Buyers and sellers are still playing with alternative currencies such as VideoAmp, iSpot are Comscore, but nothing will take the place of C3/C7 ratings in a majority of this year’s upfront sales. Note: This story is available to TVNewsCheck Premium members only. If you would like to upgrade your free TVNewsCheck membership to Premium now, you can visit your Member Home Page, available when you log in at the very top right corner of the site or in the Stay Connected Box that appears in the right column of virtually every page on the site. If you don’t see Member Home, you will need to click Log In or Subscribe.

Media agency Magna Global reduced its forecast for U.S. advertising spending because of the from Russia’s invasion of Ukraine. Magna now expects U.S. ad spending to increase 11.5% to $320 billion. Its original forecast was for 12.6% growth. The war in Ukraine has exacerbated supply chain issues and inflationary pressures.

’22 Will Be Spot TV’s ‘Year Of The Test’

Executives from NBCUniversal Local, Magna Global, Zenith and Dentsu told a TVNewsCheck webinar last week that the move from GRPs to impressions, plus Nielsen’s inclusion of BBO homes in its measurement, will make for a year of transition before ratings normalize.

National TV ad revenues, thanks in part to the Tokyo Olympics, are expected to grow 4.6% in 2021, rebounding from a recession caused by COVID-19 that was more mild on the media than predicted, according to a new forecast from media buyer Magna Global.

In the throes of a pandemic, national television advertising revenues are expected to drop 13.2% this year and recover by 4.3% in 2021 according to a new forecast from major media buyer Magna Global. Even with heavy political spending in a presidential year, local TV is expected to be down 2.4% for 2020. After the election, a 14.5% drop in 2021 is expected. Core revenue for local TV is seen edging up 0.1% in 2021.

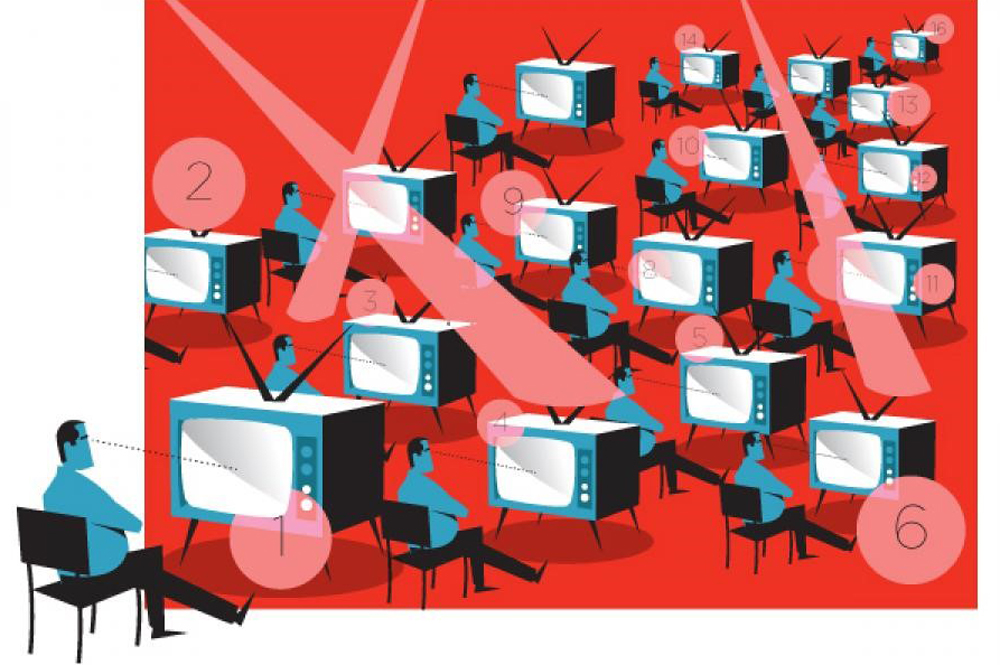

Automated Selling Is Coming — With A Price Tag

Developers of the software or platforms that make automated spot sales possible will be demanding a small percentage of the business they handle, possibly up to 1.5%. With broadcasters’ ringing up several billion in national spot sales each year, the automation fees could quickly run into tens of millions of dollars.

Magna Global has updated its ad forecast to reflect a slightly greater increase in spending next year, though the jump is partially offset by a slowdown in offline ad spending.

Ad-buying companies including Omnicom Media Group, Publicis Media and Magna Global tap the independent measurement firm to help them make sure ads don’t appear alongside objectionable YouTube video content.

Magna Global, the large media-investment unit of Interpublic Group, is working on what David Cohen, the company’s president of North America operations, calls “an aggressive kind of television alternative package” in time for the “upfront,” the annual market during which U.S. TV companies try to sell the bulk of their ad inventory.

After celebrating the benefits of robust ad spending in 2016, the U.S. media world may have to prepare for a hangover next year. Madison Avenue is seen paring back on the amount it spends in 2017 as advertisers ponder heavier investment in digital media and gauge the pulse of consumers under a mercurial new U.S. president, according to two of the ad sector’s biggest purchasers of commercials. While advertisers will spend more money overall, the amount of increase in their outlay from year to year is expected to narrow.

Interpublic Group’s Magna Global has struck a multi-year deal with YouTube to invest $250 million into digital video. It’s YouTube’s largest upfront deal ever for its premium Google Preferred program. Over the next three years, Magna Global will get “competitive rates” on Google Preferred’s unskippable ad inventory as well as access to measurement tools and top creators.

Programmatic ad buying has issues, but it’s growing rapidly around the globe. According to a just-released study from Magna Global, programmatic ad spend will account for about a third of display and video expenditures this year, or about $14.2 billion, up 49% compared to 2014. According to the report, programmatic ad spend will reach $37 billion by 2019, accounting for half of display and video expenditures. That’s an average annual growth rate of 31% over the next four years.

Why The Less Rosy Media Forecasts

There has been good economic news of late. The unemployment rate has declined, home sales and prices are rising, and consumer confidence was up last month. But those positive indicators are not reflected in the latest round of forecasts for the U.S. media economy, released Monday. Michael Leszega, senior associate of forecasting at Magna Global, talks about digital deflation, the state of the U.S. economy, and why out of home is bucking the downward trend.

There has been good economic news of late. The unemployment rate has declined, home sales and prices are rising, and consumer confidence was up last month. But those positive indicators are not reflected in the latest round of forecasts for the U.S. media economy, released Monday. Michael Leszega, senior associate of forecasting at Magna Global, talks about digital deflation, the state of the U.S. economy, and why out of home is bucking the downward trend.

Budgets allocated for programmatic TV buying, as well as the average cost of programmatic buys across platforms, are expected to surge over the next few years, according to the latest report from IPG Mediabrands’ Magna Global.

A year that started off with promise ended with a clunk, with advertising revenue growing at the slowest rate in six years. Total 2014 spending was up 3% percent, but when you take out political spending and the Winter Olympics, that number shrinks to just 1.6%, or $161 billion, according to Magna Global.

It was a weak year for the U.S. TV ad market in 2014 and that softness is expected to continue this year, according to a new forecast from Interpublic-owned media buying and research firm Magna Global. It now expects TV ad revenue to decline 2.9% this year including the impact of political and Olympic spending, compared with its August projection of a 0.9% decrease. In 2014, U.S. TV ad revenues were up 3%, but factoring out political and Olympic TV ad sales they fell 0.4%.

Interpublic’s Mediabrands unit has formed an alliance with more than 15 minor TV networks to develop and organize data and technology that would enable the agency and its clients to buy their advertising inventory programmatically. The initiative, which is being led by Mediabrands’ Magna Global unit, so far includes more than 15 networks, about half of which are not even measured by Nielsen.

TV revenue in the U.S. will decrease by 1.4%, Magna Global said, while digital media will increase 15.5% to reach 31% market share. Mediocre spending in the U.S. was the result of a number of factors, including bad weather that hit retail, restaurants and automotive dealers early in the year, as well as heightened interest in digital.

A new forecast from Forrester Research says ad dollars will hit $77.01 billion that year and balloon to $103.4 billion by 2019, leaving television well behind despite its continued growth. Other recent forecasts have predicted online will overtake digital, but they put that date further away.

Hearst, Meredith, Raycom, Scripps and Sinclair will join in testing the programmatic targeting and automated buying platform based on WideOrbit’s WO Central. “By providing a programmatic solution that allows agencies to perform targeted, data-driven, audience buys across markets, and delivers real-time analytics and audience insight for on-the-fly optimization, we’re creating a brand new revenue stream for our television station partners,” says WideOrbit’s Eric Mathewson.

Why Programmatic Ad Buying Is So Hot

Over the past year, buzz over programmatic ad buying has soared, but it’s been hard to determine just how popular it is. Now there are some solid numbers behind the buzz. A new forecast from Magna Global predicts programmatic buys worldwide will hit $21 billion this year, up 52 percent from last year. Magna’s Vincent Letang, EVP-director of global forecasting, and Luke Stillman, manager of global forecasting, talk about why programmatic is growing so fast, how it is changing media people’s jobs, and whether the rest of the world is adopting programmatic as fast as the U.S.

Digital Ad Rev To Top TV In U.S. By 2017

In a “POV” piece written this week by top Magna forecaster Vincent Letang, he writes that digital will outgrow TV a year earlier in the U.S. than the firm initially thought — “mostly because Magna downgraded the long-term television advertising projection based on poor performance of television this year in terms of viewing and ad sales.”

Magna Global lowers its 2014 outlook to a 5.1% bump in ad spending, down from earlier prediction of 6%. The problem: The second quarter was a little soft.

Magna Global has agreed to buy some digital video ad inventory from ABC this summer using a new level of data-driven targeting and automated purchasing, an eight-week test that marks ABC’s first programmatic sales of digital video.

Big Events Spark Strong 2014 Ad Spending

U.S. ad spending will grow a healthy 6% this year, led by World Cup, Winter Olympics and the midterm elections, according to Magna Global. Much of the improvement is tied to one-time events, such as the midterm election, this summer’s World Cup and February’s Winter Olympics. But the overall economy is looking better too.

A Brighter Outlook For Ad Spending

A new forecast from Magna Global predicts that ad revenue will increase by 6% this year, up from its December prediction of 5.5% growth. Magna credits the improving economy for the bump in its forecast. Vincent Letang Magna EVP, says that the unemployment rate continues to drop while important indicators like industrial production are growing. Those things increase advertisers’ confidence in the economy.

Google continues to rake in advertising dollars once earmarked for television. Magna Global, part of IPG Mediabrands, committed $100 million of its managed client advertising dollars to the Mountain View, Calif. company in a one-year upfront deal, as more marketing brands realize the benefit of integrating television advertising with digital media.

Google continues to rake in advertising dollars once earmarked for television. Magna Global, part of IPG Mediabrands, committed $100 million of its managed client advertising dollars to the Mountain View, Calif. company in a one-year upfront deal, as more marketing brands realize the benefit of integrating television advertising with digital media.

Three new ad spending forecasts released Sunday night are pegging ad growth next year partly on the Winter Olympics, the World Cup and the mid-term elections in the U.S. It’s the first time in 20 years that a new platform is expanding overall ad spending without cannibalizing other media, one forecast said.

Still A Moderate Outlook For U.S. Ad Spending

Things are looking up for the U.S. economy. May retail spending was up 0.6% a bigger gain than expected, and unemployment continues to drop. Those promising economic signs should eventually improve the outlook for U.S. ad spending this year, but it hasn’t quite happened yet. The latest forecast from Magna Global projects a 0.4% increase in U.S. ad revenue this year, to $155 billion.

Global TV Ad Growth: 3% In ’13, 6% In ’14

The global advertising market will continue to grow modestly at low single-digit increases through the end of the year — but will spike up to a 6% growth rate next year. Magna Global’s latest advertising forecast will get to $486 billion with 3% growth for 2013 — a slowdown from the 3.9% growth of a year ago. Still, the media agency group unit says the market will show double the growth levels next year — 6.1%, to reach $515 billion.

Ad Spending Forecast: Next Year Looks Good

Magna upgrades its 2014 outlook to 5.9% growth, up from 5.4% citing an improving ad economy as 2013 closes with advertisers increasingly optimistic about the direction of the country and Olympic ad sales gaining over the last Winter Games.

Magna upgrades its 2014 outlook to 5.9% growth, up from 5.4% citing an improving ad economy as 2013 closes with advertisers increasingly optimistic about the direction of the country and Olympic ad sales gaining over the last Winter Games.

2013 To See Local, Network Rev. Decreases

Magna Global revised its forecasts, with national television revenue seen finishing down 6.4% this year while local TV is forecast to grow 1.4% on a normalized basis and drop 9.1% when including the lack of political advertising.

Record Political Spend Rescues Soft Market

Magna Global says total local television political advertising was $273.9 million in 2Q 2012 with a growth rate of 29.8%, compared with 2010.

Strong Broadcast Upfront Benefits Cable, Too

Pivotal Research Group’s Brian Wieser is forecasting that broadcast ad pricing in the upfronts this spring will rise 8% on the assumption that spending by the national marketers will be about the same as last year — $8.9 billion. That’s not only good for broadcasting; that’s good for cable, he says. The “tacit collusion” among the Big Four insures that the anchor price of all upfront advertising remains high.

Pivotal Research Group’s Brian Wieser is forecasting that broadcast ad pricing in the upfronts this spring will rise 8% on the assumption that spending by the national marketers will be about the same as last year — $8.9 billion. That’s not only good for broadcasting; that’s good for cable, he says. The “tacit collusion” among the Big Four insures that the anchor price of all upfront advertising remains high.

Assessing The Networks’ Fall Schedules

This year’s upfront, however, was nearly surprise free. The networks did gravitate toward comedy more heavily than in the past, but that trend has been developing gradually over the years. Lisa Quan, VP and director of audience analysis at Magna Global, talks about this year’s upfront presentations, what the big themes are for fall and what makes for a good upfront.