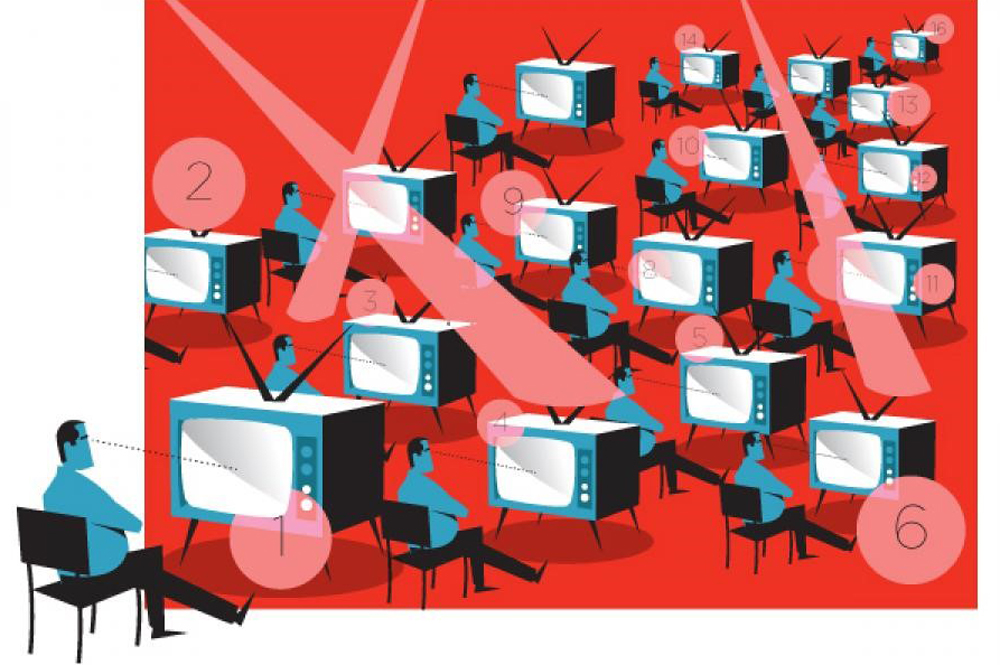

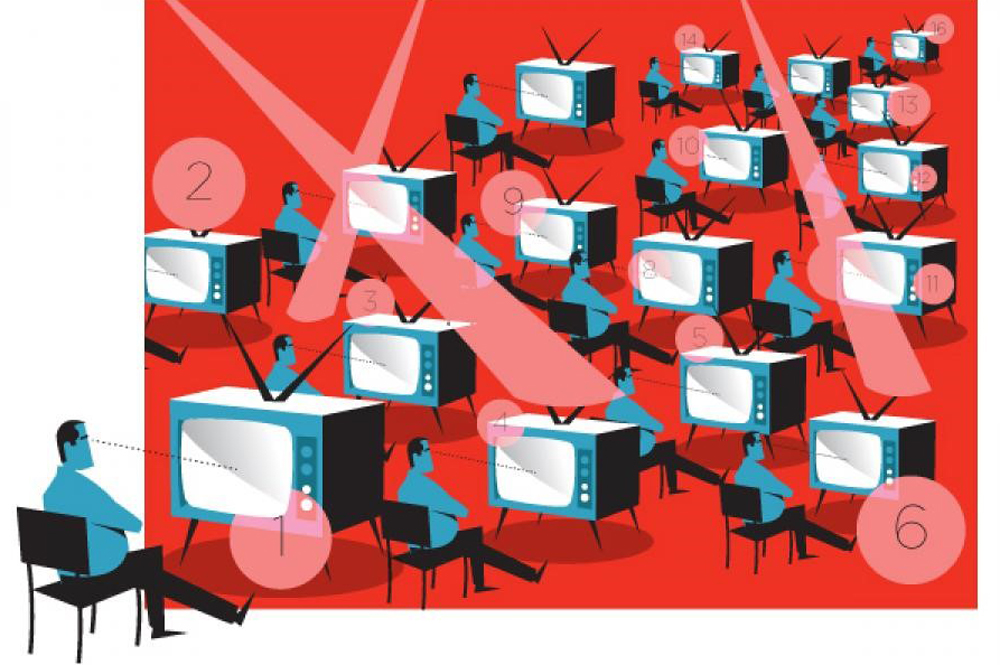

TV Measurement Standard Remains Firmly In Flux

The search to nail down a new currency of TV measurement is fully underway with NBCUniversal last week announcing it had more than 100 proposals in hand to create alternate measurement systems; WarnerMedia jumping into the fray with its own ideas; and industry giant Nielsen yesterday saying it will begin measuring viewership of individual commercials.

Nielsen’s announcement comes at a time when the industry standard for TV measurement — of which Nielsen has largely been the sole provider for more than 70 years — is under serious scrutiny. Last Tuesday, NBCUniversal convened its first working group around its Measurement Innovation Forum. Last Friday, WarnerMedia said it plans to roll out its own audience-measurement data next year and is working with different measurement vendors and agencies to do just that.

“It’s going to be the Wild West out there for a while,” says one industry source.

At the end of the day, TV stations have simple and reasonable business desires: “The bottom line is we want an accurate ratings system,” says Dan Carlin, VP, programming, research and creative services at Fox’s WNYW New York. “There’s a lot of revenue out there and we want our buyers, salespeople and TV stations to all be confident that the numbers are accurate.”

Frank Comerford

Dan Carlin

Several central pieces of the debate are already largely settled. TV station groups and agencies seem to be inexorably moving away from ratings and toward impressions, although some are doing that more aggressively than others. NBCUniversal first announced two years ago that it would be making that transition, and has been trading on impressions since last spring, according to Frank Comerford, chief revenue officer and president of commercial operations for NBCUniversal Local, and Kelly Abcarian, EVP, measurement and impact, NBCUniversal Media.

“I think everyone is [making the move to impressions] to an extent,” Comerford says. “They all know they have to do it and that it’s really the correct thing to do.”

Earlier this month, Nexstar said it would sell advertising based on impressions starting Jan. 1, in advance of Nielsen incorporating broadband-only homes into its measurement sample, which is expected to happen by the start of the January sweep on Jan. 6. Other groups say they are in progress on that transition but it’s not so easy because all of their customers aren’t yet willing to do deals based solely on impressions.

Becky Meyer

“Really it’s the buy side that needs to shift,” says Becky Meyer, national sales manager, Gray Television. “We’re trying to be as flexible as anyone might need us to be. We can talk any language that anyone wants us to talk.”

Who Will Be The Arbiter?

That highlights the core problem of TV measurement: it’s not the technology or the data, both of which exist and are plentiful, it’s the question of what measurement will serve as the currency and who the arbiter of that currency will be. Since 1950, that arbiter has been Nielsen, but when the Media Rating Council pulled the ratings giant’s accreditation in September — at least partially at Nielsen’s request — that allowed a long-accumulating snowball of complaints to start rolling down a steep hill, including that Nielsen is not being transparent enough about how issues around its panel are being resolved.

Sean Cunningham

“What the market needs is some actual collaboration and transparency, which has to be a departure in behavior from what Nielsen’s historic [behavior] has been,” says Sean Cunningham, president and CEO of the Video Advertising Board (VAB).

Nielsen says it’s working with both the MRC and its clients to get back on track.

“Over the last several months, we have listened to client feedback on both our data quality issues as well as the desire for more transparency in our communications,” Nielsen said in a statement to TVNewsCheck. “In response, we have reaffirmed our commitment to improving our transparency as we progress toward recovering our panels and our goal of regaining accreditation for our television measurement services. We increased the frequency of our communications and are sharing developments in a more timely and transparent manner.”

Searching For Alternatives

In the meantime, major media companies such as NBCU, WarnerMedia and ViacomCBS, the last of which said in September it was collaborating with VideoAmp, are looking for measurement alternatives. Nielsen is working hard to stay in that mix, submitting its own RFP to NBCU’s effort. The measurement giant also is moving forward with individual commercial metrics, the BBO rollout and continued work toward multiplatform measurement metric Nielsen One. Part of what keeps Nielsen in the mix is that advertising agencies and media buyers are skeptical of measurement information generated by sellers, preferring independent third-party data, which is what Nielsen has always provided.

While the industry seeks one currency measurement on which to buy and sell, it also looks at many other layers of data to determine the effectiveness of advertising.

“I think there will be more than one measurement yardstick that a buyer and seller can use to agree on a transaction,” Abcarian says. “We will continue to use our own insight around our own first-party data that we gather on consumers who come to our owned-and-operated apps like Peacock, NBC One and so forth.”

As the TV industry continues to evolve, it will have many more data sources from which to draw, including smart TVs and automatic content recognition (ACR) data and, in three to five years, NextGen TV (also known as ATSC 3.0).

Sean Muller

“We have a lot of respect for what Nielsen can do as a measurement company overall,” says Sean Muller, CEO, iSpotTV, a Nielsen measurement alternative. “But they do struggle with granular, second by second cross-screen ad measurement in particular. And it’s no secret they have a lot of work to do to modernize and pivot their infrastructure. They are a panel-led company, which makes it hard to capture cross-screen ad and content measurement.

“The problem with BBO-based measurement will only get harder as consumer behaviors shift,” he says. “What we don’t know is how many boxes will be used in the future, [but] we do know TVs will be the best primary source of viewership validation and verification, because [they are] screen level. The struggles there reinforce the importance of smart TV-delivered ACR data. Only screen level verification can span broadband and cable homes. At iSpot, we invested in smart TV data years ago and have supplemented that with millions of set-top devices and other data to get a solid view of households, business and brand impacts and more.”

BBO Homes Worries

In the immediate future, however, many in the industry expressed concern about Nielsen’s plan to incorporate broadband-only homes — meaning homes that receive only broadband internet and do not receive pay TV or over-the-air TV signals — into the sample.

“Historically, increases like that were added over several weeks or months so as to not disrupt the entire business and give all parties time to understand the changes,” Abcarian says. “It appears that [Nielsen] plans to bring in the entire sample at once. That could include hundreds of homes per market equaling as much as 25% of the sample that will be added overnight when the switch gets turned on.

“That extreme change could be substantial for local stations and outlets,” she says. “We have yet to see their approach to estimating that universe and we haven’t seen any evaluation or impact data to help us replan Q1. We know these BBO homes watch and view television differently. As much progress has been made trying to move to impressions, this could slow things down as they put the whole marketplace in turmoil.”

Kathy Doyle

“Adding in BBO homes becomes a huge challenge,” says Kathy Doyle, EVP, local investment, Magna Global. “In the past, Nielsen and industry has stated [this data] will be included and then the rug gets pulled out from under us. That change wreaks havoc with our schedules and estimates.”

Nielsen Says No More BBO Homes Delays

Over the past two years, Nielsen has said it was adding BBO homes to the sample several times but it has kept having to delay the integration due to the pandemic and other reasons. This time, however, it should be a go.

“Nielsen’s prior delays to the integration of broadband-only homes were done in response to client requests,” the company said. “The details behind the plan to launch in January 2022 were communicated at the time the revised date was announced, and we do not anticipate any further changes. The move to impressions is dependent on the inclusion of these homes in measurement, and we are eager for the industry to see this benefit.”

There also are concerns that Nielsen’s national sample of 30,000 to 40,000 homes is too small to adequately capture all of the fragmented viewing that is taking place. And in local markets, those sample sizes are even smaller with as few as 1,000 homes representing as many as 20 million viewers in large markets like Los Angeles.

“There’s a multiplicity of entities that have got … census-level data in the tens of millions of households,” Cunningham says. “So as opposed to a service where all truth and reality is stemming out of 30,000-40,000 homes, there are competitive and parallel data sets in the marketplace that are in the tens of millions. The current Q4 2021 reality is when you look at viewing trends and multichannel TV consumption and three sets of census-based data compared to Nielsen, Nielsen is always the lowest outlier in terms of TV consumption.”

An Impressions-Based Future

TV stations want to move to impressions because that measurement format allows them to count all viewers, whereas ratings are a universal estimate based on sampling. The smaller the sample size, the more likely it is that viewers are not being counted. As linear TV viewership gets more fragmented, it’s important to TV stations to be able to measure and sell to all viewers.

Jordan Wertlieb

“You start to get value for programs that have been diminished by the ratings system,” says Jordan Wertlieb, president, Hearst Television. “We’re selling audience and any way we can represent all of the audience is great.”

But for Wertlieb, nailing down one currency isn’t the be-all and end-all.

“Audience measurement is an industry tool; it doesn’t determine the effectiveness of the medium,” Wertlieb says. “We have local clients who don’t even look at the measurements, they just buy TV time based on the effectiveness of the media.”

What Wertlieb means by “effectiveness” is what running ads on television does for local advertising buyers, whether that’s causing the phone to ring, causing people to visit their shops or driving them to their websites.

Wertlieb thinks “we’re about 18 to 24 months out from using only impressions. Eventually you are going to have a platform-agnostic negotiation because you are getting more and more broadcast and cable networks that have over-the-top (OTT) platforms and those are impressions-based.

“Ratings will always be in the mix because programmers need to compare audiences by market size and ratings give them that context,” he says. “I do think ratings become antiquated for people who are trying to buy audiences in the video ecosystem.”

As the industry works to answer these questions and create a mutually-agreed-upon measurement framework, the environment remains opportunistic.

Says Cunningham: “[2022] is certainly going to be one of the most interesting years in the modern history of marketing, media and advertising.”

Comments (1)

AIMTV says:

November 23, 2021 at 11:00 am

As the billion-dollar giants battle it out, small syndicators and media are left out of the equation, priced out, as they’ve always been under the Nielsen only model. Hence, media consolidation and power are in the hands of fewer and fewer giants.

When a company like Nielsen is allowed to operate an unofficial monopoly, sloppiness, laziness, and intellectual dishonesty is bound to occur.

In the mid-to-late aughts, we met with them over concerns at their ridiculously modeled US Hispanic sampling methodology. They made promises they never delivered upon, and when confronted about their lack of follow-through, denied not only their promises but even that the very meeting (meeting? what meeting?) had ever taken place. Talk about no shame. They displayed a complete disregard for accuracy with an obsession at obtaining the highest profits and revenue possible. An accurate sample would mean alienating their biggest client in the space. In this case, Univision – itself a vastly powerful, monopolistic, and ethically challenged behemoth (at least at that time, Univision is now a hollow, desperate shell of itself). But at that time, they were two peas in a pod and the Hispanic TV ecosystem, viewers, or the search for accuracy be damned. Univision’s inability to change with the market and media landscape damned them, and it has and will continue to damn Nielsen.

Corporations are only as good as the people (some good, some bad) who work for them but a corporate culture will attract a certain kind of person. At the time, it was clear the corporate culture at Nielsen was unethical and not afraid to outright lie and mislead.

We’d already called off our embarrassing publicity campaign based on their “good-faith” promises. But in the meantime, our movement’s momentum stalled, the public had moved on, and Nielsen no longer needed to pretend they were “listening to our concerns”.

The people there have most likely changed but has the company culture in 10+ years? I have my doubts. I think it’s likely still a huge, lazy, fat company that has people in its employ that will tell you one thing today and do another thing tomorrow.

For the sake of the broadcasting business I love, I hope I’m wrong.