Advertising spending on linear television fell 7% in the fourth quarter from the prior year, according to ad intelligence company Guideline. Guideline, which acquired Standard Media Index in 2022, said the decline was the biggest since it started tracking U.S. ad spending in 2017. Since Q4 2017, ad spending on linear TV has been falling at an average compounded rate of 3.4%.

For Broadcast, 2024 Will Be The Year Of Multiple Currencies

True cross-platform measurement is also on the industry’s mind, while local linear TV measurement falls further behind.

In 2023, streaming surpassed broadcast and cable TV viewing for the first time, according to Nielsen. But in the current presidential election cycle of 2024, the mantra is — long live TV.

A new study released by TVB, conducted by GfK, attempts to better understand “the vast world of streaming and how linear television, specifically local broadcast TV, fits in it.” Four thousand respondents took part; 81% were exposed to local broadcast TV news either on a TV set or through an app/website.

Linear TV viewership made somewhat of a comeback in August after dropping to an all-time low in July, Nielsen reported in its latest monthly state of TV report. Combined viewing for broadcast and cable managed to eke back to 50.6% of total TV usage, with broadcast recording its first gain since January. Broadcast accounted for 20.4% of TV usage, which is a 1.4% gain month-over-month. As for cable, it recorded the largest monthly category across all three categories, ballooning 1.7%. Meanwhile streaming saw a bit of a decline to 38.3% but still remained the largest share of television for the month.

Linear TV’s decline to less than 50% of all TV viewing was long in coming very long. No matter what label you put on it — “linear” or “legacy” — audience erosion in TV’s older precincts has been going on for years, even decades.Indeed, it has been a recurring theme running like a thread through the history of television and the coverage of the business by TV beat reporters since the 1980s.

Broadcast and cable’s share of viewing dropped below 50% to 49.6% as streaming hit a new high in July, according to Nielsen. Broadcast’s share was 20% in July, a new low, down from 20.8% in June. Cable had a 29.6% share, down from 30.6%. It’s the first time cable’s share had been below 30%.

New research from Samba TV shows that streaming giants are facing a tightening marketplace with increased audience competition and content discoverability challenges.

Get as few as 5 million people to watch your network every night, and you too could be No. 1.

A combination of continued quarterly subscriber erosion, the shift of their best programming to streaming platforms and declining affiliate-fee growth could help accelerate the demise of linear TV as we know it, according to a MoffettNathanson report.

Older Adults And Their Post-COVID Media Habits

Adults 55-plus still favor linear television, but streaming is creeping into their viewing habits with AVOD services holding a particular appeal.

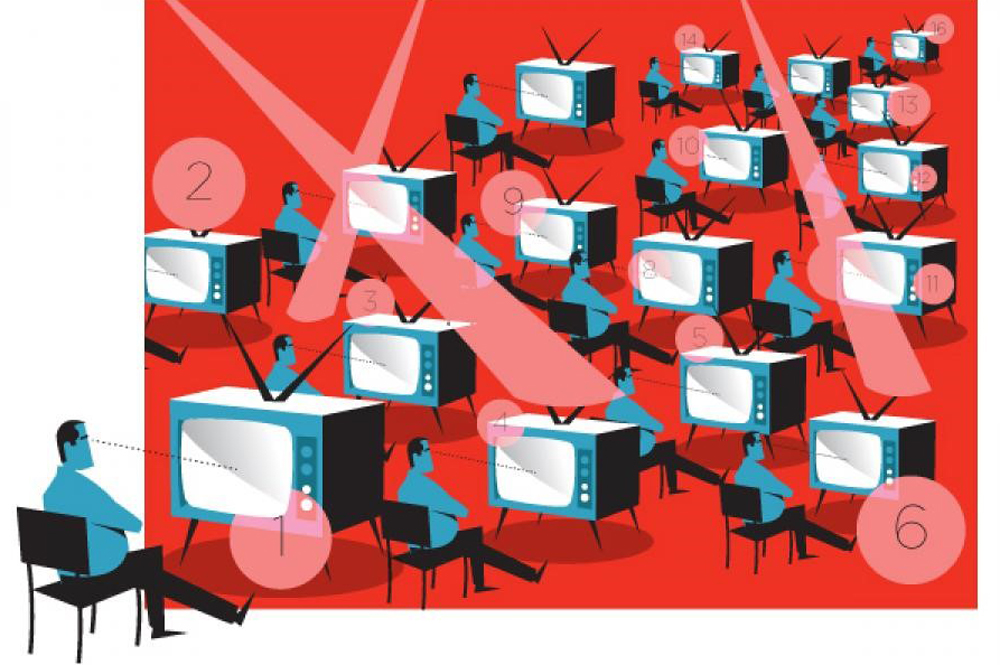

A new study from Samba TV finds that the declining reach of linear TV means nearly all linear ad impressions now reach only half of U.S. households.

While every network presenting at this year’s upfronts is highlighting their streaming wares and linear offerings, executives from TelevisaUnivision are approaching sales meetings with an ace up their sleeves: Its linear TV ratings are on the rise.

Betting that they can’t compete with Netflix and hoping a diversified approach is more lucrative, A+E, Fox Corp. and AMC Networks are leaning into the cable bundle (and ad-supported streaming).

The future in which linear TV is driven almost exclusively by live sports, news and events has arrived, according to analyst Michael Nathanson after crunching numbers from Nielsen. “Time spent on cable networks built on movies, syndicated TV and kids content has collapsed over the past two years as consumers and media companies adopted a streaming first mind-set,” said Nathanson, senior analyst at MoffettNathanson, in a report Thursday.

Linear TV advertising sales slowed in February, leaving year-to-day linear TV investments up 6% so far this year compared to last year, according to Standard Media Index. In January, linear TV sales were up 9%. But sales remain down from 2020, before the COVID 19 pandemic hit the U.S. Compared to 2020, linear television ad sales are down 6% so far this year.

Linear television advertising spending fell 1% in November compared to a year ago, with local cable operators chalking up big gains, according to new figures from Standard Media Index. National broadcast and cable networks were each down 2% for the month. Local TV station ad sales were down 9% compared to the 2020 election year.

The E.W. Scripps Co. has introduced a suite of new linear attribution features to its Scripps Octane Verify solution, an integrated advertising and measurement tool that advertisers are using to gauge […]

The entertainment company has announced tie-ups with two of the biggest ad-tech companies on the public markets (Magnite and The Trade Desk) that enable programmatic and addressable advertising on linear TV.

Post Pandemic, Linear TV’s Slow Decline Will Continue

Although linear TV enjoyed an initial pandemic boost, the effects weren’t long-lasting and didn’t reverse longstanding trends with which the industry must reckon.

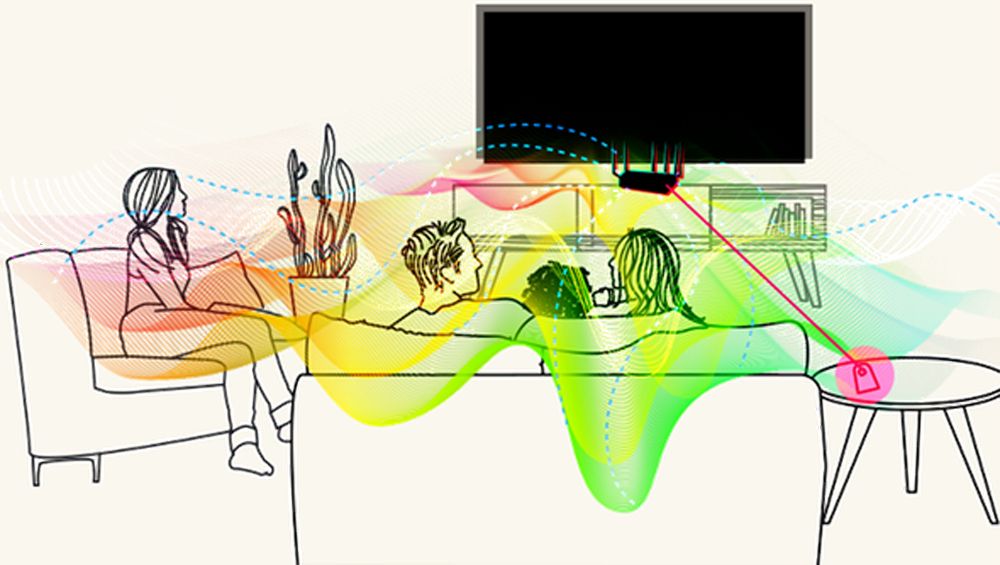

The Coalition for Innovative Media Measurement (CIMM), a division of the Advertising Research Foundation, this morning said it is launching new research to “better understand how time is spent across every platform available on TVs today.” The initiative, dubbed the “Passive TV Measurement Study,” will explicitly look at how American consumers spend time with linear TV as well as OTT (over-the-top internet-connected) devices, smart TV apps and video game consoles.

Survey Finds TV Viewers See Clear Product Differences In Streaming, Linear

A recent consumer survey found viewers turn to streaming for a specific, high-budget experience that fits into their lifestyle, while they look to linear to maximize a passive viewing experience.

Telestream, a provider of workflow automation, media processing, quality monitoring and test and measurement solutions for the production and distribution of video, today introduced the next generation of its IQ […]

The total minutes watched metric puts traditional shows on a much more equal footing.

Nielsen has promoted Scott Brown to general manager, audience measurement. In this new role, he will “continue to innovate Nielsen’s measurement products and ultimately drive the unification of linear TV, […]

The giddy excess of the Peak TV era has culminated in a sort of option paralysis among consumers, many of whom, when presented with a near-infinite number of entertainment choices, make none whatsoever.

OK, maybe not no one, but the numbers are way down. As per Nielsen, broadcast C3 ratings in the first quarter dropped 17% versus last year, with all four major broadcast networks taking major hits in the coveted 18-49 demo. (Fox, which has a heavy sports presence, was the only broadcaster network not to see double digit dives.)

With content creation seen as a major strength, leaders at NAB’s Senior Leadership Summit were greeted by a SmithGeiger survey that shows local TV news ranks as most trusted and viewed across all key 18-54 demos.

Barclays: Stop Treating OTT Like Linear TV

The failure of NBC’s comedy SVOD service, Seeso, is largely the result of a failed strategy of simply taking linear content online, Barclays contends. “In our opinion, most media companies are looking at OTT as a defense mechanism to solve for the loss of legacy distribution due to cord-cutting and shaving,” said a Barclays investor note, spearheaded by analyst Kannan Venkateshwar.

A Nielsen case study commissioned by Google found that TV reach seems to drive YouTube engagement, and in turn, YouTube engagement drives TV reach. In other words, according to the report, people who view a TV program’s content on YouTube are more likely to tune in to the actual show. Because of that, as TV audience increases, so does YouTube viewership.

Real-time information services provider Neustar and ad tech firm Simulmedia on Wednesday announced they will partner to offer a complete linear TV activation and measurement product.

With increasing screen time spent on phones, other screen time is being pushed aside. The number of people regularly watching traditional, linear TV (meaning sitting in front of their big screen) will peak this year, rising 3.1%, and will begin to decline for the first time in 2016 according to a new study from ZenithOptimedia.

Research shows that this year 80% of viewers consumed video content via broadcast TV, versus the remainder who preferred other platforms like OTT or video on demand. However, that number was down from 2011, when 89% of consumers favored linear TV. Panelists at a CCW-SATCON session said the industry — both the broadcast and advertising sides — need to start considering broadcast TV “one part of the mix,” and find the means to capture — and measure — consumers across platforms.