, introduced new diginets and have expanded them through the pandemic is a testimony to a potentially bright overall future for multicasting.

CBS Television Distribution’s lifestyle diginet Dabl, launched last September with an initial national clearance of 80% and has since grown that to 95% of the country. It continues to layer on cable distribution having done deals with Altice, Comcast and Verizon on top of its over the air (OTA) deals. And in August, Dabl will be launching an OTT service.

Dabl is not yet measure by Nielsen, but its internal data shows that it has seen double-digit percentage household ratings increases in all of its dayparts since February. Daytime is up 42%, early fringe/access is up 78% and primetime is up 33%. Plus, Dabl has increased its digital audience by 235% since January.

Meanwhile, NBCU launched its LX news streaming service targeting GenZers and millennials online last fall, then rolled it out as an OTA multicast network in May before launching its live diginet LX newscasts on June 1. Its target audience is 18-45, much younger than the 65-plus median age audience of the broadcast nightly news telecasts.

The live LX newscasts do not include the breaking news format offered by the older-skewing broadcast and cable networks but contain lots of news features with local angles that are of more interest to younger viewers and their lifestyles.

LX News staffers are located at NBC stations in newsrooms across the country and the live newscasts originate from the LX studio located at NBC’s KXAS Dallas. The live telecasts air from 8 a.m. to 10 a.m. and 8 p.m. to 10 p.m. each day. Ten minutes of commercial time airs per hour on the newscasts and ads are sold by NBC station sales staffs. LX also airs lifestyle programming content from assorted partners.

Both Dabl and LX executives believe there is room for expansion in multicast beyond traditional classic scripted programming

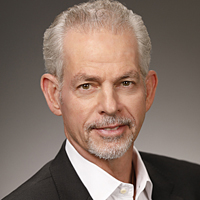

Steve LoCascio

Steve LoCascio, COO of CBS Global Distribution Group, says the initial goal of Dabl is to offer classic lifestyle programming like cooking, gardening and do-it-yourself shows rather than scripted sitcoms and comedies.

Down the road, he envisions a move into originally produced lifestyle programming but production costs would clearly be higher so it would require more ad dollars.

“Our first step is to increase our OTA distribution and hit the magic threshold to get Nielsen to measure us,” LoCascio says. “Then we can charge higher CPMs for our advertising. We believe we will get there.”

Dabl’s initial cooking and games show programming is similar to syndicated programming that is offered via CBS Television Distribution.

Down the road, LoCascio says, “We have to figure out a model to introduce original lifestyle programming. The book is open for us to do it. And if we could find a way, it would set Dabl apart from everyone else.”

Meredith McGinn

Meredith McGinn, SVP of Cozi TV, LX and LX.TV Productions, says: “It’s important for us to take a step back and see how we can best use the spectrum. One white space we saw was innovatively strengthening the news genre.”

McGinn says NBC and NBCU’s Telemundo stations “do so much news, but viewership on television continues to get older. We know younger viewers are out there.”

The goal of LX, she says, is to introduce new storytellers and new storytelling formats and that’s harder to do on the regular broadcast and cable channels.

The goal of LX is to “push the envelope in local story telling, to find interesting angles to tell the news in a more documentary style not seen in regular newscasts.”

McGinn says during the COVID crisis in April, TV viewing was up 16% among 18-24 viewers, while older viewers were also watching more on Cozi TV. During the month of April viewership on Cozi TV among adults 35-64 was up 23%.

Another Specialized Player

Eric Wotila

While large media company NBCU got into the multicast network news game most recently, an independent company run by Eric Wotila launched NewsNet in early 2019. It’s different from LX in that it is basically a 24-hour breaking news operation with no news commentary, just straight news targeting all age groups.

NewsNet operates on a continuing 30-minute news cycle of national news, sports, business, entertainment and weather that is updated every half hour. It also carries a 90-minute children’s educational programming block on Saturday and Sunday mornings.

Without a parent company’s group of stations, NewsNet has had to put together agreements with affiliates around the country. It launched with 18 stations and by May 2019 had 45. At that point, Wotila says a pause was put on affiliate growth in order to construct an expanded studio and control room at its headquarters in northern Michigan.

“We launched the network first, then we built our building,” he says. “Since then we have ramped back up doing deals with stations. We initially built our model with low-power affiliates that had no news operations, but we are now adding full-power stations and talking to larger station groups.”

Wotila believes classic entertainment programming has reached a saturation point among multicasters, but there is room for news operators in markets where stations have no local news. He says one CBS affiliate in Georgia even carries NewsNet on one of its subchannels and promotes it on its local news.

Advertising For The Future

Since the first multicast networks hit over-the-air years back, they have struggled to get mainstream advertisers, primarily because of smaller audiences and hard-to-find locations. One of the Nielsen-measured diginets has been able to get some bigger-name national advertisers, but for the most part, when the media agencies begin moving ad dollars out of broadcast and cable, those dollars primarily move to online streaming services.

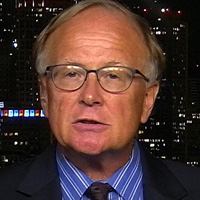

Brad Adgate

A handful of agency execs confirmed that but did not want to speak for attribution. However, Brad Adgate, a longtime research executive at Horizon Media who’s now an industry consultant, says: “Right now none of the multicast networks are a must buy for any mainstream advertiser. They are competing not only with traditional broadcast and cable networks for ad dollars, but also with streaming services and OTT media. They need to do something to stand out or they will get lost in the shuffle.”

CBS’s LoCascio agrees. “There is going to become a saturation point. The successful diginets will be the ones that can separate themselves from the clutter. The future is bright, but can there be 100 diginets out there all making money? No.”

Tracking The Ad Dollars

The many multicast networks that have survived for years and others that have jumped into the fray are getting the bulk of their ad dollars from direct response advertisers.

“There isn’t a consensus on multicast ad billings in total,” says one media agency executive. “And it’s hard to get ad billings broken out for individual networks. But the estimate is that the larger multicast networks that are rated by Nielsen average between $30 million and $50 million per year in ad billings. However, that likely drops off pretty steeply from there.”

Overall, this exec estimates, the multicast network industry in total can take in as much as $500 million a year. “Most of the larger multicast networks are profitable with the ad dollars they take in,” he says.

Mark Hodor, SVP, direct response video at Amplifi/Dentsu Aegis Network, explains why there is a sizable number of direct response advertisers that make significant investments in advertising on diginets.

“Direct response advertising has proof of performance built in and that’s how they buy it,” Hodor says. “Every direct response ad has a unique 800 call-in number or consumer response code so they can match sales outcomes to a particular ad that runs on a specific network. The advertiser can then compare how much they paid for each ad versus how much profit they made in sales from that ad.”

Ironically, this resembles the sales outcome models that traditional advertisers are now demanding that the broadcast and cable networks move toward. Over the years the broadcast and cable networks have often shied away from accepting direct response ads. At the same time, direct response advertisers have for years been tracking sales based on where the ads run.

Hodor says direct response advertisers are continuously testing new multicast networks and measuring ad response results. There are enough of them to keep the more watched diginets in business.

“The direct response folks are pretty smart,” Hodor says. “If they continue running an ad on a particular diginet, it means the ads are effective.”

Comments (1)

catskills says:

July 29, 2020 at 2:20 pm

For aggressive & well run LPTV station this info is no surprise.

The new paradigm is the 12 channel Igolgi Stat Mux & 12 Diginet choices.

A blend of paid carriage , barter nets , then shoppers & religious / ethnic paid.

With this mix most facilities are cash flowing every month & then some.

Great article but you left off Luken Communications, Fremantle & a few others.

Viewers & advertisers like Diginets cause the programming is proven, the demo has serious retirement wages & loyal viewing.

The stations whether big facility or scrappy independents need to get with this new reality or the next 10 years could be grim for the laggards !!