Is ABC Really For Sale?

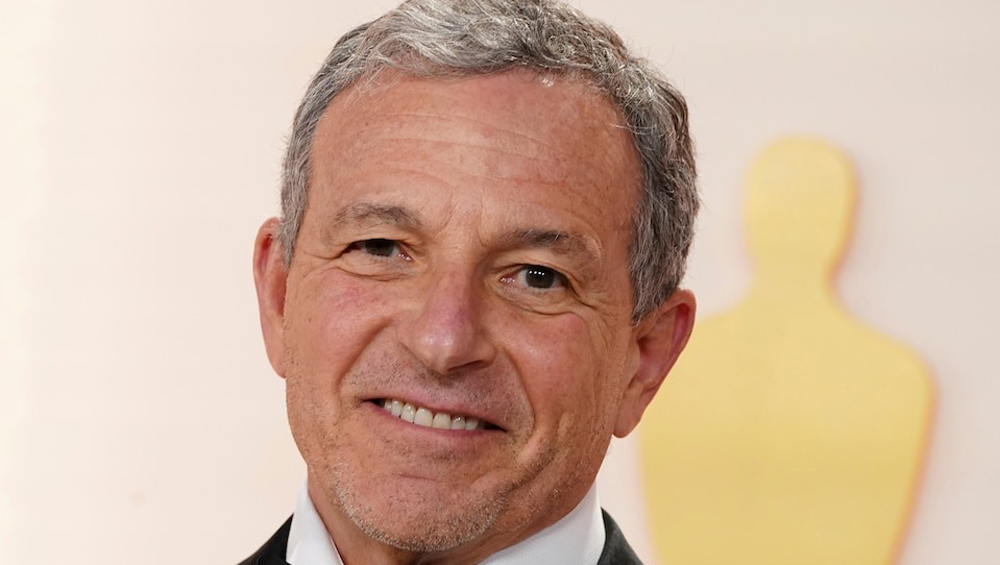

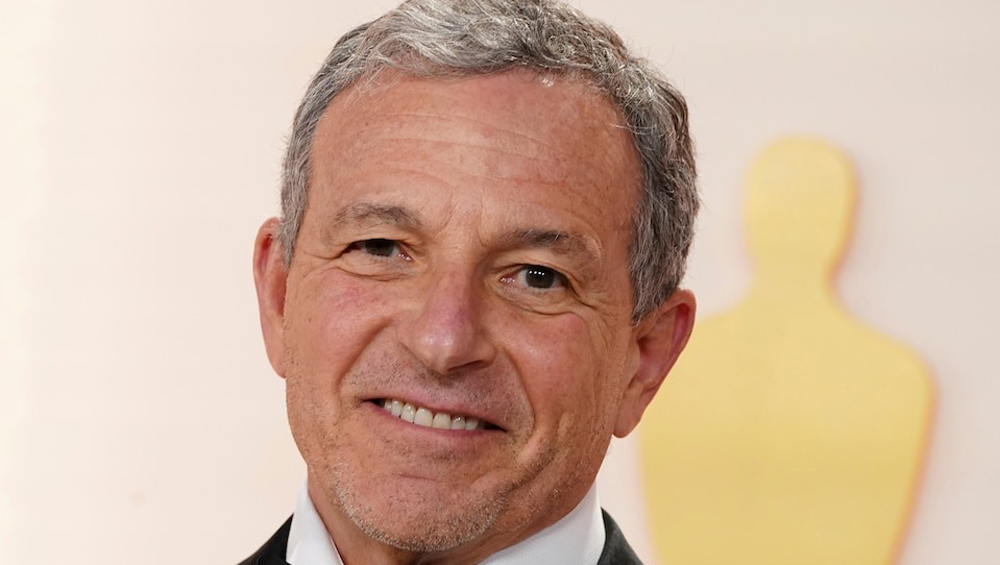

Bob Iger is in a pickle. If he could do it over, one wonders if Iger would be so quick to proclaim, as he did last year, that “Linear TV and satellite is marching towards a great precipice, and it will be pushed off. I can’t tell you when, but it goes away.”

Those were hard words, but perhaps understandable from a retired CEO turned elder statesman who felt free to speak frankly about the industry. The former head of Disney clearly had no idea that within a few months he would be back in his old job running businesses funded by linear television.

Iger’s problem now is that today’s reality and tomorrow’s divinations are two very different things. Streaming may represent the future, but for the moment it is a bottomless pit, sucking up cash like a Hoover vacuum. With so many players competing for the same user base, the word profit is nothing more than a distant hope.

Hank Price

And where does the cash to produce Disney’s streaming product come from? ESPN, the O&O station group, and thanks to retransmission consent, billions in rights fees paid to the ABC network. Moreover, like Mark Twain, Disney’s linear businesses can rightly say that so far “reports of my death have been greatly exaggerated.”

Cash flow is also the reason ESPN, despite recent declines, has never really been for sale, though Iger has said he is interested in a partnership. Needless to say, such a partner would need to be quite wealthy.

Another issue, raised by Iger himself, is that without the ABC Network, Disney has no guaranteed distribution partner for a good portion of its programming. Seeking to become a pureplay product company with an entertainment division is one thing, but giving up a guaranteed return on the cost of producing some of that programming is quite another.

Put a different way, ABC, the station O&O group, and ESPN are annuities that fund Disney’s ability to fight the streaming wars. The high cost of those wars is evidenced by recently announced price increases for the Disney+/Hulu streaming bundle.

Disney is going to need that additional revenue because a major issue in the writer’s strike is the pittance writers receive from streaming projects compared to regular series production. The other big strike issue is artificial intelligence, the use of which writers are terrified, but producers are loath to restrict.

No one can predict how the strike will be settled, but it seems reasonable to think the writers might end up with more money while the producers retain the future ability to develop and use AI. If that happens, streaming costs will go even higher, but like Esau, the writers will have given up their birthright for a pot of stew.

None of this means Iger’s attitude toward linear television has changed, especially now that total streaming viewership has passed cable and broadcast, so the two former Disney executives Iger has hired to evaluate selling the network are no doubt seriously looking at potential buyers. But selling ABC and its owned stations only makes sense if Disney receives a premium price for the properties. (How does one command a premium for an enterprise whose head has publicly predicted will eventually fall off a cliff?)

So, where does that leave the future of the network and stations? A clue may be in Iger’s search for a partner for ESPN. Would he also consider a partner for ABC and the owned stations? If so, what would that partnership look like?

If Iger does not find a buyer, or a partner that makes sense, then the most likely scenario will be the status quo. Sadly, that would leave thousands of loyal network and station employees continuing to hang in limbo, uncertain what their future might be. It would also shake the confidence of the affiliate body in Disney’s commitment to properly program the network.

That leaves Iger facing a fateful problem of his own making. He must sell the network and station group, find a cash-rich partner, or eat his previous words and reaffirm his belief in the future of linear television. The first option seems untenable, the second unlikely, the third unbelievable.

One thing we can be sure of: Sentiment will not play a part in the ultimate decision. ABC was sold to Cap Cities in 1985, followed by the sale to Disney 10 years later, so there are no sacred cows. This will be a stockholder value decision.

Stockholder value also brings a wild card into play. Iger and the board could simply sell the entire company to Amazon. In fact, Amazon might be a very good fit. Apple and even Alphabet could also be contenders, especially for a partnership rather than an outright sale.

Perhaps Iger has something else entirely up his sleeve, but whatever decision he and the Disney board ultimately make will have implications for the entire television industry, including the other networks and affiliated stations across the country.

One has the impression an industry tipping point is coming. What that turns out to be is impossible to say, but it will be fascinating to watch and see what happens.

Comments (1)

Kathy Haley says:

September 5, 2023 at 10:44 am

Bob could also listen to Kara Swisher’s recent interview with Barry Diller, during which he calls on all three major networks to reinvest in their fully distributed broadcast networks and split from Netflix, Apple and Amazon in their negotiations with the WGA. It is the networks (and their O&Os and affiliates, who will suffer most from a drought of original programming, which will set in soon. The interview is fascinating, as is your excellent analysis of the issue, Hank!