Doubling Down On Cloud At Devoncroft

LAS VEGAS — Devoncroft Partners’ annual Executive Summit drew a sold-out crowd on Saturday, as an audience of more than 700 gathered at the Las Vegas Convention Center’s “Main Stage” to examine the media technology industry through discussions with top broadcast executives and analysts from the San Diego-based research firm.

Previous Summits have taken a sharp eye to the business of technology vendors themselves, with Devoncroft principal analyst Josh Stinehour giving a detailed look at historical stock prices and debt loads, grading the relative performance of acquisitions and divestitures, and even comparing vendors’ NAB Show booth sizes. Stinehour has long maintained that broadcast vendors spend far too much on sales and marketing compared to R&D, with the NAB exhibition being a prime example.

Stinehour did take a few jabs at vendors in his opening Summit presentation. One was a slide showing a color-coded graph of current stock prices for a number of technology companies, with green representing the percentage of their stock price at their last equity offering (an IPO or secondary offering). The consistent trend on the graph was a significant loss of green (or valuation) for most.

“A lot of companies in our world are way better at selling their equity than their products,” Stinehour said.

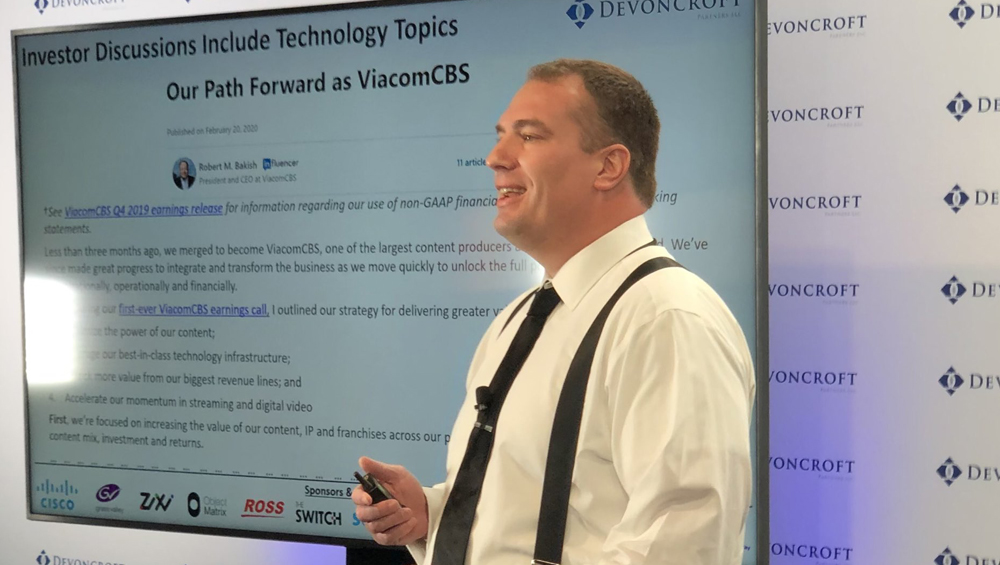

But most of Stinehour’s presentation, and the panel discussions that followed, looked beyond vendors to focus instead on broadcasters’ need to transform their businesses to grapple with the explosion in direct-to-consumer streaming and its negative impact on traditional linear business models.

But most of Stinehour’s presentation, and the panel discussions that followed, looked beyond vendors to focus instead on broadcasters’ need to transform their businesses to grapple with the explosion in direct-to-consumer streaming and its negative impact on traditional linear business models.

Stinehour has long been a champion of the public cloud as a technology solution to the new media landscape, and at last year’s Summit he predicted a “frenetic” pace of adoption through 2023. That seems to have panned out, with continued cloud investment by big media companies over the past year including enterprise-wide deals announced by Sinclair and TelevisaUnivision heading into NAB.

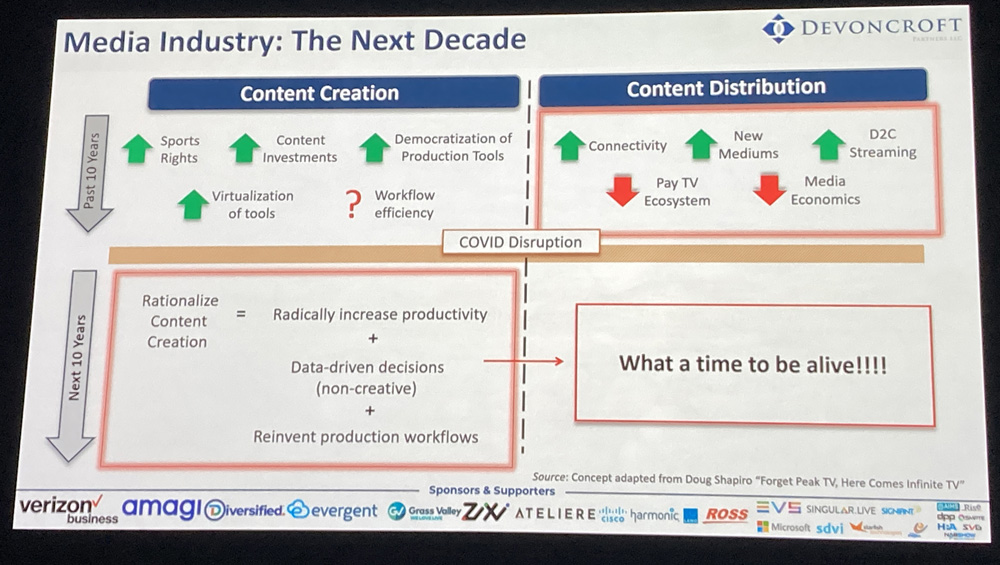

Despite the rate of cloud adoption, Stinehour said there haven’t been enough real efficiency gains realized yet, particularly in production workflows. But he expects that to change as media companies make more use of AI and data analytics in combination with the cloud.

“I think the next 10 years you’re going to see technology really disrupt the creation side, with radical increases in productivity,” he said. “Starting to really use data, not only creatively but to make decisions, and reinvent those production workflows.”

Pivoting Away From 2110

One of the first places to look for changes is Warner Bros. Discovery, which is already a big user of the public cloud for playout and content prep workflow through initiatives taken years ago by the former Discovery and Warner Bros. businesses. In a Q&A session with Devoncroft founder and president Joe Zaller, Brinton Miller, EVP of media technology operations at Warner Bros. Discovery, described how after the merger closed last year his team undertook a “bottom-up” analysis of live production across the newly combined companies. No one had a hard number on the total volume, he said, and there was some initial pushback on making technology changes.

An exercise that Miller thought might run four to six weeks wound up taking several months, mapping “every dollar spent” between personnel, equipment and travel expenses, including the number of cameras and IFBs on every individual production.

The “first shocking finding,” said Miller, was that Warner Bros. Discovery produces around 80,000 hours per year of live news and sports. The analysis also provided a “roadmap” for focusing conversations on technology and production process, he said, and “allowed us to go through production budgets and red circle where there were large amounts of spend that we wanted to pick at — things that probably weren’t doing anything to create production value, it was just spend.”

One of those areas is 2110-compliant IP routing infrastructures, where Warner Bros. Discovery has already made significant investments, including new plants in New York, London and Washington, D.C. In fact, Miller said that by the end of 2023 the company will have around 28 “shiny new” 2110 control rooms. But he described them as a “burden.”

“The technical heft of that infrastructure and just the sheer amount of problems we’ve been having, at least for me, it’s time to start to pivot,” Miller said. “They’re great, we’re going to run the wheels off them. But if I had a dollar for every time we had some random 2110 problem take out a production, I’d have enough money to build another control room somewhere.”

So Warner Bros. Discovery is aggressively pursuing live production in the cloud, and is already testing software-based production control rooms (PCRs) in New York, D.C., Atlanta and the U.K. Miller said the technology is ready now, and that starting next month, “we’ll be doing about 30 European sporting events a month with a full cloud production infrastructure.” The company will also start testing a cloud PCR for CNN in May.

“In my mind, we’re going to go all in,” said Miller. “Don’t get me wrong, there’s always Election Night and NBA All-Star Weekends and these big events, and there will always be nights where we have big traditional control room infrastructure running. But the other 80% of production can absolutely live at this point in a lot of the software products we’re using.”

Post-Merger Management

Another newly-formed media colossus looking to the cloud for production efficiency is TelevisaUnivision, formed in January 2022 by the merger of Spanish-language broadcasters Televisa and Univision. The company announced a deal Friday with Avid Technology to centralize existing Avid-based workflows for its news, sports, entertainment and dramatic productions on Google Cloud, including Avid’s Media Composer editing software, MediaCentral content management and Nexis storage products.

The deal with Avid will provide remote access to Avid tools for TelevisaUnivision’s editors and contributors, and will also allow the broadcaster to scale resources up and down with Avid’s Flex subscription. It marks the first broadcast implementation of Avid’s products on Google Cloud, which Univision had already partnered with through an enterprise-wide deal back in April 2021.

Speaking at Devoncroft, Ralf Jacob, TelevisaUnivision EVP of global broadcast engineering, described the deal as “a consortium of these three companies, strategizing on how we can look at the traditional broadcast workflows and move some of those assets into the cloud,” including TelevisaUnivision’s content library of over half a million assets.

Google Cloud is proving to be a strong partner overall, Jacob said, and is assigning subject matter experts to advise in “every move we make.”

Cloud-based production is just one of several post-merger technology initiatives being tackled by Jacob, who joined TelevisaUnivision last August after serving as president of Verizon Digital Media Services, where he integrated the AOL and Yahoo businesses. Others include moving to IP distribution to replace existing satellite deals that are expiring; updating playout; consolidating metadata and asset management; and eliminating redundant software. He said there was significant technology overlap between the former Televisa and Univision businesses, with a total of 1,250 discreet software packages.

“While we are continuing to run the business, this is a running bus and we’re changing the tires as we’re moving into the cloud,” said Jacob. “The smart thing was to take a look at how you consolidate all of the software packages, and the hardware deals that you made on prem, potentially, and put them on the same bill. And then start looking for vendors that are eager to do things like what we’re doing with Avid, where there’s a willingness to help us in the transformation.”

Sinclair is continuing a cloud transformation of its own. The company moved playout of its national networks to the cloud two-and-a-half years ago, and has since moved its archive and content ingest and preparation functions there as well. While Sinclair uses multiple cloud vendors, much of its recent work has been done on the Amazon Web Services platform. Last week the company highlighted that arrangement by declaring AWS as its “preferred cloud provider.”

Sinclair had previously declared plans to move playout of its local broadcast stations to the cloud, and last Friday it announced a deal with Amagi to do just that. Sinclair will use Amagi’s Cloudport solution to launch local broadcast station affiliate playout origination in the AWS cloud, with the first station slated to go live in June with continuous rollout through 2025. Sinclair would be the first big station group to adopt the cloud for local playout.

Mike Kralec, Sinclair SVP and chief technology officer, told the Devoncroft audience that Sinclair’s cloud journey began with “small steps” and plenty of failures and integration problems. But he said that was part of the process, as working with rapidly evolving cloud technology means constant iterations and “looking at never being at that future state, never being at that point where we’re actually done.”

In choosing a software vendor for its cloud workflows Sinclair was looking to team with a cloud-native company like Amagi, which has agreed to work closely with Sinclair to evolve its Cloudport playout solution over time to meet the stations’ needs.

“We want to be a partner with these software companies in the cloud for media operations,” Kralec said. “We want to help to be the product development team, we want to be the people to communicate part of the vision for how we can maximize the business value out of the cloud.”

Comments (0)