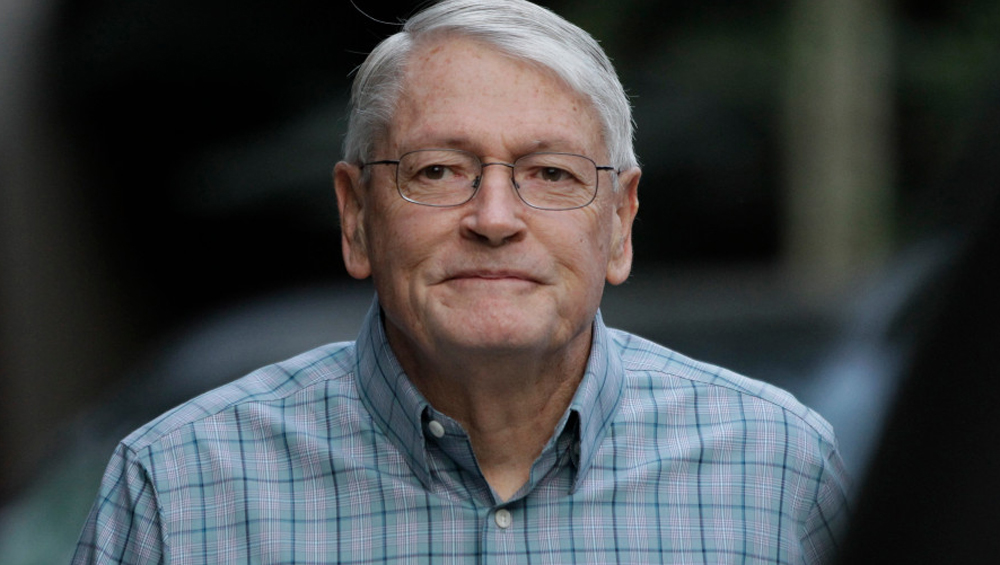

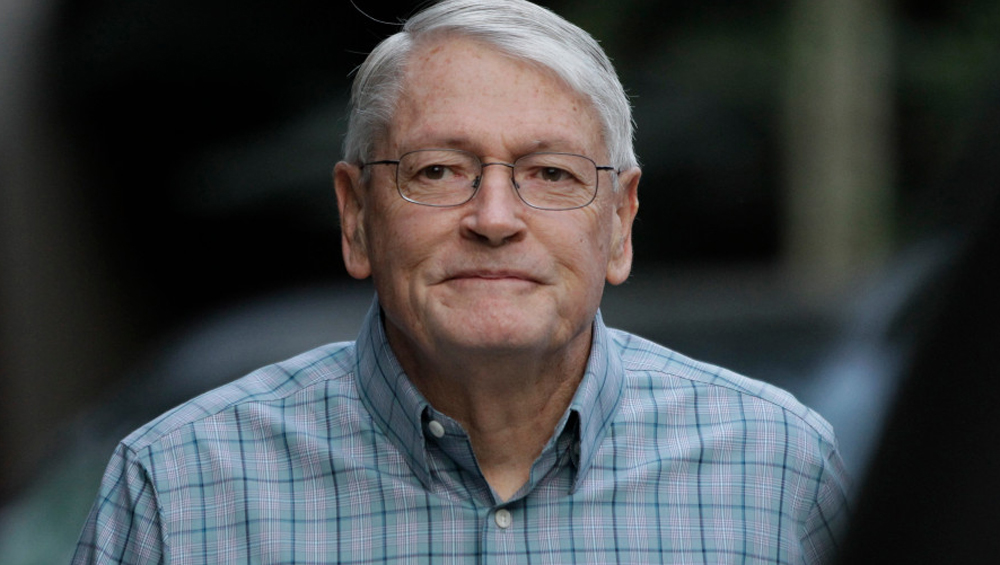

John Malone has stepped down from his role as director emeritus on the Charter Communications board, citing concerns that his simultaneous presence on Warner Bros. Discovery’s board of directors violates the Clayton Act.

The six-year-old suit accused the defendants of unfairly benefitting from Charter’s $78.7 billion purchase of Time Warner Cable in 2015.

The suit accused Malone of unfairly benefiting from Charter’s $78.7 billion acquisition of Time Warner Cable in 2015. The defendants didn’t admit wrongdoing.

The media mogul also said news channels should do a better job of distinguishing between news and opinion.

CNN’s Problems Are Bigger Than Jeff Zucker

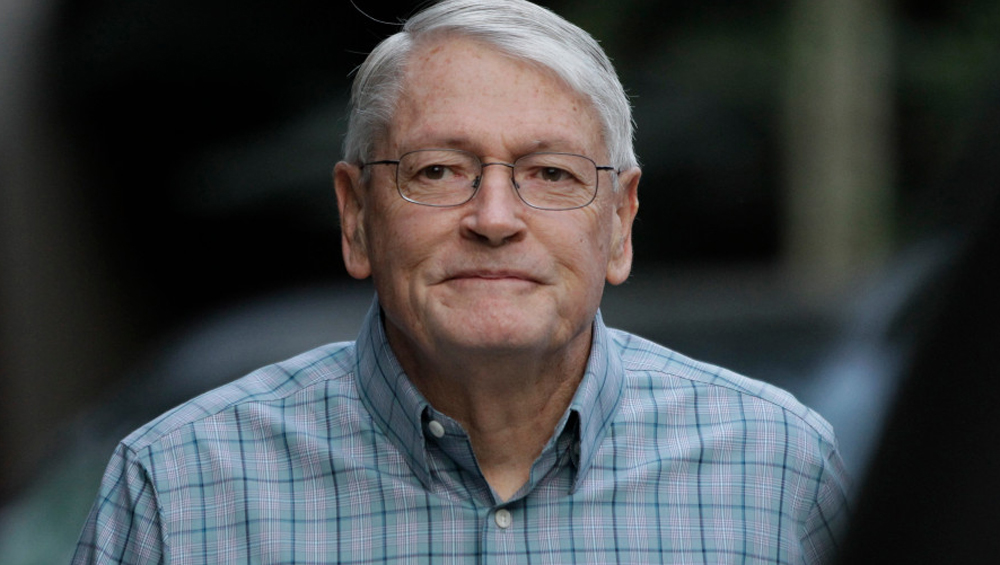

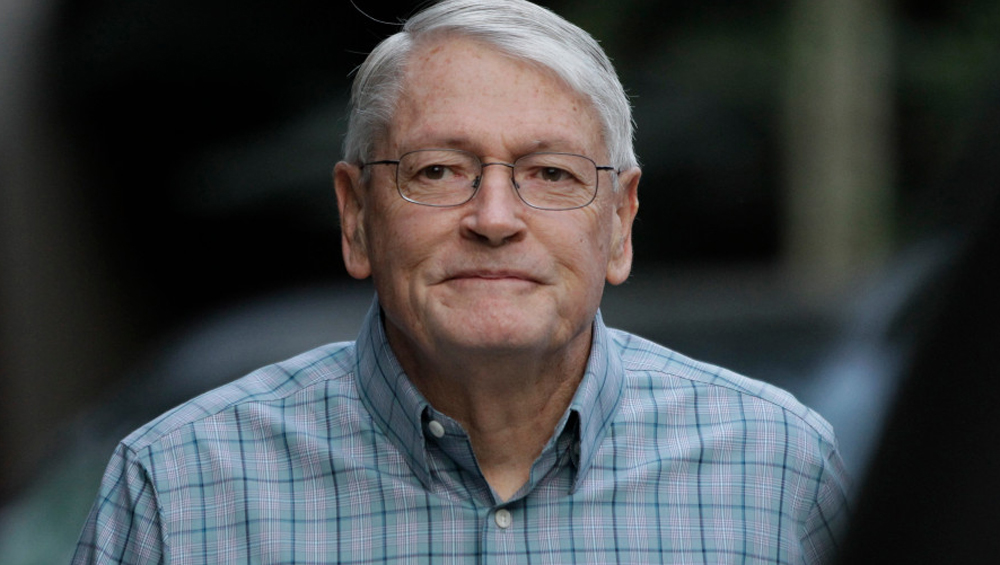

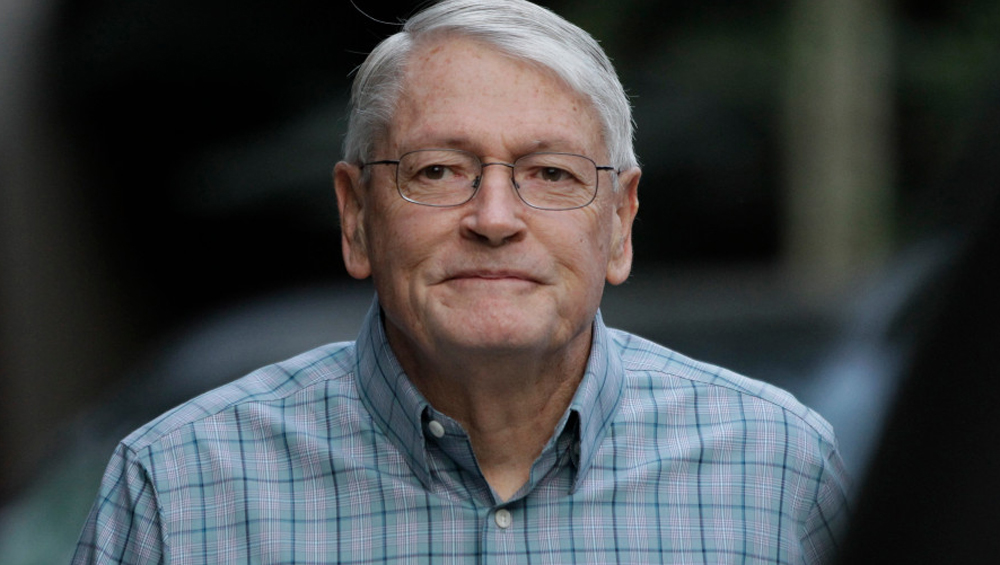

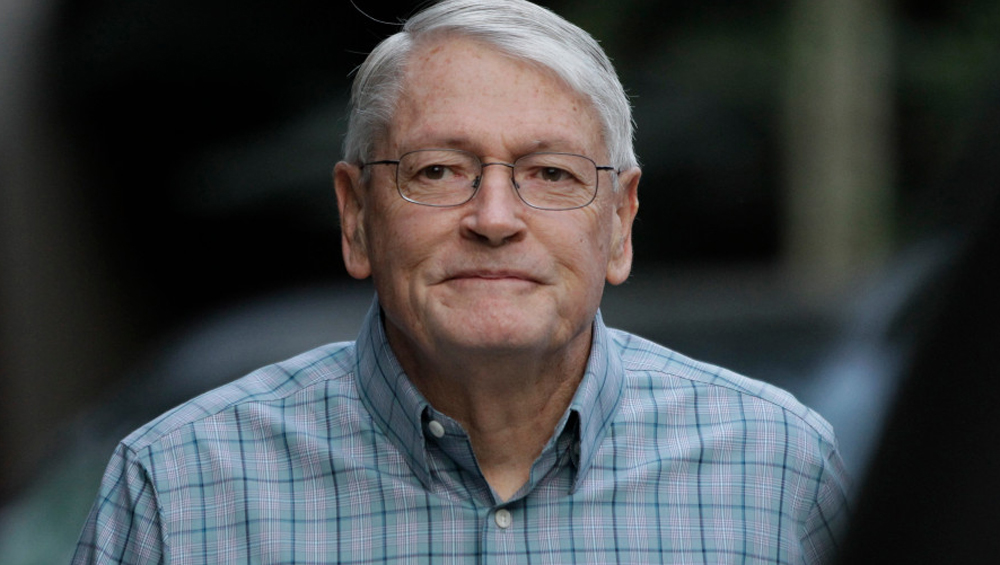

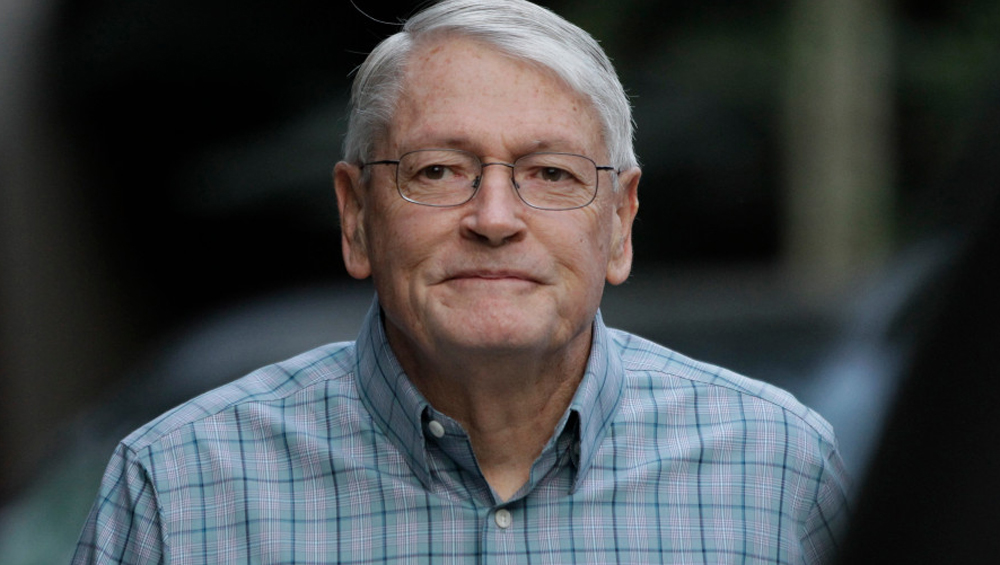

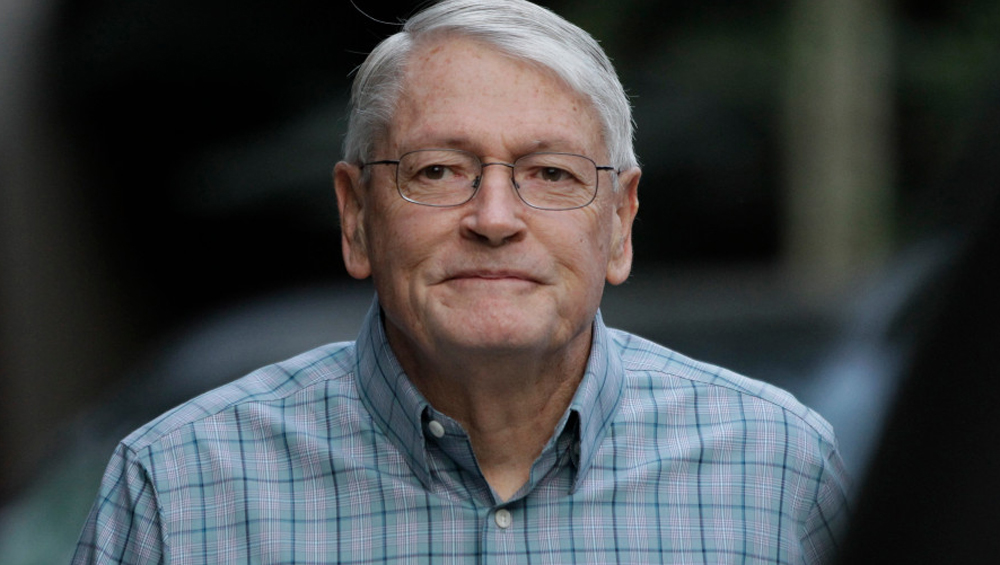

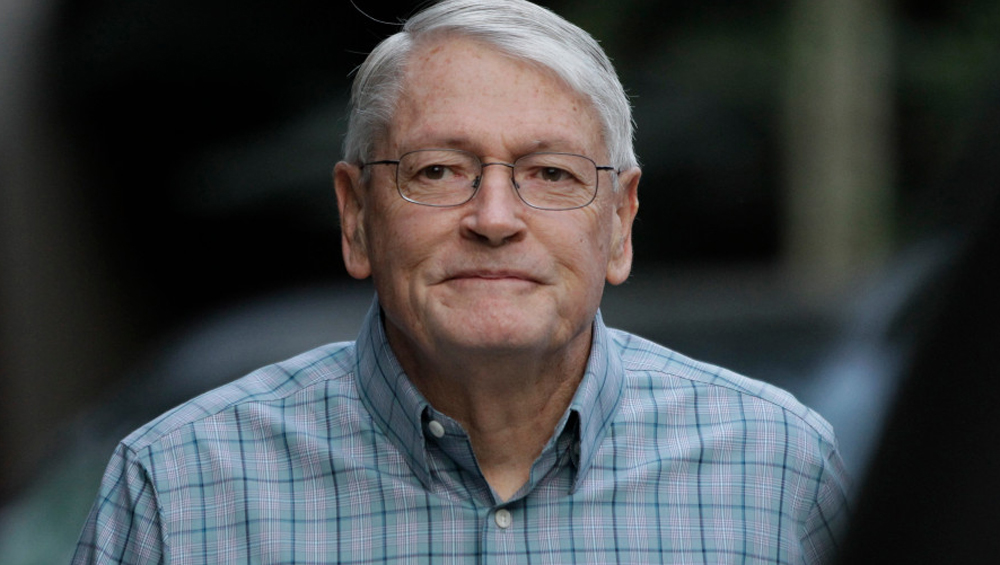

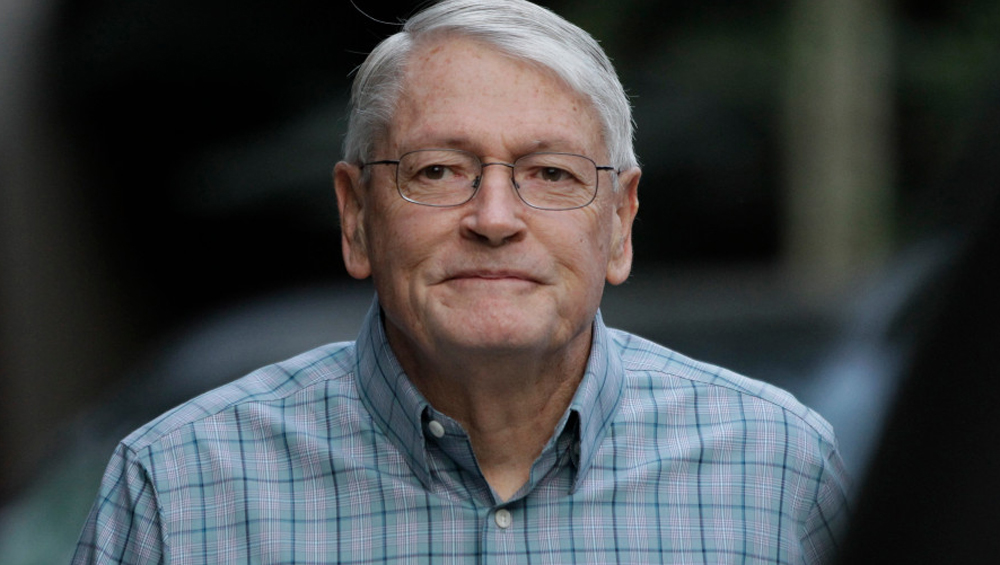

How an upcoming merger at WarnerMedia could upend life at the cable news network. Above, The TV magnate John Malone, who has profited immensely from the consolidation of the media market, is poised to play an influential role in the new company.

Cable legend John Malone, just days after converting his super-voting shares in Discovery Inc. to common stock for no premium to help facilitate its merger with WarnerMedia, has agreed to sell his Class B shares on TV and online retailer Qurate Retail Group to long-time lieutenant Greg Maffei, for about $400 million in cash or stock.

Liberty Media Chairman John Malone told CNBC that Amazon, Apple or Roku could dominate in the crowded streaming space given their ability to scale globally. “I think these global platforms will be enormously powerful,” Malone said in an interview that aired Thursday on CNBC. Most products they create will be selling wholesale through these transport systems, the billionaire media mogul added.

Liberty Media chairman John Malone believes that consolidation, which has swept through the traditional cable distribution business largely at his own hand, will come to streaming video as well, and that could be good news for traditional pay TV companies.

After recently selling his remaining stake in Lionsgate, billionaire investor and media mogul John Malone has acquired more stock of Discovery in what is believed to be his largest or one of his largest open-market purchases of the stock ever.

According to an SEC filing, the billionaire investor no longer “beneficially” owns class A shares in the Hollywood studio.

Jim Dolan may soon have a bidder for MSG Networks, which broadcasts games for the New York Knicks, the Rangers and the Islanders. Dolan’s old pal John Malone is said to be eyeing the regional cable and satellite TV network as part of his master plan to own regional sports networks from Miami to New York, sources tell the New York Post.

Billionaire media mogul John Malone is cobbling together a team to bid for the Fox-owned regional sports networks being sold by Disney — and his roster will be going head-to-head against Major League Baseball.

When John Malone retired from the boards of Lions Gate and Charter Communications last month, the media and telecom industries shuddered: Was the Cable Cowboy finally calling it quits? Not quite. The 77-year-old billionaire, who helped build the pay-TV industry and now sees it threatened by cord cutting, remains on the boards of eight public companies and has no plans to leave them. He’s still the largest shareholder of Charter, the No. 2 U.S. cable company. Two of his deputies are still directors at Lions Gate, an independent studio. And when he calls, executives still listen. Nothing is really changing, he says. He just wants to spend more time with his wife.

The Wall Street Journal reports that media mogul John Malone and his lieutenants are quietly building a cable colossus in Europe and Latin America that potentially could be the backbone for the next generation of wireless-internet service. Journal subscribers can read the full story here.

Aggressive investor John Malone could be looking to supercharge efforts by his companies to provide Spanish-language content to an underserved domestic market that is 60 million strong and growing.

More than ever, the media industry is hurtling toward greater consolidation. And consummate deal makers like John C. Malone, the 76-year-old telecommunications billionaire, are increasingly testing the waters for potential transactions.

More than ever, the media industry is hurtling toward greater consolidation. And consummate deal makers like John C. Malone, the 76-year-old telecommunications billionaire, are increasingly testing the waters for potential transactions.

The Liberty Media chairman is discussing buying a “significant stake” in Univision, according to The Wall Street Journal. It says the owner of the dominant Spanish-language broadcaster in the U.S., has been fielding interest from potential bidders after the media company’s initial public offering was delayed, according to people familiar with the matter. WSJ subscribers can read the full story here.

Operators had better be standing by to handle this one: The nation’s two best known home-shopping TV operations, QVC and Home Shopping Network, are set to come together under an all-stock deal valued at approximately $2.1 billion put together by John Malone’s Liberty Interactive Corp.

Content distribution giant Disney is being held back from its full potential by ESPN and may consider spinning off the sports broadcast network, Liberty Media Chairman John Malone told CNBC on Thursday. “If I had to guess, what you will see is a split of Disney with ESPN spun off and, probably, ESPN could be owned and protected by a distributor in the U.S.,” Malone said.

Mario Gabelli, the second-largest shareholder in Viacom behind Sumner Redstone, said he believes billionaire John Malone is cooking up a deal for the company. Malone weighed in on the battle for control of the New York media conglomerate Thursday at Allen & Co.’s exclusive business confab in Sun Valley, saying the company’s assets are undervalued because of all the drama around it.

For Starz, the long road to its $4.4 billion sale to Lionsgate this week began on Jan. 14, 2013, the day its stock began trading as a standalone entity spun off from Liberty Media.

The coming consolidation of John Malone’s media empire will occur, Starz CEO Chris Albrecht said on Thursday. The question is when.

The cable mogul was feted Wednesday night by the UJA-Federation of New York, which bestowed on Malone its Steven J. Ross Humanitarian Award as part of its annual Leadership Awards dinner. Charlie Rose conducted a candid “fireside chat” with Malone views on everything from the state of competition in TV (“the nightmare scenario for any businessman is that you have a rich, dumb competitor”) to his libertarian perspective on the presidential race (“you just shake your head — there are very real problems we have in our society and we worry about restrooms?”) to what keeps him up at night (“you gotta worry about everything”).

The cable mogul was feted Wednesday night by the UJA-Federation of New York, which bestowed on Malone its Steven J. Ross Humanitarian Award as part of its annual Leadership Awards dinner. Charlie Rose conducted a candid “fireside chat” with Malone views on everything from the state of competition in TV (“the nightmare scenario for any businessman is that you have a rich, dumb competitor”) to his libertarian perspective on the presidential race (“you just shake your head — there are very real problems we have in our society and we worry about restrooms?”) to what keeps him up at night (“you gotta worry about everything”).

His Liberty Interactive will spin off two units, while Liberty Media will reclassify its common stock into three tracking stocks.

Billionaire John Malone continues to circle Lionsgate. Lions Gate Entertainment Corp., the parent of the Santa Monica television and film studio, said Tuesday that it was selling 6.8% of its shares to two companies: Discovery Communications and Liberty Global. Malone holds a significant stake in both Discovery and Liberty Global. Discovery and Liberty Global each will pay about $195 million for a 3.4% stake in Lions Gate, according to the companies.

John Malone’s sprawling interests are being scrutinized by U.S. regulators reviewing the deal he helped broker to merge Time Warner Cable and Charter Communications, where he is a leading shareholder, to create the second-largest U.S. cable company.

John Malone’s international cable company Liberty Global has bought Ireland’s commercial broadcaster TV3 in a deal worth up to €87 million ($96 million). The deal was made between Liberty Global’s UPC Ireland and U.K. private equity group Doughty Hanson, which bought TV3 in 2006 for €265 million ($292 million).

Billionaire John Malone, fresh from helping engineer a mammoth cable TV merger between Charter Communications and Time Warner Cable, is examining ways to consolidate studios and smaller channels to better compete as the traditional TV bundle begins to unravel.

The chairman of Liberty Media, which is Charter Communication’s biggest shareholder, said Tuesday that TV Everywhere — the cable industry’s answer to Netflix — is a flop. Malone shared his blunt assessment of the initiative — which allows cable customers to watch TV shows via the Web — as part of his pitch for Charter buying bigger rival Time Warner Cable.

John Malone made his fortune as a pioneering baron of American cable, and has had his hands in everything from the Discovery Channel to DirecTV.

John Malone’s Liberty Media Corp. has started the process of spinning off its cable assets through a stock dividend to its shareholders to form a new listed company called Liberty Broadband. Liberty Broadband, in a regulatory filing, says the stock dividend would be worth up to $4.8 billion and Malone would retain a voting interest of 47.3%.

It remains to be seen whether cable operators will try to mimic Aereo if its approach to delivering broadcast TV — without paying for it — passes muster at the Supreme Court. But at least one major MSO was interested enough in Aereo that it tried to buy a stake in the company: Liberty Global, the international cable operator led by Chairman John Malone, at one point considered investing in the TV-streaming startup but ultimately decided not to, according to CTO Balan Nair.

The Wall Street Journal is reporting that John Malone agreed to give the chief executives of Discovery Communications Inc. and Liberty Global PLC the right of first refusal to acquire his voting stakes in those companies. WSJ subscribers can read the full story here.

Liberty Media Corp. on Friday said it would offer to buy out the minority shareholders in satellite radio provider Sirius XM Holdings Inc., in a deal that could give cable mogul John Malone a freer hand in driving cable consolidation.

“Grow big or go home” has been John Malone’s business plan since he was a cable system operator in Denver in the 1970s. Today Malone, 72, is at the center of a consolidation effort that would combat ever-increasing programming costs, as well as compete more efficiently with new providers like Netflix.

“Grow big or go home” has been John Malone’s business plan since he was a cable system operator in Denver in the 1970s. Today Malone, 72, is at the center of a consolidation effort that would combat ever-increasing programming costs, as well as compete more efficiently with new providers like Netflix.

Liberty Media Corp.’s top executives estimate that a merger between Charter Communications and Time Warner Cable could generate roughly $700 million in annual synergies, according to people close to the matter.