Data Dominates NextGen TV Conference

ATSC President Madeleine Noland

Last week in Washington, D.C., the Advanced Television Systems Committee (ATSC) celebrated its 40th anniversary at its annual NextGen Broadcast Conference, with veteran attendees reflecting back to the “Grand Alliance” of broadcasters and consumer electronics companies that formed the original ATSC 1.0 digital television standard and paved the way for HDTV broadcast programming.

But this year’s discussion on the new ATSC 3.0, or NextGen TV, standard only touched briefly on the improvements in linear programming that 3.0 enables, such as high dynamic range (HDR), 4K, enhanced audio and interactive applications. Instead, much of the conference focused on alternative uses of the broadcast spectrum such as datacasting and position, navigation and timing (PNT) applications, possibly in combination with wireless carriers’ existing 5G services. Most of these proposed data applications would be offered as business-to-business (B2B) services.

New Datacasting Venture Formed

Some concrete datacasting news came on the first day of the conference, with big LPTV player ARK Multicasting and tech firm Gaian Solutions announcing a joint venture to create a “Broadcast Internet Network” covering 30% of the U.S. The datacasting network will deliver a variety of applications through ARK’s 300 stations including IoT management, “smart city” services and digital signage, the companies said.

“We are shopping for partners in other markets, as the potential for growth and reach is tremendous, and the opportunity for all television broadcasters who partner is unmatched by existing models” said Joshua Weiss, CEO of ARK.

Nexstar-Scripps Datacasting

Executives from three of the country’s biggest station groups, Nexstar Media, Sinclair and E.W. Scripps, also appeared together to describe their datacasting efforts to date. BitPath, a joint venture between Nexstar and Sinclair, has already been working on PNT applications for the past two years including enhanced GPS services to provide better accuracy for utility and industrial applications. It first demonstrated its “NavPath” enhanced GPS product at NAB 2022 and expects to have it commercially deployed by the end of the year.

Del Parks

“Doing data is really important for Sinclair, and it’s been a goal of ours for 10 years,” said Sinclair President of Technology Del Parks.

But Nexstar has also been working with Scripps on datacasting over the past year, after the groups first collaborated in 2021 to test 3.0 multi-frequency networks (MFNs) using low-power stations in Michigan. Nexstar and Scripps have actually developed a “core network” of four stations — two Nexstar and two Scripps — that are live today with datacasting services on a test basis, and which they described in detail in D.C.

“We thought there was an interesting match between our two companies in terms of scale and reach,” said Nexstar CTO Brett Jenkins, who noted that the two groups combined reach roughly 92% of the U.S.

Brett Jenkins

Finding new revenues through business like datacasting with 3.0 is essential for large broadcasters “playing the long game” like Nexstar, Jenkins said. He compared the datacasting opportunity to the new revenue stream stations created years ago by charging pay TV operators retransmission fees — a development without which he said broadcasting would have been unlikely to survive.

“I don’t think any of us would have jobs, or at least not jobs in broadcasting, because broadcasting wouldn’t exist,” Jenkins said. “That’s a good example of diversification of revenue streams. And I think that’s what excites the three of our companies. We know that it’s in a way existential for us.

“You know, HDR pictures, as beautiful as they are, are not going to keep people at our stations employed,” he added. “We have to find ways to continue to grow and build these businesses.”

Kerry Oslund

Kerry Oslund, VP strategy and business development for E.W. Scripps, said broadcasters have an opportunity to become a “holistic wireless operator.” He suggested that the revenues from datacasting could help subsidize broadcaster’s public service mission of informing their communities with local news and other quality programming. (Oslund also noted that 5% of datacasting revenues would go to the U.S. Treasury, as per FCC rules.)

“It’s a virtuous cycle,” Oslund said. “The idea that we can offer commodity data services to finance the premium services that are important to us. Most important in my view, in my ‘why,’ is so we can continue to do quality local news and community service. Datacasting, commodity services, are so boring that it’s absolutely exciting to think that we are going to have another revenue stream that is going to help fund all of the important stuff that we do.”

Core Exercises

Oslund has worked with Jenkins to develop the Nexstar/Scripps core network with a mix of technology partners including Hewlett Packard Enterprise, Ateme, Harmonic, DigiCAP, Triveni Digital, Heartland Video Systems and Sony. Sony has provided the effort with prototype mobile receivers based on its Xperia Android smartphone and 3.0 receiver chip.

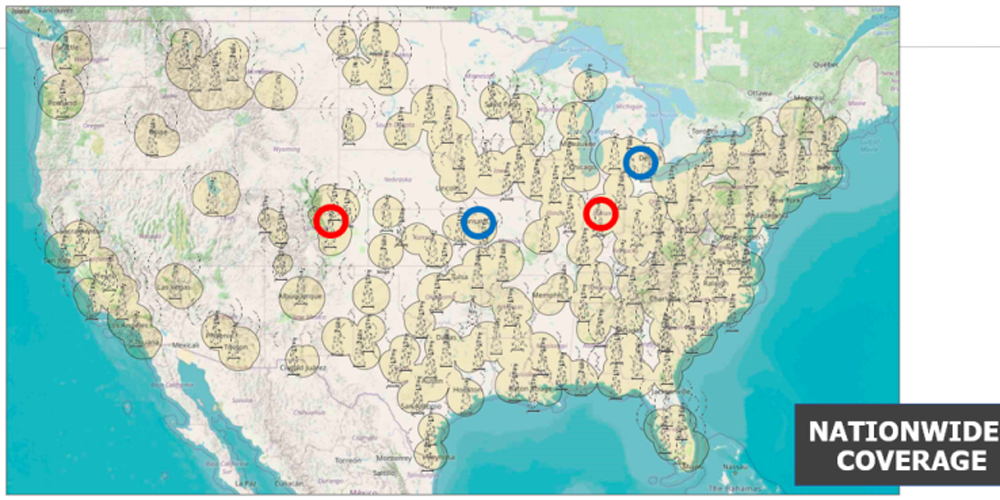

Four high-power, high-tower 3.0 stations currently make up the core network: Nexstar’s KWGN Denver and WTTK Indianapolis, and Scripps’ WMYD Detroit and KMCI Kansas City. The four stations cover about 5% of the U.S., Oslund said. He displayed a map showing projected coverage of the stations for receivers like the Sony Xperia phones, which use a USB dongle to receive the 3.0 signals, and other portable devices with low-gain antennas at a low height (such as receivers in automobiles).

The established Longley-Rice model for signal propagation, based on reception with antennas at a height of 10 meters, doesn’t pass muster for datacasting, Jenkins said. Instead, Nexstar and Scripps are adopting a “telco mentality” when predicting coverage for prospective data customers.

“One of the cool things we’re starting to do now, because we have receive devices that are positionally aware and can give us feedback through a backchannel, is we can start proving the coverage maps, the way we calculated them, are actually being received by the receivers in these markets,” Jenkins said.

The Nexstar/Scripps core network map

Each 3.0 station has about 26 megabits per second (Mbps) of total capacity. Given the reality of the 3.0 rollout, where stations currently have to share channels while showing “substantially similar” programming to their 1.0 broadcasts, that leaves at most three to four Mbps per market for datacasting services, Oslund said.

Those services could be non-real-time (NRT) file transfers or a data carousel, where the same file is being sent over and over again; KMCI is currently running a data carousel of a PDF file of the novel War and Peace and an MP4 of Taylor Swift’s Shake It Off. Oslund said that customers would be able to pay for capacity on either a gigabytes-sent or time basis.

He went on to demonstrate the core network by accessing the “Portal” control screen. A “system health page” showed the existing services running on the four 3.0 stations, including linear programming and data services. WMYD Detroit is currently broadcasting five HD feeds and two datacasting services, while the other three stations in the core network are transmitting four HDs and one datacasting service each.

Oslund then reserved 2.5 Mbps across WMYD and KMCI for a new datacasting service. He uploaded a variety of files (ZIP, PDF, KMZ and MP4) from his laptop computer, which went up to the cloud, and then down to the broadcast airchain for local transmission. A green light on the Portal screen indicated that the files had been “published,” i.e., successfully transmitted.

“No more PowerPoints,” Oslund said. “We can do this live.”

However, the second part of the demo failed, in that Oslund didn’t get confirmation that the files had actually been received by the Sony phones in the field (a failure that he blamed on his own operator error). That “return path report,” which he said Scripps has usually received without trouble in its testing, includes details like the file name, size of the file, device ID and GPS coordinates of the receiver. Once it confirms receipt of the files, Scripps could then bill a theoretical datacasting customer.

The current core network simply represents a “start,” and Oslund’s goal is to light up many more markets with Nexstar.

“Imagine 50 markets when we’re going in and doing a presentation,” he said.

While NextGen TV sets are continuing to roll out at steady pace and new accessory receiver devices are coming to market, both Oslund and Jenkins said there is still much work to be done on the receiver side for enterprise datacasting applications.

“It does not seem to be an ecosystem that is springing up out of the ground fully formed,” Jenkins said. “It certainly hasn’t happened in the last couple of years. That’s going to take a lot more muscle and leaning in from those of our companies who are bullish about this and want to see these capabilities develop.”

Working With 5G, GPS

When asked what vertical markets look to have potential for broadcasters’ 3.0 data services, Oslund said one of the “early opportunities” was working with private 5G networks to extend their effective coverage range from the “bubble” of 5G to the much bigger “dome” of 3.0 broadcast, which could be useful for connected devices or utility trucks.

“The idea is there are so many companies and enterprises that are moving to private 5G using either CBRS or Wi-Fi technologies,” Oslund said. “They generally have a range of no more than two miles, but they’re not subject to anything from the public internet. So, we’re talking about an extension of broadcast services in combination with private 5G.”

NAB President Curtis LeGeyt (Glen Dickson photo)

Jenkins noted that the PNT market was attractive, given both the increasing number of devices and applications that rely on location data and the fact that could be serviced today even with the relatively small amount of bandwidth that 3.0 stations have available. (Another panel discussion at the NextGen conference on “Broadcast Position Systems” detailed how 3.0 could serve as an alternative source of location data in the case of GPS outages.)

For its part, Sinclair has been talking for several years about 3.0 working alongside 5G, instead of competing with it. The company has partnered with Indian firm Saankya Labs to develop a 3.0 receiver chip set, which could be enabled in combination 5G/3.0 devices. It has also worked with Korean telco SK Telecom, through the joint venture CAST.ERA, to explore how 3.0 can work together with 5G wireless signals.

One application that Sinclair and SK Telecom have successfully tested in both Korea and the U.S. is using 3.0 signals in combination with 5G to deliver geo-targeted content to moving automobiles. By using the reception of a 3.0 correction signal to enhance the positional GPS data received by a smartphone, Sinclair has demonstrated that it can improve the location accuracy of GPS from 3 meters down to 3 centimeters.

Sinclair view telcos as customers for its 3.0 data services, Parks said, and that is why the company is working hard internationally to get 3.0 accepted as part of the worldwide 3GPP wireless standard.

“The goal would be to combine those 5G networks with the broadcast networks,” Parks said. “It’s not an either/or, it’s an ‘and’ function.”

Comments (1)

SunnyAnd75 says:

June 22, 2023 at 11:00 am

Glen, as always, great information gathering. I would like to hear a response from some of these broadcasters with regards to how financially valid these ideas really are and what’s to prevent existing wireless companies from competing against a great idea that we might develop.

Question on the business of being a backup for GPS- When was the last time you heard of the GPS system, which is operated by the government and funded at a level that doesn’t make sense to any broadcaster, failing? I don’t believe that it ever has. Are GPS devices really going to add UHF tuners for this potential once-in-a-lifetime event when manufacturing margins are everything? The antenna wavelength required for UHF channel 14-36 is substantially larger than most GPS devices. VHF facilities would need antennas taller than the human body. This challenge is never discussed during these speculative conversations. There’s a reason why channels 37-51 (600 MHz) was selected for the recent spectrum auction- Lower frequencies (Ch 14-36) are not efficient in smaller devices, such as cell phones. (Why isn’t this issue being discussed?)

Is sending a single file over and over again over a 45 mile radius really the best use of 6 MHz of public spectrum? Isn’t there a concern of wireless companies seeing this as terribly inefficient and lobbying for our spectrum? What would prevent them from filing for your license at renewal and committing to doing double the local news you are doing so they can take your 6 MHz and do what they have already been doing for 25+ years? Worse, suppose we come up with a great datacasting idea. What’s to prevent them from re-partitioning even 2% of their network infrastructure for a 1-to-many application? There’s nothing stopping them from doing this now. The only reason why this hasn’t yet happened is because they do not see an opportunity that makes financial sense.