Disney Shareholders Back CEO Iger, Rebuff Activist Shareholders Who Wanted To Shake Up Company

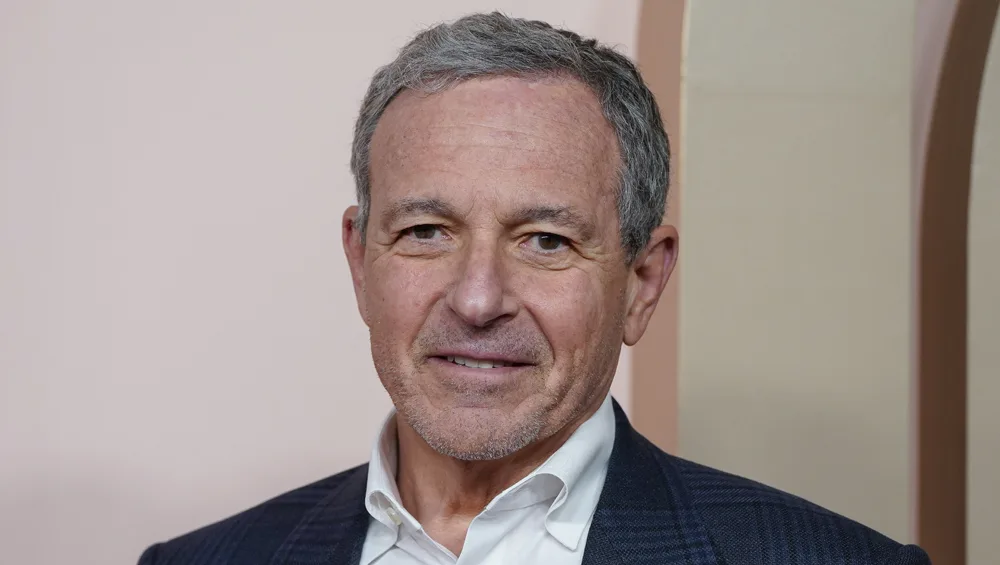

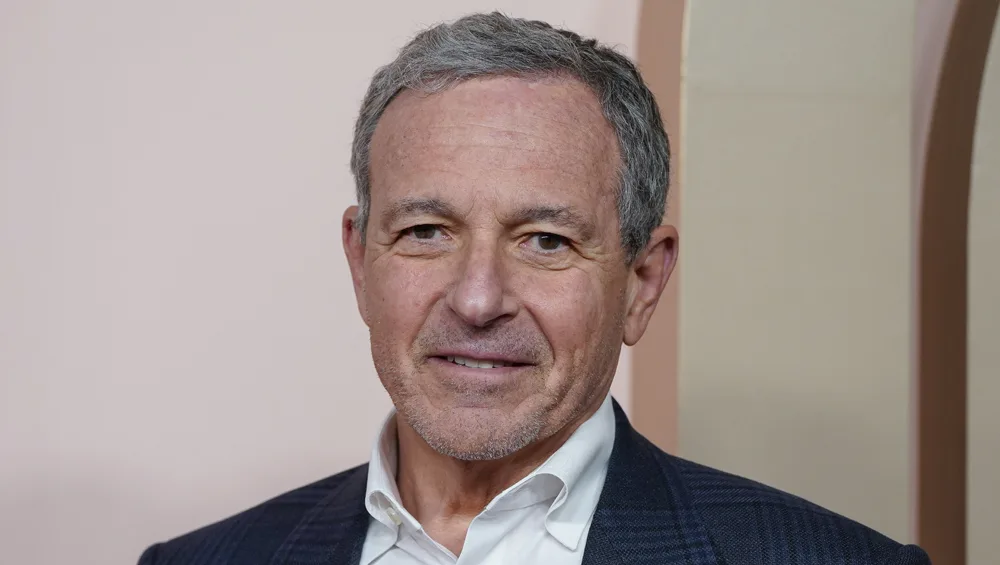

SAN FRANCISCO (AP) — Disney shareholders have rallied behind longtime CEO Robert Iger, voting Wednesday to rebuff activist investor Nelson Peltz and his ally, former Disney Chief Financial Officer Jay Rasulo, who had sought seats on the company’s board.

The company had recommended a slate of directors that did not include Peltz or Rasulo.

The dissident shareholders had said in a preliminary proxy filing that they wanted to complete a “successful CEO transition” at Disney and align management pay with performance. Despite their loss, they declared a victory of sorts following the vote, noting that since Peltz’s company, Trian Partners, started pushing Disney in late 2023, the entertainment giant has engaged in a flurry of activity, adding new directors and announcing new operating initiatives and capital improvement plans for its theme parks.

“Over the last six months, Disney’s stock is up approximately 50% and is the Dow Jones Industrial Average’s best performer year-to-date,” Trian said in a statement. Shares in Walt Disney Co., which is based in Burbank, California, were down about 3.4% in Wednesday afternoon trading.

The activist group previously said it wanted to see Disney achieve “Netflix-like” financial performance, specifically citing a 2027 target for Disney to raise a profit margin measure called EBIDTA — earnings before interest, taxes, depreciation and amortization — to levels of 15% to 20%.

But Disney is already operating at that level. In the quarter that ended in December 2023, Disney’s EBIDTA margin was 18%, according to data compiled by CapitalIQ. For the previous fiscal year that ended in September, Disney’s EBIDTA margin was 16.5%, according to the same data.

Disney announced in November 2022 that Iger would come back to the company as its CEO to replace his hand-picked successor, Bob Chapek, whose two-year tenure had been marked by clashes, missteps and weakening financial performance.

Iger was Disney’s public face for 15 years as chief executive before handing the job off to Chapek in 2020, a stretch in which Iger compiled a string of victories lauded in the entertainment industry and by Disney fans. But his second run at the job has not won him similar accolades.

Comments (2)

Cosmo says:

April 3, 2024 at 2:43 pm

Over 5 years Disney stock is over 40% behind the DJIA. But the wokestappo will continue to run the company.

[email protected] says:

April 3, 2024 at 11:40 pm

I knew that Bob Iger was going to win the fight that it was going to fail from an outsider that I didn’t believe he was for the little guy/gal. Disney still is a billion dollar empire Cosmo, even if the stock is down which you don’t get.