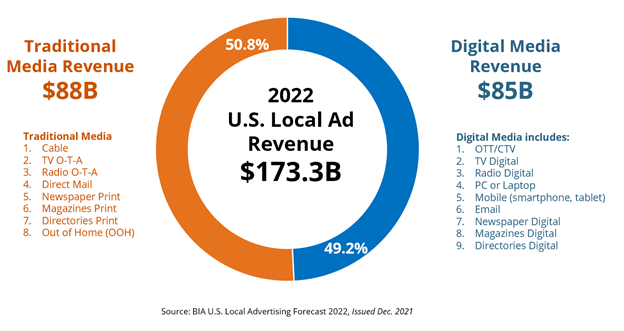

BIA Ups 2022 Estimates For U.S. Local Ad Revenue To $173.3B

BIA Advisory Services has increased its 2022 U.S. Local Advertising Forecast estimate to $173.3 billion, from its earlier estimate of $161.5 billion issued late summer. The 2022 forecast indicates an 11.4% increase over 2021 due to faster than anticipated growth in digital advertising and a strong political year. Traditional media ad revenue still maintains a slight advantage over digital at 50.8% of the ad spend ($88 billion), while digital media will get 49.2% of the ad spend at $85 billion.

“2021 has been a year of fluctuations,” said Mark Fratrik, BIA’s SVP and chief economist. “The first two quarters of the year saw strong growth, with some stalling in Q3 once the Delta variant appeared late summer. We’ve taken pandemic concerns plus inflation and supply chain issues into account to prepare our local media estimates and, overall, we are bullish on ad revenue for 2022.”

Key indicators from the U.S. Ad Forecast for 2022 include:

- In terms of growth, over-the-top (OTT) will grow 57.4% this year, surpassing the growth of mobile as consumers continue to embrace various streaming services on their TV screens.

- Mobile ($35.7 billion), direct mail ($33.4 billion) and PC/laptop ($32.1 billion) continue as the top three paid media channels for 2022.

- Local television is slated to grow 28.4% in 2022, getting a large share of political advertising.

- Total local political advertising will approach $8.4 billion in 2022 with local television getting a large share of the spend. Fairbanks, Alaska; Augusta, Ga., and Tucson, Ariz., are the top three strongest political ad markets for television.

- Out of BIA’s 12 main verticals, the automotive vertical has fallen in terms of ad spend from the fifth position to the seventh position. Technology and Leisure/Recreation verticals each moved up one spot primarily because of the decrease in local automotive ad spending.

- The strain around the retail industry pushed it from its longstanding position as top vertical spender in local advertising. The finance/insurance vertical will now be the top spender in 2022.

BIA’s CEO and founder, Tom Buono, offered his assessment of the forecast saying: “Political spending is anticipated to be very large next year and other bright spots are surfacing that will affect ad revenue across the country for all media channels. As we continuously track economic conditions, we realize it’s an ever-changing situation for local businesses, which affects their ad spend decisions. Except for restaurants and various retail categories, we anticipate most business verticals to exceed 2019 levels in 2022.”

Buono discusses more details about the economic underpinnings of the forecast in the latest company podcast, BIA’s Expectations for Local Advertising 2022: December Update, which is available for download now.

Comments (0)