Station Group Of The Year | Nexstar: Making The Most Of Having The Most

“I tell people all the time: the thing I don’t want written on my tombstone is, he couldn’t manage what he built,” says Nexstar Media founder and CEO Perry Sook .

And what Sook has built over the past 23 years is a TV station group of unprecedented proportions.

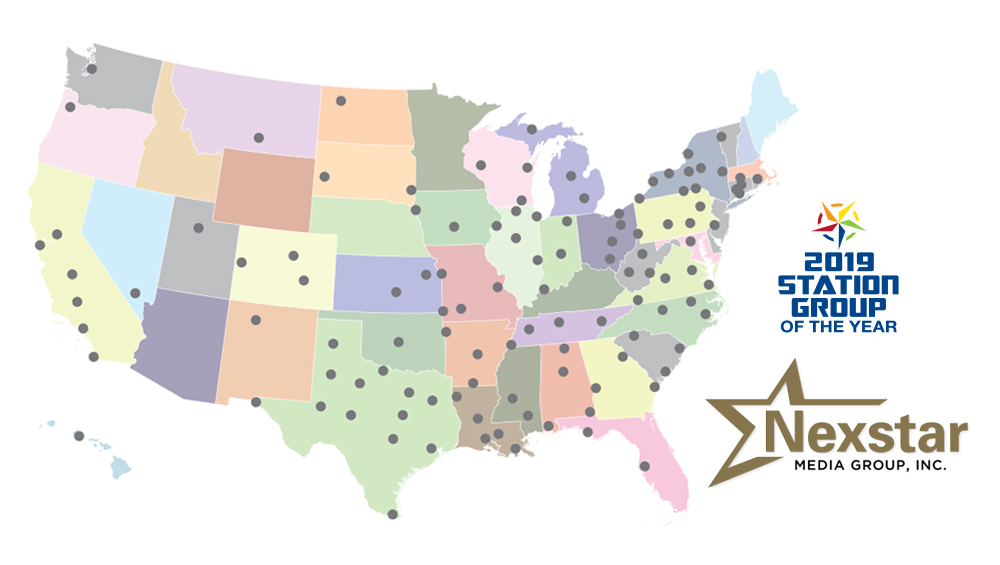

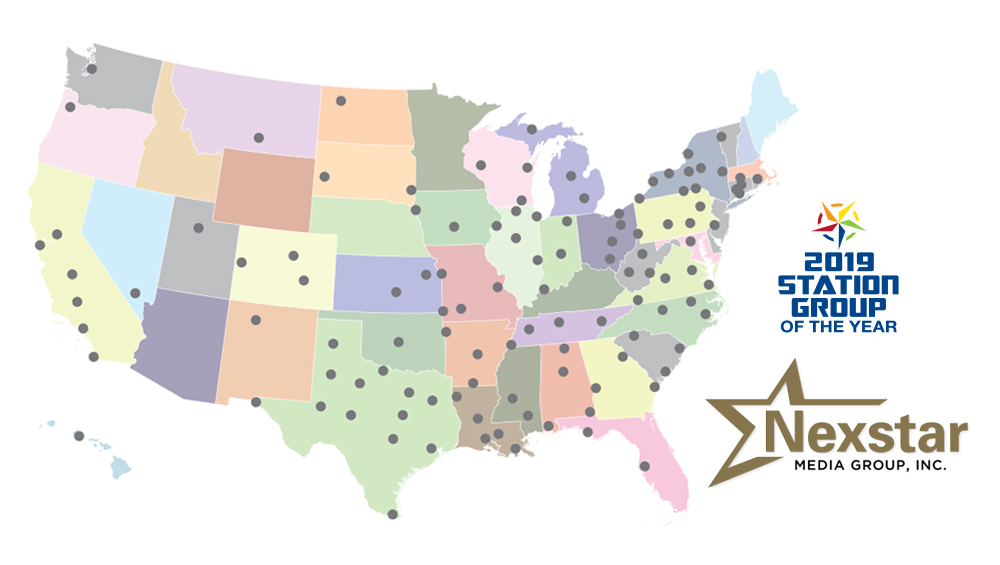

With the closing of his $4.1 billion acquisition of Tribune last month, Nexstar Media now comprises 197 stations in 115 markets covering nearly 63% of TV homes. And with some 13,000 employees, it will generate more than $4 billion in revenue a year.

“This is a creation of local content, both digital and linear,” says Sook during a visit to the company’s spacious headquarters in the Dallas suburb of Irving where everything looks as if it had been built within the last 12 months. “Taken together with the unrivaled national reach, there has not been a company like this.” (For a profile of Sook, click here.)

To avoid the epitaph, Sook is working hard with his executive team to bring Tribune stations into the fold and impress upon them the Nexstar way. “The major focus of the next year, year and a half, is making sure that the integration of Tribune is seamless, that we get it right; then we begin to adopt the best practices of both groups across the platform and we start to talk about growth again.”

Few doubt that Sook is up to the task as he has bought and absorbed stations on an ever-increasing scale since 1996 when he founded the company with the purchase of WYOU Wilkes-Barre/Scranton, Pa. Just two years ago, he successfully engineered a $4.6 billion merger with Media General.

“It took 15 years to get to 9% of the U.S. [TV homes] and then, in the last eight years, we went from 9% to 18% to 39% and now to roughly 63% of the country,” he says.

“I mean there was a lot of toiling in the fields early on to get the company to a certain point where it could be positioned for the next steps of growth.”

Sook has had plenty of help, most notably from Tim Busch, who joined Nexstar as a GM in Rochester, N.Y., in 2000 and rose to president in 2017.

“The acquisition process [for Tribune] is no different than any of the others,” he says, noting that it involves teams from operations, HR, legal and technical.

“We thoroughly evaluate what every one of the markets is doing. Each has its dynamics and is in a different point in its life cycle. Then we make our evaluation and determination of how they are going to move forward.”

Each station is its own business unit, he says, and, ultimately, it is up to the general managers to execute. “They are empowered to make the decisions to run their operations. We just ask them to make wise decision and stay within the [budgetary] guidelines.”

To manage the new outsized Nexstar, Sook and Busch have expanded its C-suite, creating new positions to oversee retransmission consent and network relations (Dana Zimmer), sales (William Sally), national programming (Sean Compton) and public relations (Gary Weitman). Zimmer, Compton and Weitman joined Nexstar from Tribune.

They’ve also increased the number of regional vice presidents from six to eight. The RVPs are the go-betweens corporate and the stations. They stay in touch with their assigned station general managers, communicating and enforcing corporate cost and revenue expectations and policies and facilitating the sharing of ideas among the stations.

They’ve also increased the number of regional vice presidents from six to eight. The RVPs are the go-betweens corporate and the stations. They stay in touch with their assigned station general managers, communicating and enforcing corporate cost and revenue expectations and policies and facilitating the sharing of ideas among the stations.

And right now, they are enjoying the confidence of Wall Street. Most analysts are seeing a lot of upside with price targets going as high as $161 and averaging $135. (It is now trading around $100.)

“They have one of the top — if not the top — management teams in the business,” says David Joyce, of EvercoreISI. “They have proven themselves time and again at how great they are at acquiring and integrating.”

Jim Goss is another Nexstar bull. “It’s arguably one of the best companies in broadcasting,” he says “In 20 years, it’s gone from entrepreneurial mode to its current status as the largest independent broadcaster with stations in two of the top three markets.”

Kyle Evans, of Stephens, picked Nexstar as his “official best idea” earlier this year, based on his beliefs (later proved correct) that the Tribune deal would close and that Nexstar would prevail in its retransmission clash with AT&T’s DirecTV (also proved correct).

“You’ve got best-in-class operators with maximum scale and a strong duopoly footprint at a very reasonable multiple, and you are going to get a capital allocation story from these guys where the wealth transfers from the debt holders to equity holders,” he says. “That’s the kind of story that has broad appeal.”

If history is any guide, Nexstar’s greater scale will bring new operating efficiencies and give the company even greater cost-saving leverage in dealing with the networks, cable and other distributors and vendors.

Less clear is Nexstar’s ability to capitalize on the Tribune-swollen station portfolio to create new businesses and revenue streams, to make the company more than just a collection of stations, each doing its thing and each contributing its bit of cash flow to the mother ship in Irving.

Sook recognizes the challenge of making Nexstar greater than the sum of its parts and says he sees opportunities in programming, digital media and spectrum.

In addition to the stations and their added coverage, the Tribune assets included two networks, basic cable’s WGN America, which reaches into 80 million homes, and the diginet Antenna TV.

That changes the discussion with program producers, Sook says. “You are talking to your syndication partners differently. You’re not just saying: ‘Hey, we have a three o’clock time period I have to fill.’ You’re saying: ‘We have got a lot of real estate, and we have got a lot of different opportunities.’ We will think of programming holistically — the stations, the diginet and the cable network.

“That’s why we hired a programming executive — to focus exclusively on programming — acquiring programming,” Sook says.

For financial reasons alone, it makes sense to hang on to WGN America, he says. But, he adds, it’s also a “nice business.

“I liken it to an independent television station from the 1980s where you bought off-network programming, and you got a couple of hooks. Then, you could build a business on that.”

“Long term, WGN America has to have an identity, a brand and a voice in the marketplace or it is going to be tougher and tougher for it to grow. I think you will see original programming, but it is not going to be of the bet-the-house-on-one-show kind.”

Sook also muses about network TV, noting that Nexstar is now the largest CW affiliate group with several of its major-market stations. “Should we be a part owner of that network at some point? Should we own all of it? I mean it depends on what [current owners] AT&T and CBS want to do.”

Another opportunity is news. Nexstar could, he says, aggregate the power of its local newsrooms into a national news service, possibly as part of WGN America. “We have more journalists in the U.S. across our 115 markets than any other organization in the country, more than any broadcast network, more than any cable network.”

Sook is hopeful that the addition of the Tribune website traffic will re-energize Nexstar’s stagnant digital business. By Comscore’s accounting, Sook says, the Tribune and Nexstar local websites combined will be among of the top three news and information destinations on the web. “There is an appetite to buy that, but we will have to evolve so that virtually it looks like a single URL. If somebody wants to buy it, they could do it by pressing a button.”

Folding the Nexstar and Tribune traffic together dovetails with another initiative that is intended to boost digital revenue, Sook says — Nexstar is assigning 20% of its journalists to work exclusively on digital.

“So that may mean a single anchor at 10 or 11 o’clock, but the late news business is growing single digits if it growing at all,” he says. “People want relevant local content when they want it and they don’t necessarily want to have to wait for the appointment television.”

The renewed focus on digital also ties in with Nexstar’s push to sell TV spot with impressions rather than ratings points, Sook says. With TV impressions, he says, Nexstar will be able to sell TV and digital together.

“If we have an exclusive sales force and an exclusive port of entry into buying those impressions, we will have a competitive product offering that others will not be able to match because they will not have the scale that we will.”

One thing the Tribune deal will not do is lead Nexstar deeply back into reselling digital inventory for third parties. “Those businesses are hard to scale because they were all manually administered and so those are the kind of businesses that we have exited.”

And that goes for reselling inventory of such powerhouses as Google and Facebook, he adds. “They could wake up one morning and decide to change the rules and put you either out of business or severely handicap your business overnight.”

Now that it has stations in Chicago, Los Angeles and other top markets, Nexstar could follow Gray Television and Tegna in bringing its national spot sales in-house and dismissing its two rep firms (Katz and Cox Reps), but it is not — at least not immediately.

“If we decided to do it ourselves it would not be to save money, it would be to have a single point-of-contact sales organization to sell all of our assets, Sook says. “But we have contracts with both firms that extend for several years. So, it will be a while before we decide what we want to do.”

Nexstar was built on Big Four affiliates in small and medium markets. But the Tribune merger suddenly thrust it into major markets without the comfort of major affiliations. The markets include six in the top 10: Los Angeles (KTLA), Chicago (WGN), Philadelphia (WPHL), Dallas (KDAF), Washington (WDCW) and Houston (KIAH).

If Sook has any qualms about entering unknown broadcasting territory, he is not admitting to them. To him, he says, a station is a station and if it stays focused on the local viewer, it will do OK.

“Look at WGN in Chicago or KTLA in Los Angeles. They have local news from 4 a.m. until 11 a.m. and they are generally No. 1 in the time period and nobody says, ‘Oh, that is a CW or that is an independent station.’ Those are two of the best-run local television stations in America.

“I can say that because I have been in a lot of them. They are in touch with their community, they are constantly in their community and it is a seven-day-a-week commitment for them. So, I guess it is my way of saying you don’t have to have a network partner to be considered a successful local television station.”

(Because it was bumping up against the FCC national ownership cap, Nexstar had to spin off Tribune’s WPIX New York to Scripps, but it has an option to buy it back if the FCC relaxes its rules, and Sook says he would one day like to exercise that option.)

With his enlarged footprint, Sook is more excited about the prospects for ATSC 3.0, the new broadcast standard, not so much for more or improved television, but for the whole new business of datacasting.

“What I see us becoming is the wireless interconnector of the internet of things. We are that wireless mobile last-mile connector. There is a value there, but it is going to take 10 years before we have enough stations on the air with 3.0 that we can begin to model a business plan.”

The FCC ownership rules say that he can’t buy stations in any additional markets, unless he exits markets of comparable size. That leaves the door open for station swapping or acquiring second stations in some markets, but not much else.

But the ownership rules are fluid, the national cap depending in large part on who happens to be running the agency as chairman. Should the current or future chairman decide to further ease the rules, Sook says he would charge back into the station trading marketplace.

“We have aspirations to get bigger, both in market and then in national reach potential. If the rules change, we will be right there trying to grow opportunistically as we always have.”

And, should it become bigger, odds are Nexstar and Sook will somehow manage.

Comments (1)

[email protected] says:

October 16, 2019 at 11:55 pm

I don’t see Nexstar buying back WPIX as I don’t see the FCC relaxing any more rules just my opinion.