How AI Can Help Unlock New Digital Revenue From Local TV Documentaries

Many TV station groups invest significant resources into producing local documentaries every year. But are they fully maximizing the digital revenue potential of this content? Without strategically placed mid-roll ad markers, long-form VOD assets may be under-monetized, sometimes relying on just a single pre-roll ad. Even worse, viewers could be frustrated by randomly inserted mid-roll breaks that disrupt the documentary’s narrative flow.

The good news is there’s an AI solution to this problem (of course). By harnessing advanced computer vision and machine learning, AI-powered ad-break technology can identify natural points for ad insertion and create a better, more contextually relevant ad experience for viewers. The AI analyzes the story’s progression, detects scene segments, and finds visually similar shots to place ads without interrupting crucial moments.

Here’s how station groups can use AI-powered ad-break technology to boost both digital revenue and viewer satisfaction with long-form content.

Understanding The Revenue Opportunity Around Optimized Ad Breaks

When documentaries originally air on broadcast TV, they are monetized with about 15 minutes of commercials per hour.

Let’s do some rough ROI estimates. Using an average of 15 minutes of commercials per hour, that’s 30 30-second spots. Rates vary by DMA and time slot, but as an example, if those 30 commercials sold at $500 per spot, that’s $15,000 in potential revenue.

After their broadcast debut, these documentaries typically find new distribution opportunities as VOD assets in O&O apps and websites. In addition to live streams, some FAST channel distribution partners, like LocalNow, Zeam and Haystack, will also accept VOD content.

But how many ads are running in your documentaries on these digital platforms? Probably a lot less than broadcast. An hour-long documentary will typically have around four-five commercial breaks on digital, with about two-three ads per break. So, maybe 15 total ads per hour.

Programmatic CPMs can vary, but let’s assume a $12 CPM and a 100% fill rate. For every 1,000 views of this documentary, your station would earn $12 per commercial. If there are 15 commercials per hour, that’s $180 per 1,000 views (RPM). At that rate, it would take about 83,000 views for those 15 commercials at a $12 CPM to earn the same $15,000 that the broadcast airing generated.

Depending on the content of the documentary, generating that kind of digital revenue isn’t impossible. But if you haven’t added mid-roll ad markers, then your documentaries might only be monetized with a single pre-roll. With only one 30-second ad, it would take 1,250,000 views at a $12 CPM to generate the same $15,000 as the documentary earned in a broadcast.

Obviously, not maximizing the number of mid-roll ad markers in your documentaries is a missed revenue opportunity. But how can station groups do this for their documentary archives? Sure, you could assign someone on your staff to watch documentaries and manually place ad markers in every video. But it’s a very tedious and time-consuming task. And it’s not scalable.

“Smaller stations typically aren’t staffed for such a project,” notes Tom Sly, VP, enterprise strategy at E. W. Scripps. “And larger stations, while they may have more resources, the amount of content produced can make it difficult.”

AI Can Automatically Add Mid-Roll Ad Markers For You

Imagine being able to process an hour-long documentary, find the original broadcast commercial breaks and add mid-roll ad markers for less than the cost of a pint of beer. This is now possible thanks to advancements in AI technology.

At this year’s NAB Show, Swedish-based company VionLabs showcased its groundbreaking AINAR ad-break detection software. The company claims that this AI-powered solution “enables platforms to deliver a viewing experience that balances advertiser needs with viewer satisfaction,” and can revolutionize the way “content creators approach ad placement in their programming.”

VionLabs’ approach uses four parallel AI neural networks that each contribute to a comprehensive understanding of the video:

- Black Frame & Speech Avoidance Detector: Ensures ads don’t cut off key dialogue or narrative moments

- Deep Learning Story Flow Analysis: Identifies natural lulls in the story suitable for ad insertion

- Scene Boundary Detector: Pinpoints transitions between scenes that are ideal for breaks

- Shot-Similarity Algorithm: Finds visually similar shots to place ads without disrupting the visual flow

After processing a video, VionLabs generates a metadata file with ad break timestamps. Content managers can then use tools like AWS MediaConvert and AWS MediaTailor to trigger these ad markers in their O&O video platforms, or provide this metadata to partners, like LocalNow, when securing distribution deals.

Using Contextual Data To Boost CPM Rates

As the advertising industry transitions away from using cookies, advertisers are looking for new ways to deliver targeted messaging, and contextual targeting is one of the industry’s preferred solutions.

In addition to detecting mid-roll ad break opportunities, VionLabs’ contextual insights tool identifies the context surrounding each ad break. Using this info, it can then match related IAB category tags to that specific break. For example, a documentary about local cuisine could have IAB tags such as “cooking,” “food & drink” and “barbecues” applied to relevant ad breaks.

According to VionLabs’ CEO, Marcus Bergström, adding contextual tags to ad breaks, “boosts advertiser satisfaction by placing brands alongside relevant content.” It can also improve the overall viewer experience and help “prevent irrelevant ads from appearing in your content.”

Screenshot showing how VionLabs detects optimal ad break placements and applies IAB tags to content. (Source: VionLabs)

Contextual IAB tags can be a critical component to your video revenue strategy. “Without contextual data, the advertiser only knows the asset name, not the demographics that might be watching,” says Jaime Branson, founder of ViewTV. “Without this data, you’ll mostly get remnant ads with lower CPMs.”

For example, content with contextual IAB tags earns an average CPM of $17.10 on ViewTV’s international FAST platform, Kapang. Content without tags typically have reduced CPMs that can sink to low single digits, sometimes $4, or less.

Cleaning Up Older VOD Assets With Baked-In Commercials And Slates

What if your doc’s only surviving copy has baked-in commercials, promos or slates? Those need to be removed before digital distribution.

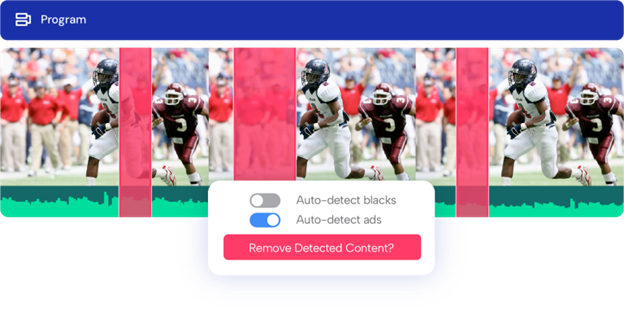

It’s a bit pricier compared to a pint of beer, but Prime Image specializes in this issue and has helped both movie studios and TV stations clean up their content libraries. Prime Image’s AI editing technology can detect and remove extra clips, like color bars, blacks, slates, commercials, etc. from large batches of video files.

Image via Prime Image

Retiming Older Video Content

Another potential issue with older content is reduced commercial inventory. The amount of commercial time per hour has grown from about 10 minutes in the 1960s to around 18 minutes today. But AI can retime older video assets to accommodate modern ad loads.

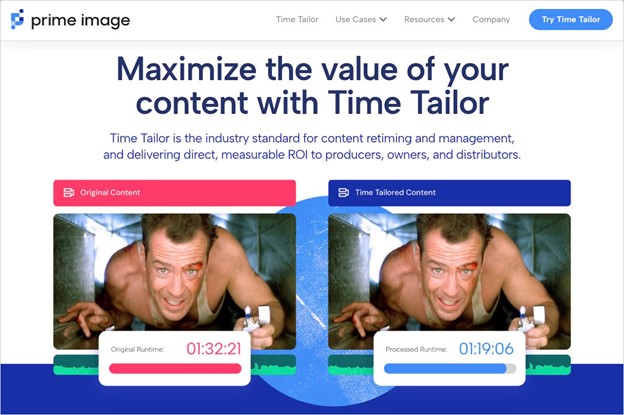

Prime Image’s Time Tailor solution has processed entire collections of movies, classic TV programs and game shows to make each video asset fit into specific time durations. Using AI, Prime Image can trim videos without speeding up or slowing down content, and has native integrations with SDVI, AWS and Amagi.

Screenshot of Prime Image’s website showing its retiming solution called Time Tailor (Via PrimeImage.com)

AI Ad Break Detection In Next Generation FAST Platforms

Right now, the burden to generate mid-roll ad markers is on the shoulders (and wallets) of station groups. But that’s starting to change.

Some FAST services, like Canela.tv, already have AI-powered ad-break detection solutions built-in to their platforms. These systems can smartly detect ad break opportunities, even if they weren’t marked by the original content creators.

Image via Canela Media

The new AI-native version of STIRR, currently being rebuilt from the ground up, will also have the ability to detect optimal placements for various ad types, including binge ad breaks. It’s an extra upfront cost for FAST platforms, but creates long-term value for both advertisers and content partners. (Disclosure: STIRR is a client of my consulting company, Ordo Digital.)

However, this won’t help stations better monetize their owned and operated digital properties. So, for now, investing in some AI-driven ad break optimization still makes a lot of financial sense.

Using AI To Maximize Long-Form VOD Revenue

As broadcast groups seek new revenue opportunities, using AI to optimize the mid-roll ads in long-form content is an easy win. With a minimal investment, station groups can optimize their documentaries and other long-form VOD assets to increase earnings potential. It’s a smart, future-focused investment to maximize ROI as digital video consumption continues to grow.

Jon Accarrino is founder of the AI and media technology consulting firm Ordo Digital.

Comments (0)